- China

- /

- General Merchandise and Department Stores

- /

- SZSE:000419

Undiscovered Gems With Strong Fundamentals February 2025

Reviewed by Simply Wall St

As global markets grapple with tariff uncertainties and mixed economic signals, small-cap stocks have shown resilience, particularly as the S&P 600 reflects a broader sentiment of cautious optimism amidst these fluctuations. In this environment, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and potential growth; companies that demonstrate robust financial health and adaptability may offer promising opportunities even in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 29.70% | 115.27% | 164.65% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

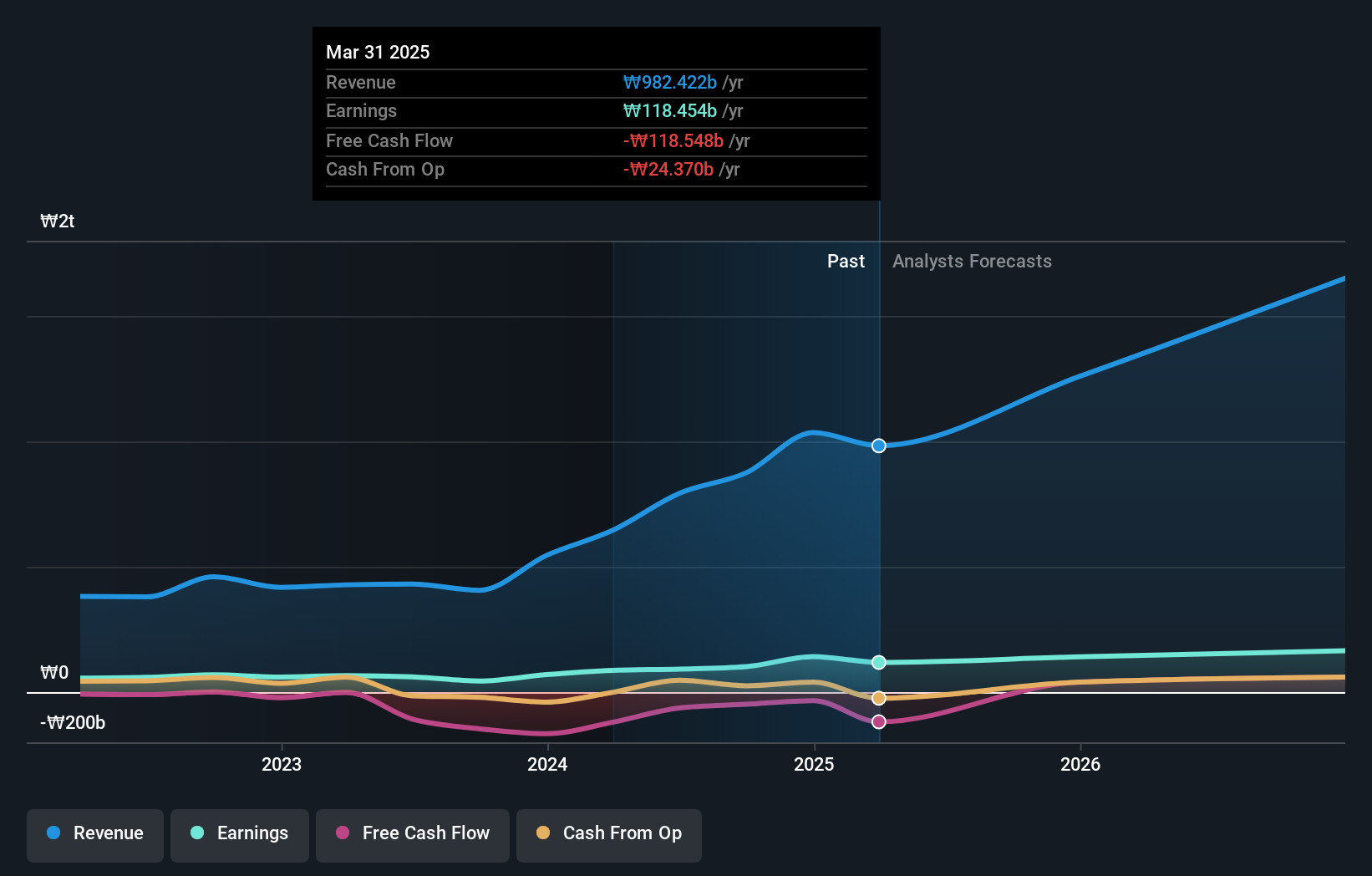

People & Technology (KOSDAQ:A137400)

