- Japan

- /

- Hospitality

- /

- TSE:2753

Amiyaki Tei Co., Ltd. (TSE:2753) Stocks Shoot Up 26% But Its P/S Still Looks Reasonable

Despite an already strong run, Amiyaki Tei Co., Ltd. (TSE:2753) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 78%.

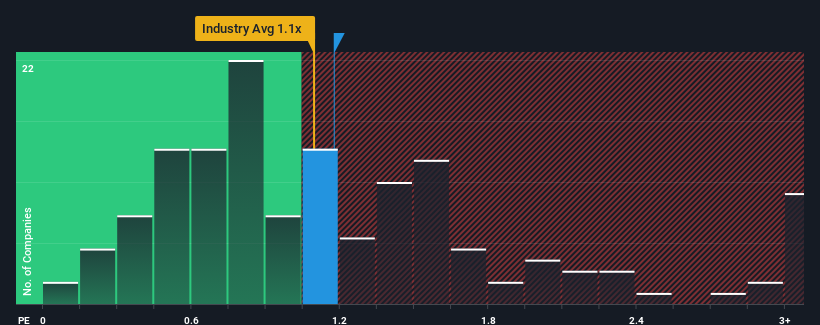

Although its price has surged higher, you could still be forgiven for feeling indifferent about Amiyaki Tei's P/S ratio of 1.2x, since the median price-to-sales (or "P/S") ratio for the Hospitality industry in Japan is also close to 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Amiyaki Tei

What Does Amiyaki Tei's P/S Mean For Shareholders?

Recent times haven't been great for Amiyaki Tei as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Amiyaki Tei will help you uncover what's on the horizon.How Is Amiyaki Tei's Revenue Growth Trending?

In order to justify its P/S ratio, Amiyaki Tei would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. As a result, it also grew revenue by 30% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the lone analyst following the company. That's shaping up to be similar to the 13% growth forecast for the broader industry.

With this in mind, it makes sense that Amiyaki Tei's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Its shares have lifted substantially and now Amiyaki Tei's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Amiyaki Tei's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Hospitality industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Amiyaki Tei with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Amiyaki Tei, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Amiyaki Tei, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2753

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives