- Japan

- /

- Hospitality

- /

- TSE:3223

SLD Entertainment, Inc. (TSE:3223) Stock Rockets 48% But Many Are Still Ignoring The Company

The SLD Entertainment, Inc. (TSE:3223) share price has done very well over the last month, posting an excellent gain of 48%. The annual gain comes to 111% following the latest surge, making investors sit up and take notice.

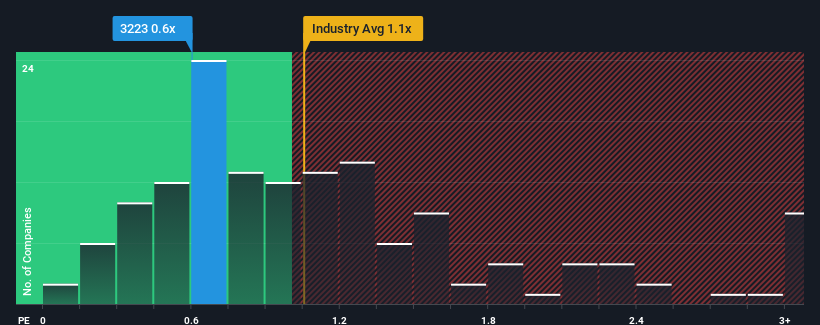

Even after such a large jump in price, it's still not a stretch to say that SLD Entertainment's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Hospitality industry in Japan, where the median P/S ratio is around 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for SLD Entertainment

What Does SLD Entertainment's P/S Mean For Shareholders?

The revenue growth achieved at SLD Entertainment over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. Those who are bullish on SLD Entertainment will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on SLD Entertainment's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For SLD Entertainment?

SLD Entertainment's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. The latest three year period has also seen an excellent 55% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 12%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that SLD Entertainment is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does SLD Entertainment's P/S Mean For Investors?

SLD Entertainment's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that SLD Entertainment currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Having said that, be aware SLD Entertainment is showing 3 warning signs in our investment analysis, and 2 of those are potentially serious.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3223

Flawless balance sheet and good value.

Market Insights

Community Narratives