Rock Field Co.,Ltd.'s (TSE:2910) investors are due to receive a payment of ¥9.00 per share on 19th of January. This makes the dividend yield 1.6%, which will augment investor returns quite nicely.

Rock FieldLtd's Projections Indicate Future Payments May Be Unsustainable

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, the company was paying out 142% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 69%. Generally, we think cash is more important than accounting measures of profit, so with the cash flows easily covering the dividend, we don't think there is much reason to worry.

Earnings per share is forecast to rise by 16.8% over the next year. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 120% over the next year.

Check out our latest analysis for Rock FieldLtd

Dividend Volatility

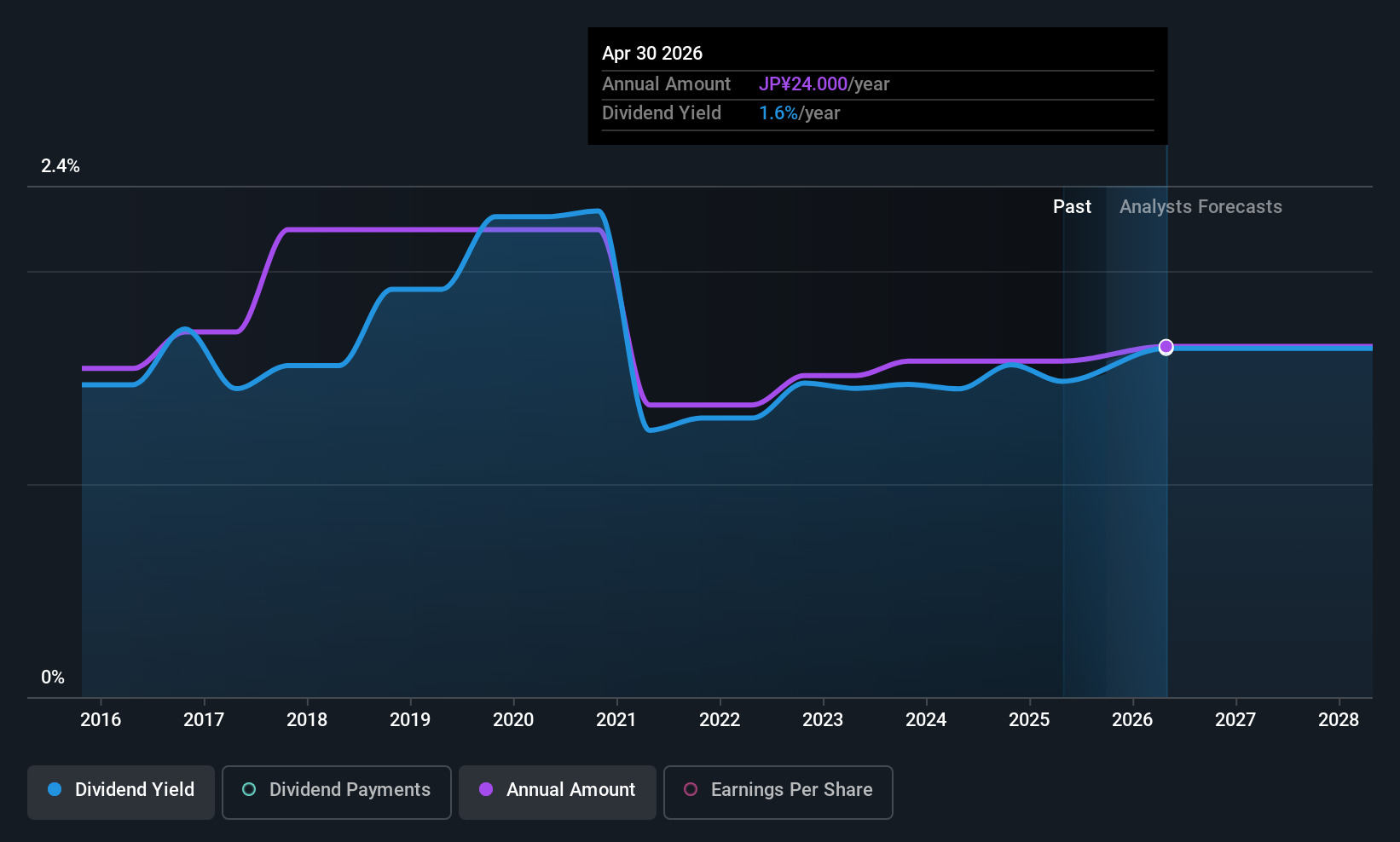

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2015, the dividend has gone from ¥22.50 total annually to ¥24.00. Dividend payments have been growing, but very slowly over the period. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

Rock FieldLtd May Find It Hard To Grow The Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings has been rising at 2.0% per annum over the last five years, which admittedly is a bit slow. The company is paying out a lot of its profits, even though it is growing those profits pretty slowly. Limited recent earnings growth and a high payout ratio makes it hard for us to envision strong future dividend growth, unless the company should have substantial pricing power or some form of competitive advantage.

Our Thoughts On Rock FieldLtd's Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Rock FieldLtd's payments, as there could be some issues with sustaining them into the future. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for Rock FieldLtd that investors should know about before committing capital to this stock. Is Rock FieldLtd not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2910

Rock FieldLtd

Engages in the manufacture and sale of delicatessen products in Japan.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026