- Japan

- /

- Specialty Stores

- /

- TSE:3046

Three Japanese Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

Japan's stock markets have recently experienced significant losses, with the Nikkei 225 Index falling 4.7% and the broader TOPIX Index down 6.0%, partly due to a hawkish turn from the Bank of Japan and disappointing U.S. macroeconomic data dampening investor sentiment. Amidst this volatility, there may be opportunities to identify stocks that are trading below their estimated value. In such an environment, a good stock often has strong fundamentals, including solid earnings potential and a resilient business model that can weather economic fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TESEC (TSE:6337) | ¥1329.00 | ¥2466.94 | 46.1% |

| KATITAS (TSE:8919) | ¥1596.00 | ¥3158.35 | 49.5% |

| Optimus Group (TSE:9268) | ¥410.00 | ¥752.22 | 45.5% |

| S-Pool (TSE:2471) | ¥236.00 | ¥465.99 | 49.4% |

| Members (TSE:2130) | ¥715.00 | ¥1414.81 | 49.5% |

| Kanamic NetworkLTD (TSE:3939) | ¥456.00 | ¥877.20 | 48% |

| Taiyo Yuden (TSE:6976) | ¥3413.00 | ¥6392.17 | 46.6% |

| Nissha (TSE:7915) | ¥1464.00 | ¥2696.03 | 45.7% |

| Takara Bio (TSE:4974) | ¥947.00 | ¥1814.48 | 47.8% |

| UUUMLtd (TSE:3990) | ¥334.00 | ¥662.16 | 49.6% |

We'll examine a selection from our screener results.

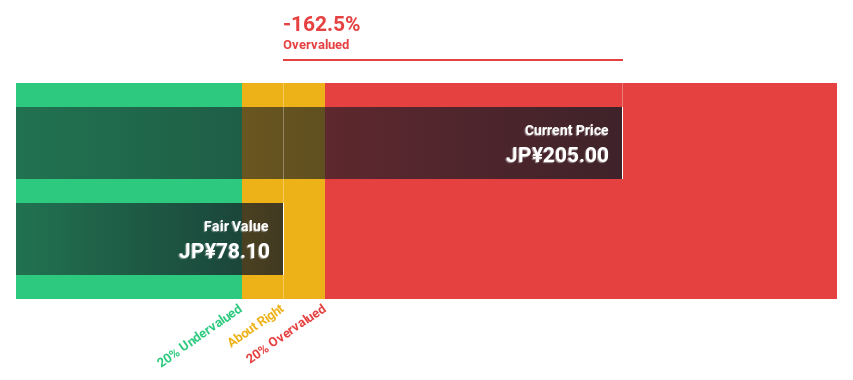

Lifedrink Company (TSE:2585)

Overview: Lifedrink Company, Inc. manufactures and sells beverages in Japan, with a market cap of ¥79.56 billion.

Operations: Lifedrink generates revenue from manufacturing and selling beverages exclusively within Japan.

Estimated Discount To Fair Value: 24.8%

Lifedrink Company appears undervalued based on cash flows, trading at ¥6090, which is 24.8% below its estimated fair value of ¥8098.42. Despite high debt levels and volatile share prices, the company's earnings grew by 52% last year and are forecast to grow 9.45% annually, outpacing the JP market's 8.9%. Revenue is expected to grow at 6.3%, faster than the market's 4.1%, with a projected return on equity of 23.1% in three years.

- In light of our recent growth report, it seems possible that Lifedrink Company's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Lifedrink Company's balance sheet health report.

