- Japan

- /

- Hospitality

- /

- TSE:3350

Metaplanet (TSE:3350) Valuation in Focus After New Preferred Shares and Bitcoin Strategy Unveiled

Reviewed by Kshitija Bhandaru

Metaplanet (TSE:3350) has drawn fresh attention after President Simon Gerovich outlined a new strategy to issue preferred shares. The company aims to boost its Bitcoin holdings per share without affecting current shareholders. This move comes as digital asset-based financial products gain traction among Japanese firms.

See our latest analysis for Metaplanet.

Metaplanet’s bold approach has kept it in the spotlight, but that hasn’t shielded the stock from turbulence. Over the past year, shareholders saw a remarkable total return of 258.89%. However, the past 90 days brought a steep 60% slide in the share price as optimism cooled and volatility spiked. Still, the company’s long-term total returns outpace most peers, hinting that investor enthusiasm for its Bitcoin-centric strategy remains alive despite recent shakeouts.

If Metaplanet’s ups and downs have you looking for your next opportunity, this is the perfect moment to discover fast growing stocks with high insider ownership

With such dramatic price swings and bold strategic moves, the key question emerges: is Metaplanet now trading at a bargain, or is the market already factoring in all the company’s future potential?

Price-to-Earnings of 48.5x: Is it justified?

Metaplanet’s shares currently trade at a price-to-earnings (P/E) ratio of 48.5x, more than double the hospitality industry average of 24.2x. This elevated multiple suggests investors are paying a premium compared to peers, possibly because of aggressive growth expectations or the attention drawn by its Bitcoin-focused model.

The price-to-earnings ratio compares a company’s current share price to its earnings per share. It is often used to gauge how much investors are willing to pay for a company’s future profit streams. For fast-growing or highly anticipated businesses, the P/E can soar well above sector averages as markets price in future earnings growth.

Metaplanet’s multiple signals strong sentiment, but it may also indicate the market is overestimating the pace or sustainability of the company’s profit growth. When compared head to head with industry peers and the peer group average P/E of 15.8x, Metaplanet’s valuation looks especially stretched. Despite lofty growth forecasts, the current trading level is well above comparable companies. Notably, the estimated “fair” P/E ratio in this case is 85.1x, which is even higher than where the market currently prices the stock. This hints that sentiment could push valuations higher if growth materialises as hoped.

Explore the SWS fair ratio for Metaplanet

Result: Price-to-Earnings of 48.5x (OVERVALUED)

However, sharp declines in short-term returns and high volatility could signal that investor sentiment may shift quickly. This could challenge the current bullish narrative.

Find out about the key risks to this Metaplanet narrative.

Another View: Discounted Cash Flow Perspective

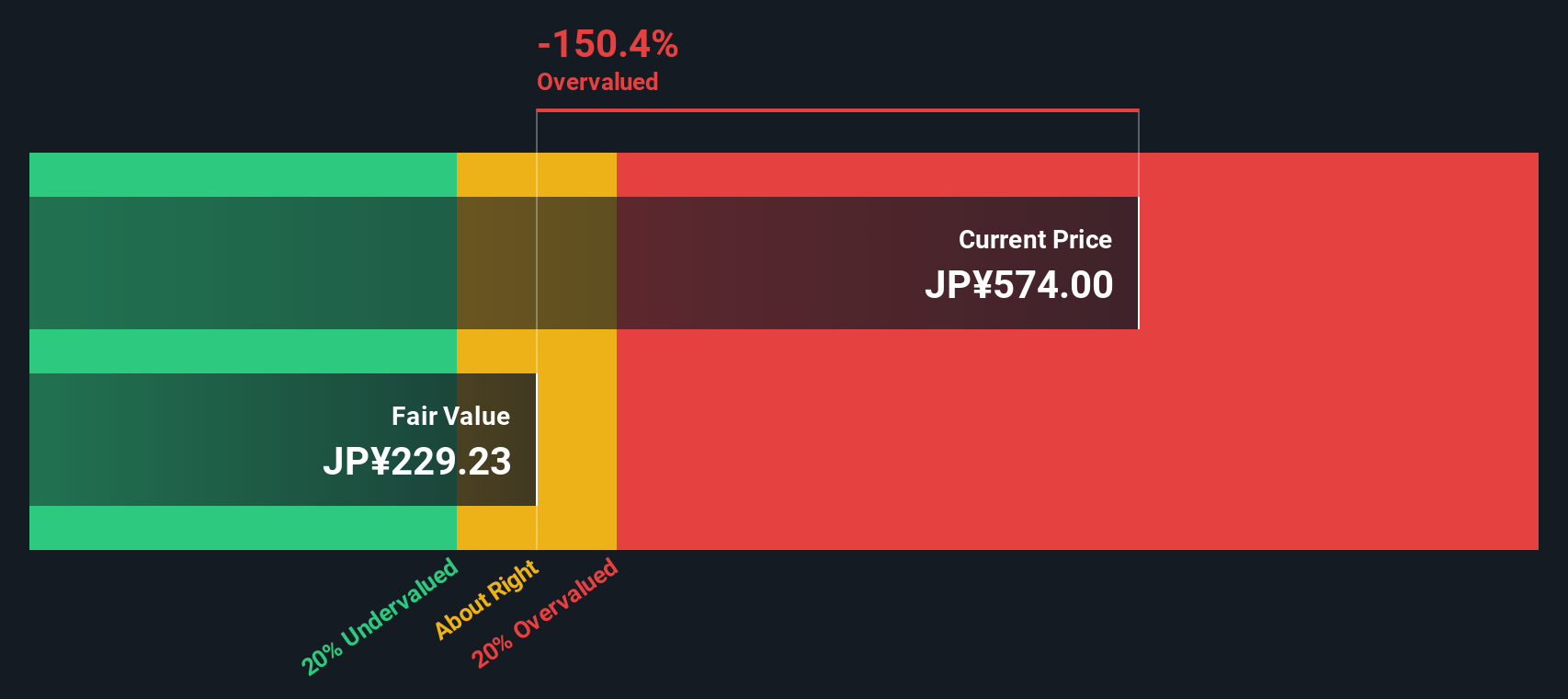

Taking a different approach, our DCF model estimates Metaplanet's fair value at ¥227.69 per share, which is well below today's price of ¥454. This suggests the market might be overly optimistic about future cash flows. Does this mean the hype is running ahead of the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Metaplanet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Metaplanet Narrative

If you’re looking to form your own perspective or want to dig deeper into the numbers, crafting your own analysis takes just a few minutes. So why not Do it your way.

A great starting point for your Metaplanet research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Stay ahead and keep your portfolio thriving by searching for standout companies shaping the future right now.

- Tap into game-changing trends in artificial intelligence by selecting from these 24 AI penny stocks, which are pushing boundaries and redefining what tech can do.

- Secure powerful cash flow opportunities with these 868 undervalued stocks based on cash flows before the rest of the market catches on to these potential bargains.

- Accelerate your returns with these 26 quantum computing stocks, where disruptive computing breakthroughs are creating exciting new rewards for early movers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3350

High growth potential with adequate balance sheet.

Market Insights

Community Narratives