- Japan

- /

- Food and Staples Retail

- /

- TSE:9974

Belc (TSE:9974): Assessing Valuation Following Increased Dividend Declaration

Reviewed by Kshitija Bhandaru

Belc (TSE:9974) just declared a higher dividend for the second quarter, raising payouts to JPY 62.00 per share from JPY 58.00 a year ago. Dividend payments are scheduled to begin on November 4.

See our latest analysis for Belc.

Belc’s announcement of a higher interim dividend follows steady long-term progress, with its 1-year total shareholder return at 10.1% and an impressive 37% over the past three years. While momentum has cooled recently, the board’s decision suggests ongoing confidence in Belc’s fundamentals and its appeal for investors seeking reliable growth and income potential.

If you’re weighing your next investment moves, this could be the right moment to expand your search and discover fast growing stocks with high insider ownership

With shares up over 10% this year but growth moderating, is Belc still trading at an attractive value, or has the market already factored in its robust outlook and dividend strength? Could there still be a buying opportunity ahead?

Price-to-Earnings of 12.3x: Is it Justified?

Belc trades at a price-to-earnings (P/E) ratio of 12.3x, which is notably below both the industry average and its peer group. This suggests the market sees some value in the shares relative to consumer retailing stocks in Japan.

The price-to-earnings multiple compares the company’s current share price to its per-share earnings, providing a quick sense of how much investors are willing to pay for each unit of profit. For retailers like Belc, this is a widely used measure of market confidence in future earnings stability and growth.

At 12.3x, Belc's P/E ratio not only sits below the industry average of 13.3x but is also significantly cheaper compared to the peer average of 43.4x. Relative to the estimated “fair” P/E ratio of 16.1x, the stock appears undervalued, giving investors possible room for upside if market perceptions align more closely with fundamentals.

Explore the SWS fair ratio for Belc

Result: Price-to-Earnings of 12.3x (UNDERVALUED)

However, slowing revenue and net income growth, along with recent softness in the share price, could challenge the current outlook if these trends persist.

Find out about the key risks to this Belc narrative.

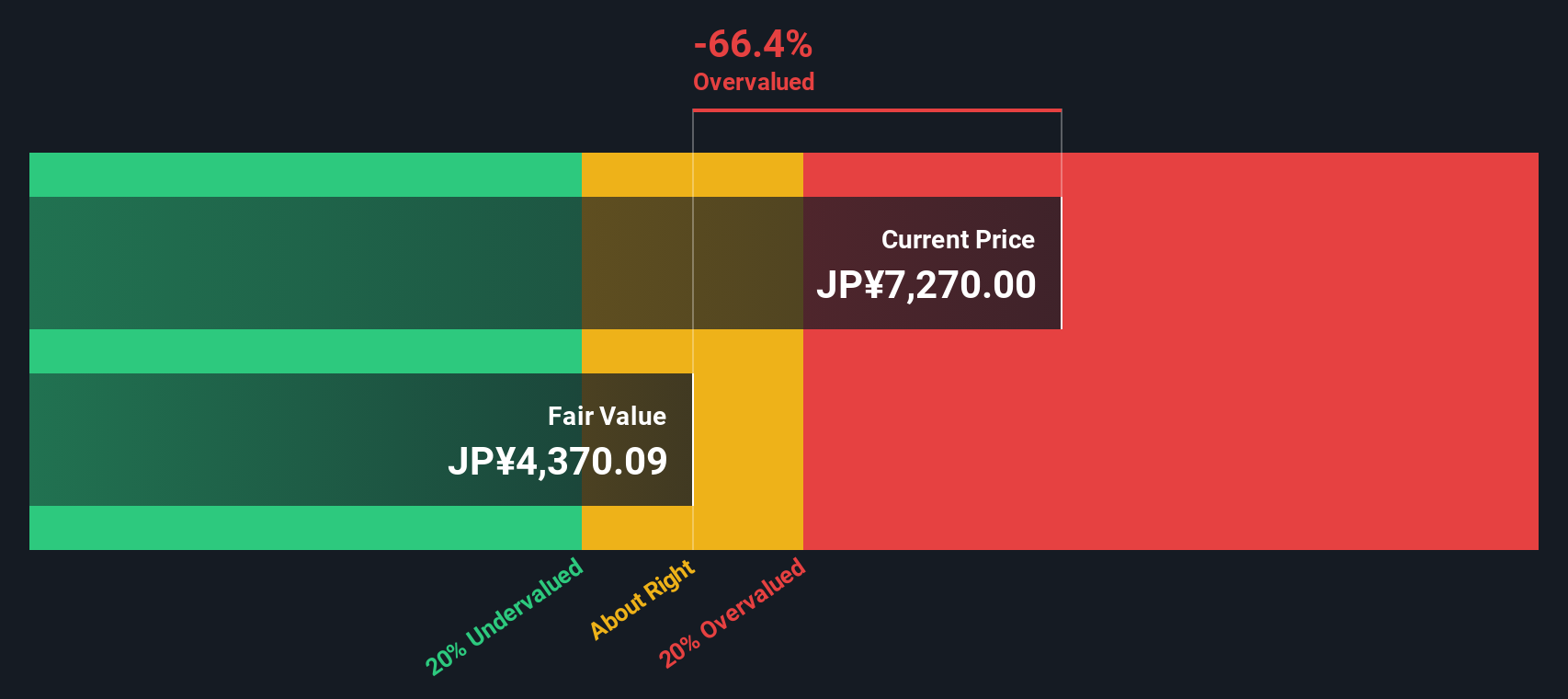

Another View: Discounted Cash Flow Suggests Overvaluation

While Belc’s price-to-earnings multiple indicates value, our SWS DCF model comes to a very different conclusion. Based on projected cash flows, the DCF estimates Belc’s fair value at ¥4,370, which is well below the current share price of ¥7,270. Is the market too optimistic about future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Belc for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Belc Narrative

If you’d rather crunch the numbers yourself or want to examine the data from your own angle, you can build a personalized view in just minutes, and Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Belc.

Looking for more investment ideas?

Unlock opportunities others might miss by checking out hand-picked stock ideas targeted for the current market. These fresh opportunities could give your portfolio an edge:

- Explore next-generation financial breakthroughs by reviewing these 79 cryptocurrency and blockchain stocks making strides in blockchain and digital assets.

- Capitalize on growth in artificial intelligence and see how these 24 AI penny stocks are transforming entire industries with smart solutions.

- Strengthen your income strategy and uncover these 18 dividend stocks with yields > 3% delivering reliable payouts above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Belc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9974

Solid track record with adequate balance sheet.

Market Insights

Community Narratives