- Japan

- /

- Consumer Services

- /

- TSE:2344

Did You Miss Heian Ceremony ServiceLtd's (TYO:2344) 18% Share Price Gain?

When we invest, we're generally looking for stocks that outperform the market average. Buying under-rated businesses is one path to excess returns. For example, long term Heian Ceremony Service Co.,Ltd. (TYO:2344) shareholders have enjoyed a 18% share price rise over the last half decade, well in excess of the market return of around 12% (not including dividends).

Check out our latest analysis for Heian Ceremony ServiceLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Heian Ceremony ServiceLtd actually saw its EPS drop 5.5% per year.

The strong decline in earnings per share suggests the market isn't using EPS to judge the company. The falling EPS doesn't correlate with the climbing share price, so it's worth taking a look at other metrics.

It is not great to see that revenue has dropped by 0.3% per year over five years. It certainly surprises us that the share price is up, but perhaps a closer examination of the data will yield answers.

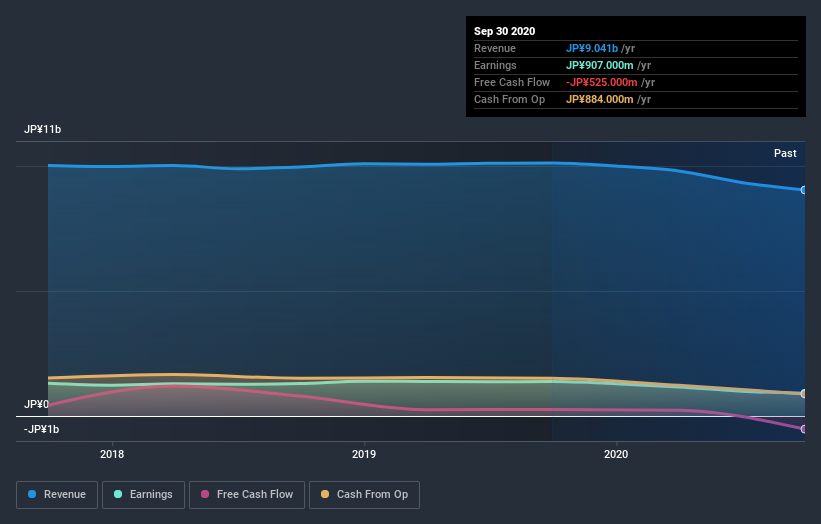

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Heian Ceremony ServiceLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Heian Ceremony ServiceLtd the TSR over the last 5 years was 37%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Heian Ceremony ServiceLtd shareholders are down 3.1% for the year (even including dividends), but the market itself is up 6.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 7%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Heian Ceremony ServiceLtd that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

If you decide to trade Heian Ceremony ServiceLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Heian Ceremony ServiceLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSE:2344

Heian Ceremony ServiceLtd

Provides services related to weddings, funerals, and other services in Japan.

6 star dividend payer with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.