- Japan

- /

- Hospitality

- /

- FKSE:6076

Amaze (FKSE:6076) Margin Decline Challenges Bullish Narratives Despite Sector-Low Valuation

Reviewed by Simply Wall St

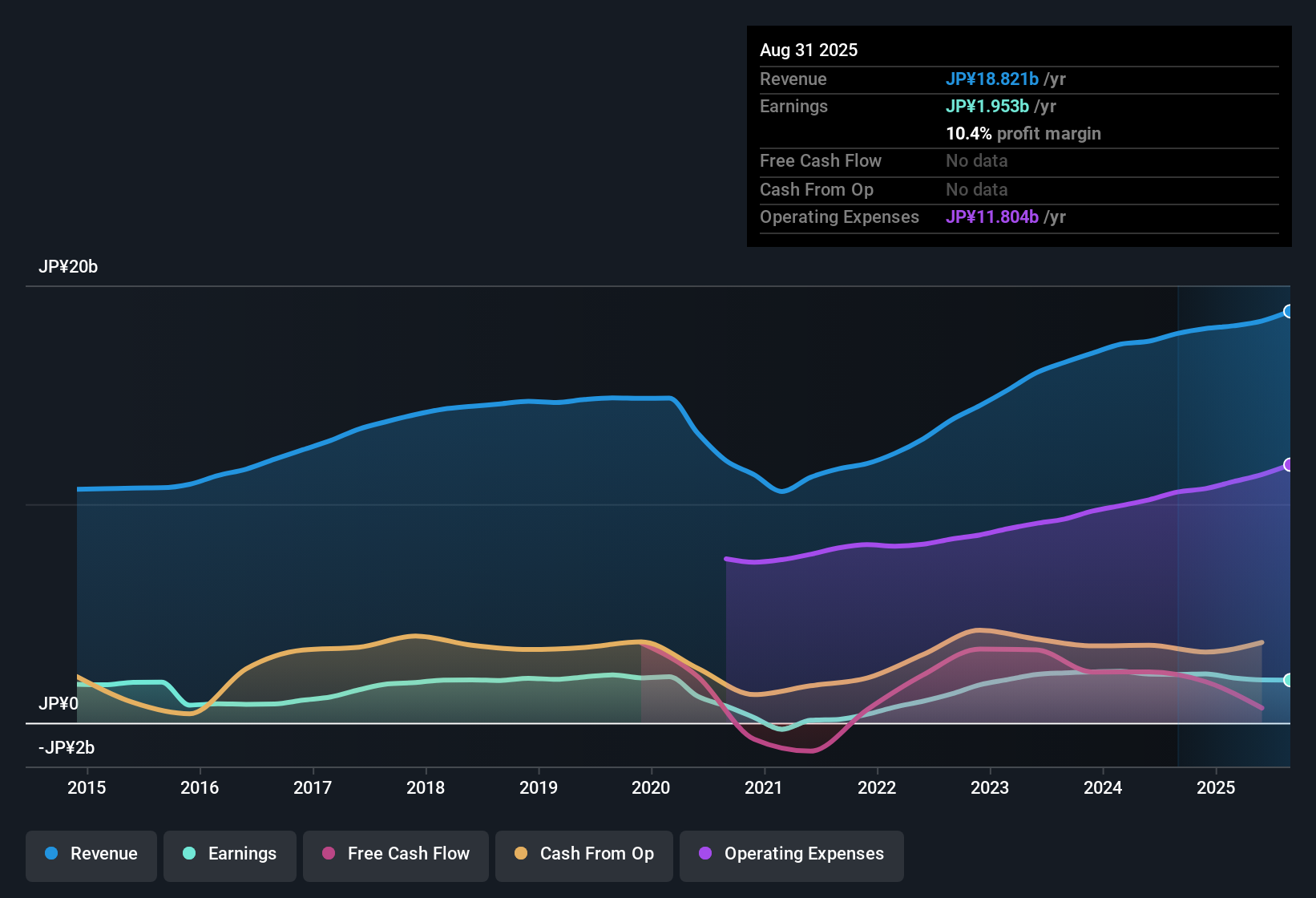

Amaze (FKSE:6076) reported a net profit margin of 10.4%, down from last year’s 12.4%. Over the past five years, the company’s earnings have grown at an impressive average rate of 34.1% per year. However, the most recent annual results showed a decline in earnings, which makes direct year-over-year comparisons less useful. With the stock trading at a Price-to-Earnings Ratio of 10.8x, well below both the JP Hospitality industry average and its immediate peers, investors may see an opportunity as Amaze’s share price of ¥1387 sits below the estimated fair value of ¥2169.9. While the numbers suggest a company with a strong historical growth record, margin pressure and the recent lack of earnings growth are central to the current debate.

See our full analysis for Amaze.Now, let's put these headline numbers next to the market’s prevailing narratives to see what really stands up to scrutiny and what might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Lose Steam Versus Five-Year Trend

- The latest net profit margin has slipped to 10.4%, marking a drop compared to the sturdy longer-term average earnings growth of 34.1% per year seen over the last five years.

- Market analysis points to Amaze’s history of rapid, quality earnings growth but also highlights that this year’s margin pressure complicates the bullish thesis.

- A five-year growth run at 34.1% annually is an outlier in the sector, strengthening the argument for Amaze’s long-term strength despite a recent earnings decline.

- At the same time, bulls must acknowledge that margins have narrowed, raising the bar for continued outperformance.

Price-to-Earnings Ratio Stays Well Below Sector

- With Amaze’s Price-to-Earnings Ratio at 10.8x, the stock trades well below the JP Hospitality industry average of 24.3x and peers at 14.1x, highlighting a significant valuation discount not yet corrected by the market.

- Contrary to more cautious takes, the current valuation gap draws attention as a clear supporting point for value-focused investors looking for both a historical growth record and margin of safety.

- The company is priced lower than peers despite strong historic growth, which supports the idea that investors are not overpaying for its future prospects.

- Even as margin pressures appear, value-sensitive investors may view peer and sector discounts as a cushion if future recovery materializes.

DCF Fair Value Suggests Upside Remains

- At a current share price of ¥1387 and DCF fair value of ¥2169.90, Amaze trades at a sizeable discount that underlines further upside is possible if margin pressures prove temporary.

- Prevailing market analysis indicates that despite earnings volatility, the gap to fair value remains significant, deepening the case for patient investors.

- Few other sector names offer this sort of estimated upside relative to current price, especially with historic growth factored in.

- If the company’s margin slippage reverses, the upside to DCF fair value could trigger renewed investor interest.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Amaze's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Amaze’s impressive five-year growth stands in contrast to recent margin pressures and an earnings decline, raising questions about its ability to deliver consistent results in the future.

If predictable, steady performance matters to you, consider stable growth stocks screener (2097 results) to discover companies delivering reliable growth through all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About FKSE:6076

Good value with adequate balance sheet.

Market Insights

Community Narratives