- Japan

- /

- Hospitality

- /

- TSE:3097

A Look at Monogatari (TSE:3097) Valuation Following New September Sales Update

Reviewed by Simply Wall St

Monogatari (TSE:3097) released its unaudited sales figures for September 2025, reporting all-restaurant net sales at 106.8% compared to 111.1% in the same month last year. These results offer a snapshot of the company’s operational pace.

See our latest analysis for Monogatari.

With Monogatari’s latest released sales providing fresh insight, investors have seen the stock deliver a strong year-to-date share price return of 16.8%. Its 1-year total shareholder return of 12.5% and remarkable 132% gain over five years highlight long-term growth momentum. The recent dip over the past month suggests some cooling, but overall sentiment remains constructive given the company’s track record.

If Monogatari’s growth history has you thinking bigger, now might be the perfect moment to discover fast growing stocks with high insider ownership.

With shares currently trading at a discount to analyst targets and recent growth rates still in the double digits, the question is whether Monogatari offers untapped value, or if investors have already accounted for its future potential.

Price-to-Earnings of 25.1x: Is it justified?

Monogatari currently trades at a price-to-earnings (P/E) ratio of 25.1x, placing it closely in line with its calculated fair P/E of 25.2x. With a last close price of ¥4,005 and consensus that the share price sits below analysts' fair value targets, investors are watching whether this valuation holds up against market dynamics.

The price-to-earnings multiple captures how much investors are paying for each yen of Monogatari’s earnings. In the hospitality sector, the P/E ratio is a key signal for both growth prospects and perceived stability, used extensively to benchmark against broader industry and market multiples.

While Monogatari's P/E signals a business that is valued fairly relative to its earnings, the story changes slightly when compared to its sector. It is modestly more expensive than the JP Hospitality industry average (24.2x), signaling investor confidence in its growth outlook and operational track record. However, compared to peers on average (40.3x), Monogatari still represents an attractive relative value. The fair P/E ratio of 25.2x, almost identical to where the stock sits today, suggests the market price could remain stable unless new growth drivers emerge.

Explore the SWS fair ratio for Monogatari

Result: Price-to-Earnings of 25.1x (ABOUT RIGHT)

However, persistent volatility in consumer demand or unexpected shifts in industry competition could pose challenges for Monogatari’s otherwise steady growth outlook.

Find out about the key risks to this Monogatari narrative.

Another View: DCF Suggests Further Upside

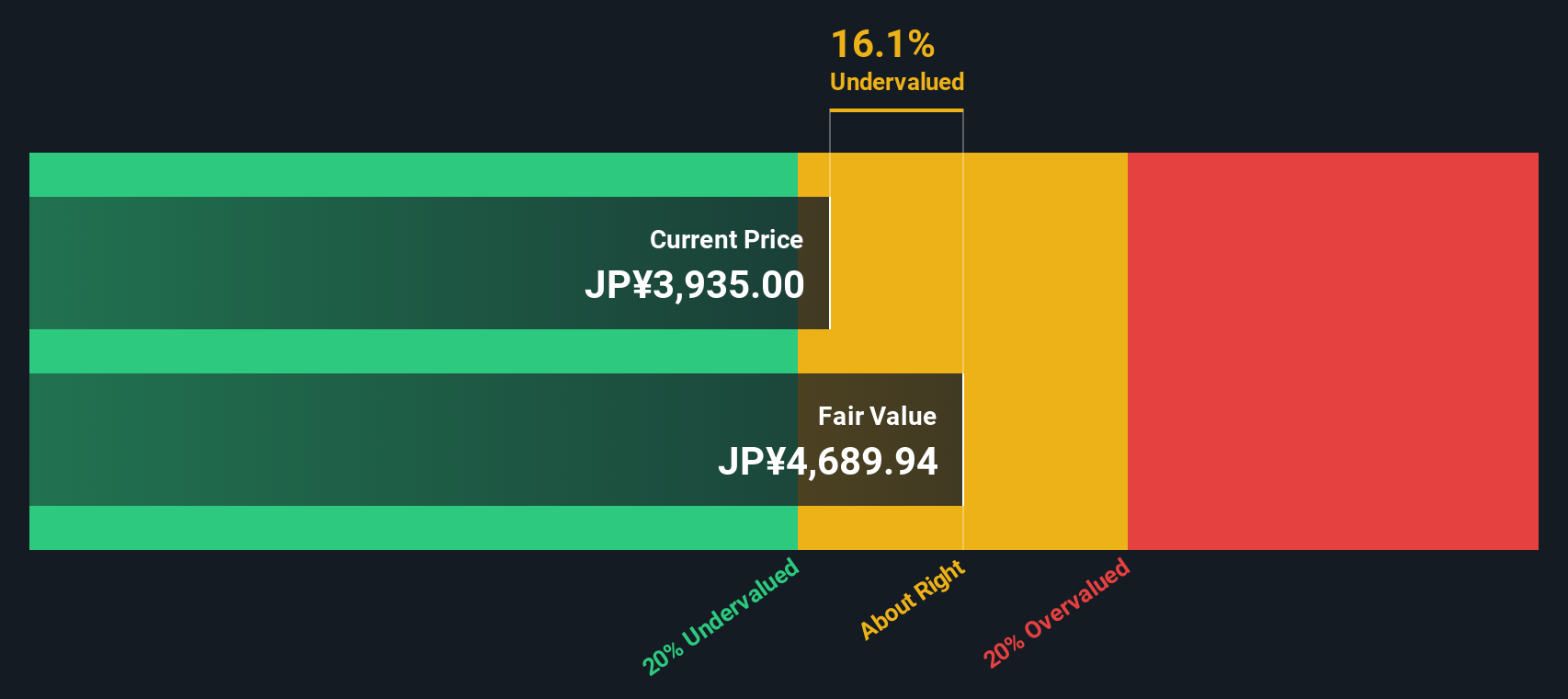

A different perspective comes from our DCF model, which estimates Monogatari's fair value at ¥4,679.09. This is about 14.4% above the current price. This approach signals the shares may be undervalued right now, even though the current market multiple suggests they are priced about right. Could the market be underestimating Monogatari's future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Monogatari for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Monogatari Narrative

If you see things differently or want to craft your own insights, it only takes a few minutes to build a narrative from your own research. Why not Do it your way?

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Monogatari.

Looking for more investment ideas?

Act now to grab fresh opportunities. Unique companies in untapped sectors and future trends could transform your portfolio if you get there before the crowd.

- Unlock long-term payouts by checking out these 17 dividend stocks with yields > 3%, featuring stocks offering higher-than-average yields with the potential to boost your income.

- Get ahead of healthcare innovation and see which firms are using cutting-edge artificial intelligence by starting with these 33 healthcare AI stocks.

- Tap into digital transformation and find growth potential with these 80 cryptocurrency and blockchain stocks at the forefront of blockchain and the evolving financial landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3097

Flawless balance sheet and good value.

Market Insights

Community Narratives