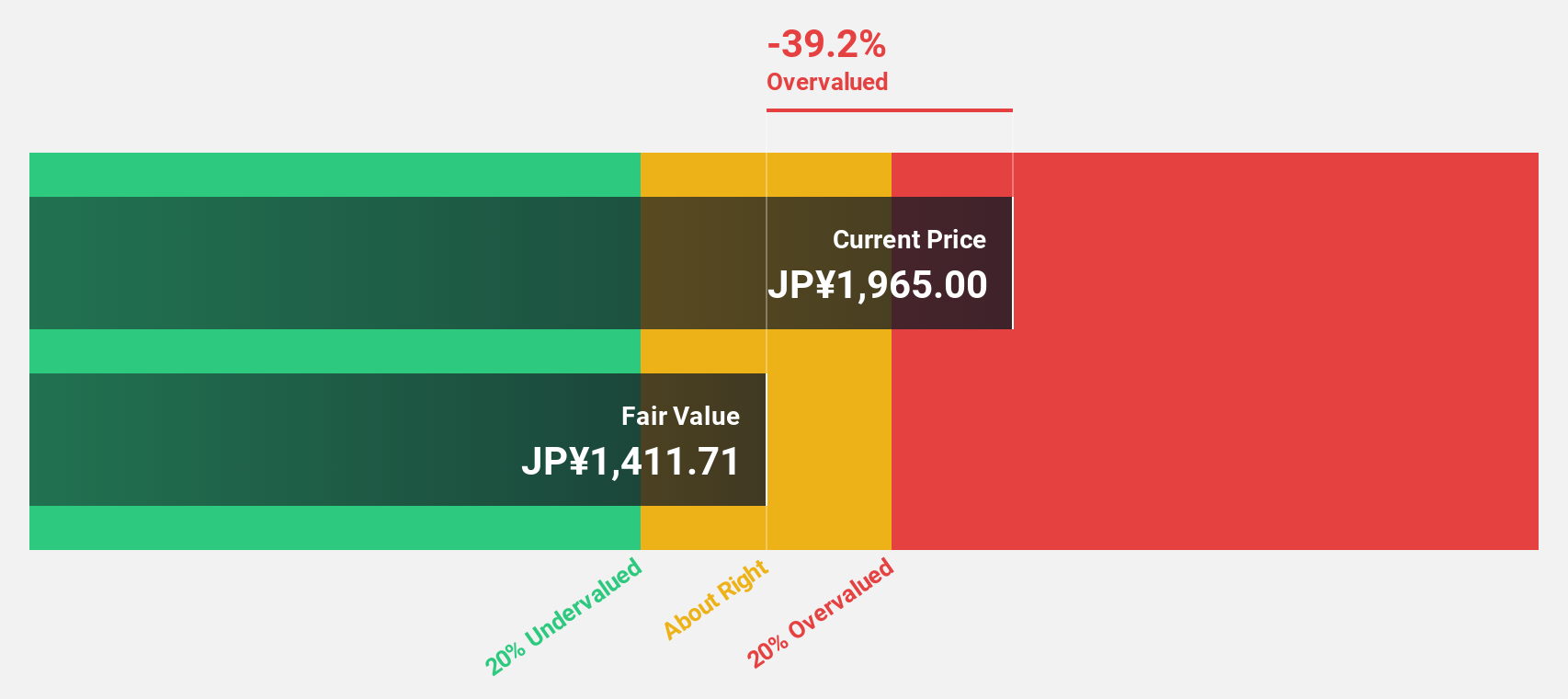

JINS HOLDINGS (TSE:3046)

Overview: JINS HOLDINGS Inc., with a market cap of ¥97.33 billion, operates through its subsidiaries in the planning, manufacturing, sales, and import/export of eyewear and fashion accessories both in Japan and internationally.

Operations: Revenue Segments (in millions of ¥): Eyewear: ¥53,200; Fashion Accessories: ¥12,500; International Operations: ¥9,800. JINS HOLDINGS generates revenue from eyewear (¥53.20 billion), fashion accessories (¥12.50 billion), and international operations (¥9.80 billion).

Estimated Discount To Fair Value: 10.8%

JINS HOLDINGS is trading at ¥4170, below its estimated fair value of ¥4676.64. Recent sales data show strong growth, with July 2024 sales up 20% year on year. The company has revised its full-year earnings guidance upward, projecting net sales of ¥79.94 billion and operating profit of ¥6.30 billion. Despite a forecasted slower revenue growth rate (6.6%) compared to earnings (20.91%), the stock remains undervalued based on discounted cash flow analysis.

- Upon reviewing our latest growth report, JINS HOLDINGS' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of JINS HOLDINGS.

