Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Horiifoodservice Co., Ltd. (TYO:3077) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Horiifoodservice

What Is Horiifoodservice's Debt?

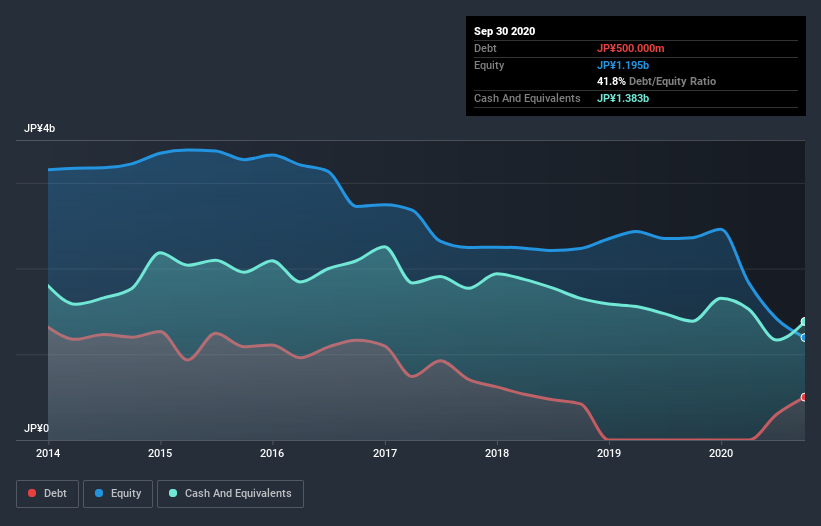

The image below, which you can click on for greater detail, shows that at September 2020 Horiifoodservice had debt of JP¥491.0m, up from none in one year. But it also has JP¥1.38b in cash to offset that, meaning it has JP¥892.0m net cash.

A Look At Horiifoodservice's Liabilities

We can see from the most recent balance sheet that Horiifoodservice had liabilities of JP¥1.15b falling due within a year, and liabilities of JP¥391.0m due beyond that. On the other hand, it had cash of JP¥1.38b and JP¥49.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥113.0m.

Of course, Horiifoodservice has a market capitalization of JP¥2.77b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, Horiifoodservice boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Horiifoodservice will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Horiifoodservice had a loss before interest and tax, and actually shrunk its revenue by 32%, to JP¥4.4b. That makes us nervous, to say the least.

So How Risky Is Horiifoodservice?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Horiifoodservice lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through JP¥496m of cash and made a loss of JP¥1.2b. Given it only has net cash of JP¥892.0m, the company may need to raise more capital if it doesn't reach break-even soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Horiifoodservice (1 is significant!) that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Horiifoodservice or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Horiifoodservice might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSE:3077

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026