- Japan

- /

- Hospitality

- /

- TSE:3350

Metaplanet (TSE:3350) Is Up 20.3% After Issuing Perpetual Preferred Shares to Fund Major Bitcoin Purchases Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Metaplanet recently announced a new “Phase II” initiative involving the issuance of perpetual preferred shares to fund further Bitcoin acquisitions, with an ambitious plan to increase holdings to 210,000 BTC by 2027 and a very large recent US$623 million purchase bringing its total to 30,823 BTC.

- This aggressive shift from a pure Bitcoin accumulation strategy to developing a broader Bitcoin financial platform highlights Metaplanet’s intention to expand both its income sources and influence within the digital asset space.

- We’ll examine how Metaplanet’s issuance of perpetual preferred shares and platform ambitions shape its evolving investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Metaplanet's Investment Narrative?

To own Metaplanet, you’d need to believe in the long-term value of Bitcoin, as well as the company’s ability to transform from a treasury play to a Bitcoin-centric financial platform. The recent Phase II announcement, featuring a US$623 million Bitcoin purchase and the launch of perpetual preferred shares, underscores its push for massive scale. This aggressive expansion comes as Metaplanet is now the fourth-largest corporate holder of Bitcoin and is being added to major indices, which could drive more institutional interest and trading volume. However, these moves also raise new short-term catalysts and risks: investors are watching closely to see if the earnings forecast revision signals better-than-expected growth or simply increased volatility. The share price’s sharp fall after the latest news points to market caution, the impact of dilution from issuing preferred shares and questions around sustainability of revenue gains have come to the fore. At the same time, the fresh index inclusions and management’s ambitions temper some near-term concerns but don’t remove uncertainty around execution and market sentiment shifts.

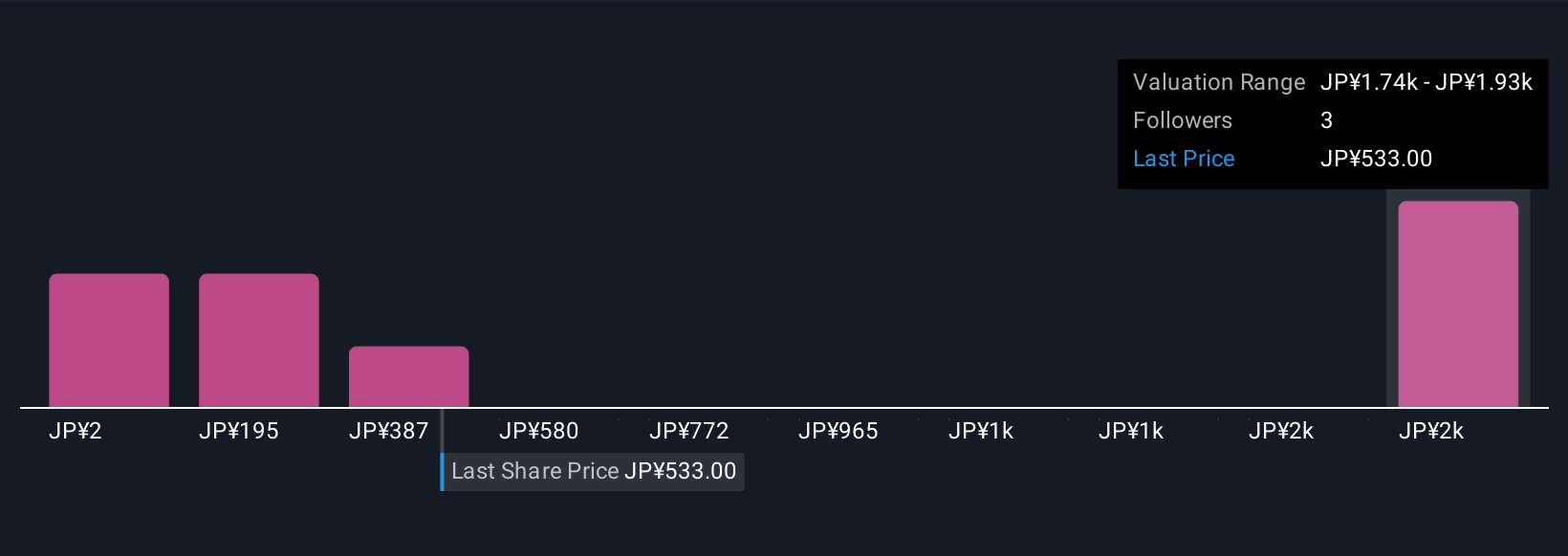

But with an inexperienced board and a new management team, execution risk is something investors can’t ignore. Metaplanet's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 6 other fair value estimates on Metaplanet - why the stock might be worth over 3x more than the current price!

Build Your Own Metaplanet Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Metaplanet research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Metaplanet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Metaplanet's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3350

High growth potential with adequate balance sheet.

Market Insights

Community Narratives