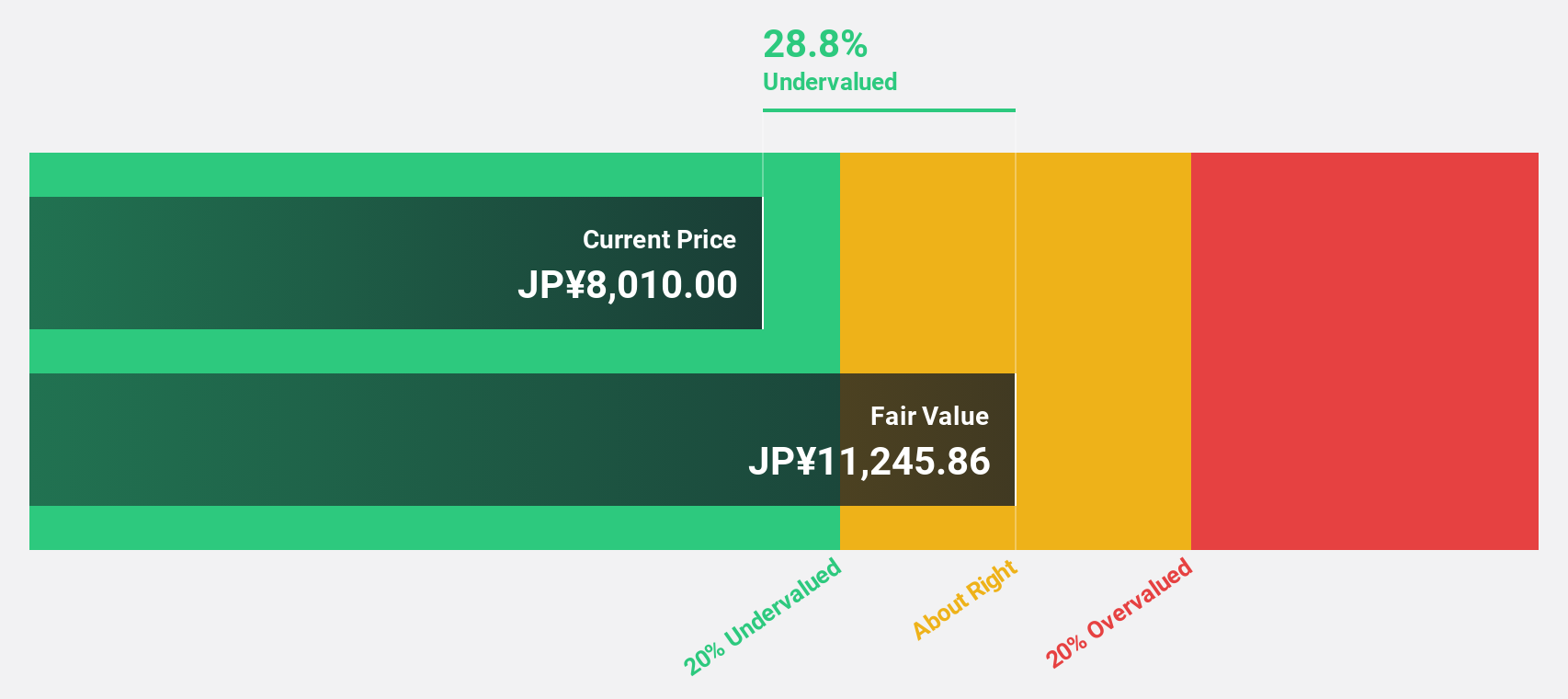

CYBERDYNE (TSE:7779)

Overview: CYBERDYNE Inc. researches, develops, produces, sells, leases, and maintains robotic equipment and systems for medical and welfare purposes across various regions including Japan, the United States, Europe, the Middle East, Africa, and Asia Pacific countries with a market cap of ¥36.74 billion.

Operations: The company's revenue segments encompass the research, development, production, sale, leasing, and maintenance of robotic equipment and systems for medical and welfare purposes in Japan, the United States, Europe, the Middle East, Africa, and Asia Pacific countries.

Estimated Discount To Fair Value: 16.9%

CYBERDYNE is trading at ¥174, below its estimated fair value of ¥209.36, making it undervalued by 16.9%. The company is expected to become profitable within the next three years and has a revenue growth forecast of 20.5% per year, significantly outpacing the JP market's 4.1%. However, its return on equity is projected to remain low at 1.2%. Recent US FDA clearance for Medical HAL expands treatment indications and sizes, potentially boosting future revenues.

- Insights from our recent growth report point to a promising forecast for CYBERDYNE's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of CYBERDYNE.

Where To Now?

- Get an in-depth perspective on all 69 Undervalued Japanese Stocks Based On Cash Flows by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3046

JINS HOLDINGS

Through its subsidiaries, engages in the planning, manufacturing, sales, and import/export of eyewear and fashion accessories in Japan and internationally.

Excellent balance sheet with reasonable growth potential.