- Japan

- /

- Hospitality

- /

- TSE:2340

Shareholders Should Be Pleased With Gokurakuyu Holdings Co., Ltd.'s (TSE:2340) Price

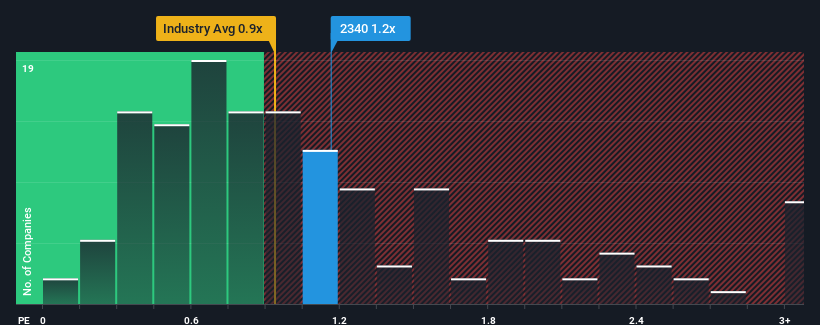

There wouldn't be many who think Gokurakuyu Holdings Co., Ltd.'s (TSE:2340) price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S for the Hospitality industry in Japan is similar at about 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Gokurakuyu Holdings

What Does Gokurakuyu Holdings' Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Gokurakuyu Holdings' revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. Those who are bullish on Gokurakuyu Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Gokurakuyu Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Gokurakuyu Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Gokurakuyu Holdings would need to produce growth that's similar to the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 34% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, it's clear to see why Gokurakuyu Holdings' P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Bottom Line On Gokurakuyu Holdings' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we've seen, Gokurakuyu Holdings' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Gokurakuyu Holdings with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Gokurakuyu Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2340

Gokurakuyu Holdings

Operates, manages, and franchises spas facilities under the Gokurakuyu and RAKU SPA names in Japan and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.