- Japan

- /

- Hospitality

- /

- TSE:2910

Discover 3 Undiscovered Gems In Japan With Strong Potential

Reviewed by Simply Wall St

Amidst a week of significant losses in Japan's stock markets, driven by disappointing U.S. economic data and a hawkish turn from the Bank of Japan, investors are increasingly seeking opportunities in undervalued small-cap stocks. Despite broader market volatility, these smaller companies often present strong potential for growth due to their innovative approaches and niche market positions. In this article, we will explore three undiscovered gems in Japan's small-cap sector that demonstrate resilience and promise amidst current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.81% | 7.30% | 7.30% | ★★★★★★ |

| Central Forest Group | NA | 5.16% | 12.45% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.80% | 6.26% | 4.41% | ★★★★★★ |

| Nice | 71.69% | -1.98% | 36.48% | ★★★★★★ |

| Ogaki Kyoritsu Bank | 130.22% | 1.61% | -0.98% | ★★★★★☆ |

| Marusan Securities | 5.33% | 1.01% | 10.00% | ★★★★★☆ |

| Kappa Create | 73.80% | -1.08% | -8.46% | ★★★★★☆ |

| Nippon Sharyo | 61.34% | -1.68% | -17.07% | ★★★★☆☆ |

| Yukiguni Maitake | 158.67% | -5.22% | -32.27% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Rock FieldLtd (TSE:2910)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rock Field Co., Ltd. engages in the manufacture and sale of delicatessen products in Japan, with a market cap of ¥37.20 billion.

Operations: Rock Field Co., Ltd. generates revenue primarily from the manufacture and sale of delicatessen products in Japan, with a market cap of ¥37.20 billion.

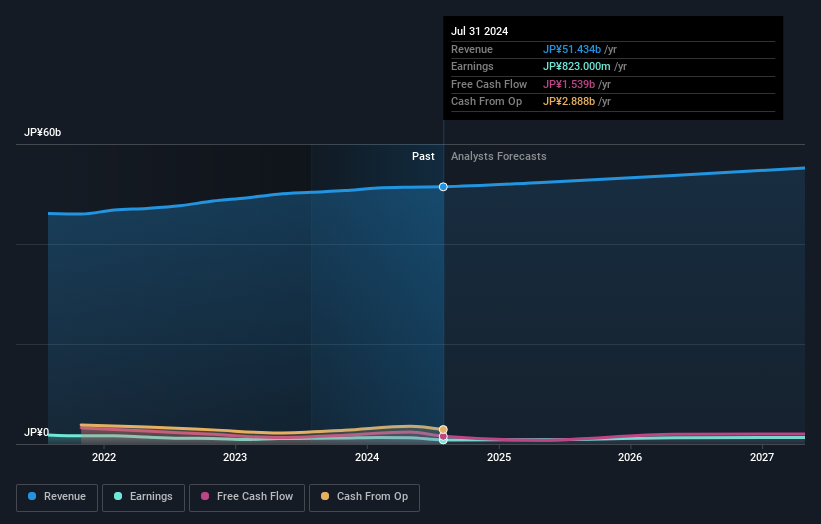

Rock Field Ltd., a small cap player, has seen earnings grow 3.1% annually over the past five years and forecasts an 8.05% annual growth rate ahead. Its debt-to-equity ratio increased from 0.4 to 2.3 in five years, but it holds more cash than total debt, ensuring stability. The company recently announced a dividend increase to JPY14 per share for FY2024 and expects net sales of JPY53.47 billion for FY2025 with operating profit at JPY2 billion.

- Navigate through the intricacies of Rock FieldLtd with our comprehensive health report here.

Understand Rock FieldLtd's track record by examining our Past report.

MedikitLtd (TSE:7749)

Simply Wall St Value Rating: ★★★★★★

Overview: Medikit Co., Ltd. manufactures and sells vascular access medical devices and has a market cap of ¥44.02 billion.

Operations: Medikit Co., Ltd. generates revenue primarily from the sale of vascular access medical devices. The company has a market cap of ¥44.02 billion and focuses on this specialized segment for its income streams.

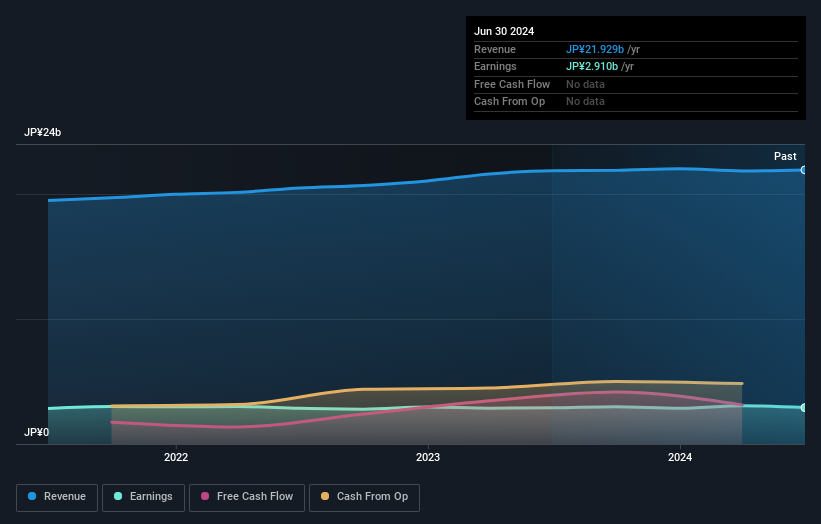

Medikit Ltd., a small-cap medical equipment company, has shown impressive performance with earnings growth of 7.2% over the past year, outpacing the industry average of 3.4%. Trading at 50% below its estimated fair value, Medikit offers significant upside potential. The company is debt-free and boasts high-quality earnings. Additionally, it remains free cash flow positive and held its Annual General Meeting on June 26, 2024.

- Click to explore a detailed breakdown of our findings in MedikitLtd's health report.

Examine MedikitLtd's past performance report to understand how it has performed in the past.

France Bed HoldingsLtd (TSE:7840)

Simply Wall St Value Rating: ★★★★★☆

Overview: France Bed Holdings Co., Ltd., through its subsidiaries, operates in the medical services and home furnishing and health sectors in Japan, with a market cap of ¥39.17 billion.

Operations: France Bed Holdings Co., Ltd. generates revenue primarily from its Medical Services segment (¥38.87 billion) and Interior Health segment (¥20.01 billion). The company has a market cap of ¥39.17 billion.

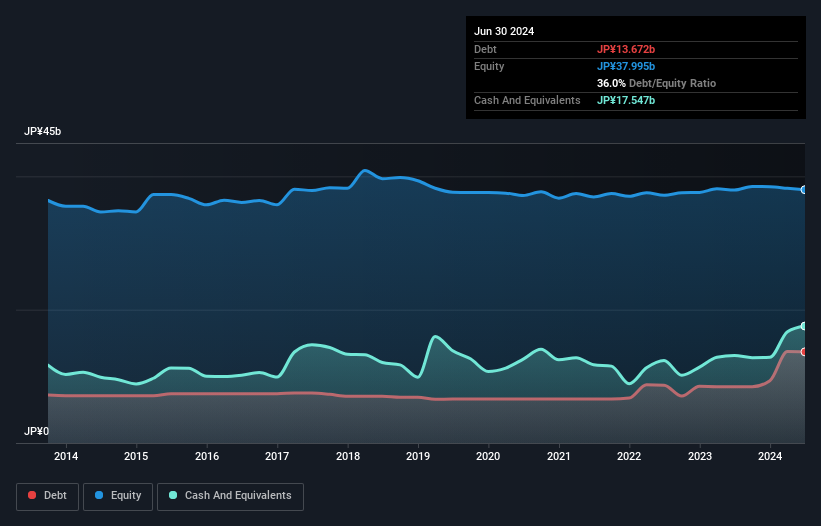

France Bed Holdings Ltd. has shown solid financial performance with net income for the fiscal year ending March 31, 2024, reaching ¥3.13 billion, up from ¥2.70 billion the previous year. The company’s earnings per share increased to ¥87.28 from ¥74.80 a year ago, reflecting robust profitability. Additionally, France Bed's price-to-earnings ratio of 12.5x is attractive compared to the JP market average of 13.2x and its debt coverage by EBIT stands strong at 72.8x interest payments.

- Get an in-depth perspective on France Bed HoldingsLtd's performance by reading our health report here.

Assess France Bed HoldingsLtd's past performance with our detailed historical performance reports.

Key Takeaways

- Unlock more gems! Our Japanese Undiscovered Gems With Strong Fundamentals screener has unearthed 693 more companies for you to explore.Click here to unveil our expertly curated list of 696 Japanese Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2910

Rock FieldLtd

Engages in the manufacture and sale of delicatessen products in Japan.

Excellent balance sheet with proven track record.