Simply Wall St Value Rating: ★★★★★☆

Overview: People & Technology Inc. specializes in providing machinery solutions including coating, calendaring, slitting, and automation with a market capitalization of ₩962.44 billion.

Operations: The primary revenue stream for People & Technology Inc. is derived from its Machinery & Industrial Equipment segment, generating approximately ₩874.54 billion.

People & Technology, a promising player in the machinery sector, has seen its earnings soar by 129.8% over the past year, outpacing the industry's -0.3%. The company's net debt to equity ratio sits at a satisfactory 22.2%, reflecting prudent financial management with significant reduction from 69.8% five years ago to 28.9%. Despite not being free cash flow positive, it trades at nearly half its estimated fair value and offers high-quality non-cash earnings. With interest payments well covered by EBIT (28.5x), People & Technology seems poised for continued growth with forecasted annual earnings growth of 22.49%.

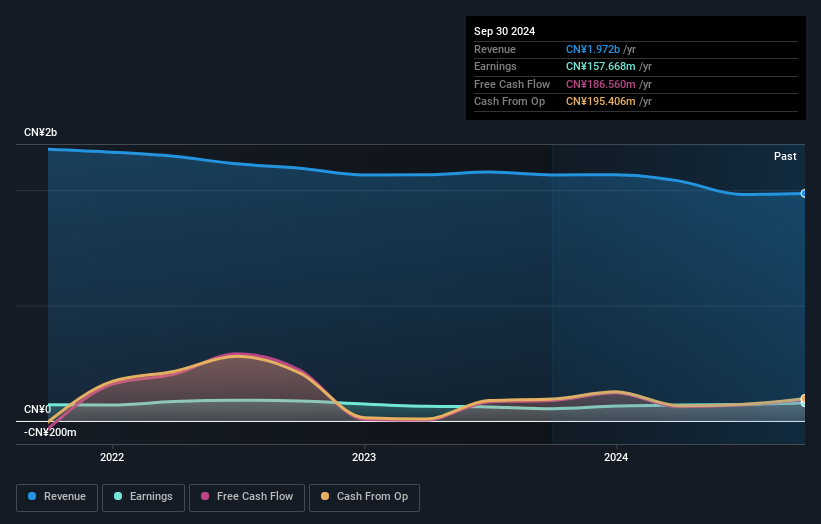

Changsha Tongcheng HoldingsLtd (SZSE:000419)

Simply Wall St Value Rating: ★★★★★★

Overview: Changsha Tongcheng Holdings Co. Ltd operates in commercial retail, comprehensive investment, and tourism hotel sectors in China with a market capitalization of CN¥3.18 billion.

Operations: Changsha Tongcheng Holdings Co. Ltd generates revenue through its commercial retail, comprehensive investment, and tourism hotel sectors. The company's cost structure is influenced by its diverse operations across these segments. It has a market capitalization of CN¥3.18 billion, reflecting its presence in the Chinese market.

Earnings for Changsha Tongcheng Holdings have shown a promising 49% growth over the past year, outpacing the Multiline Retail industry, which saw a -5.3%. Despite this recent upswing, earnings had declined by 6.8% annually over the last five years. The company's price-to-earnings ratio stands at 20.2x, notably lower than the CN market average of 37.1x, suggesting potential undervaluation. Additionally, its debt-to-equity ratio has improved from 13.5% to 7.9% in five years and it holds more cash than total debt on hand, indicating solid financial health despite previous challenges with non-recurring gains affecting results.

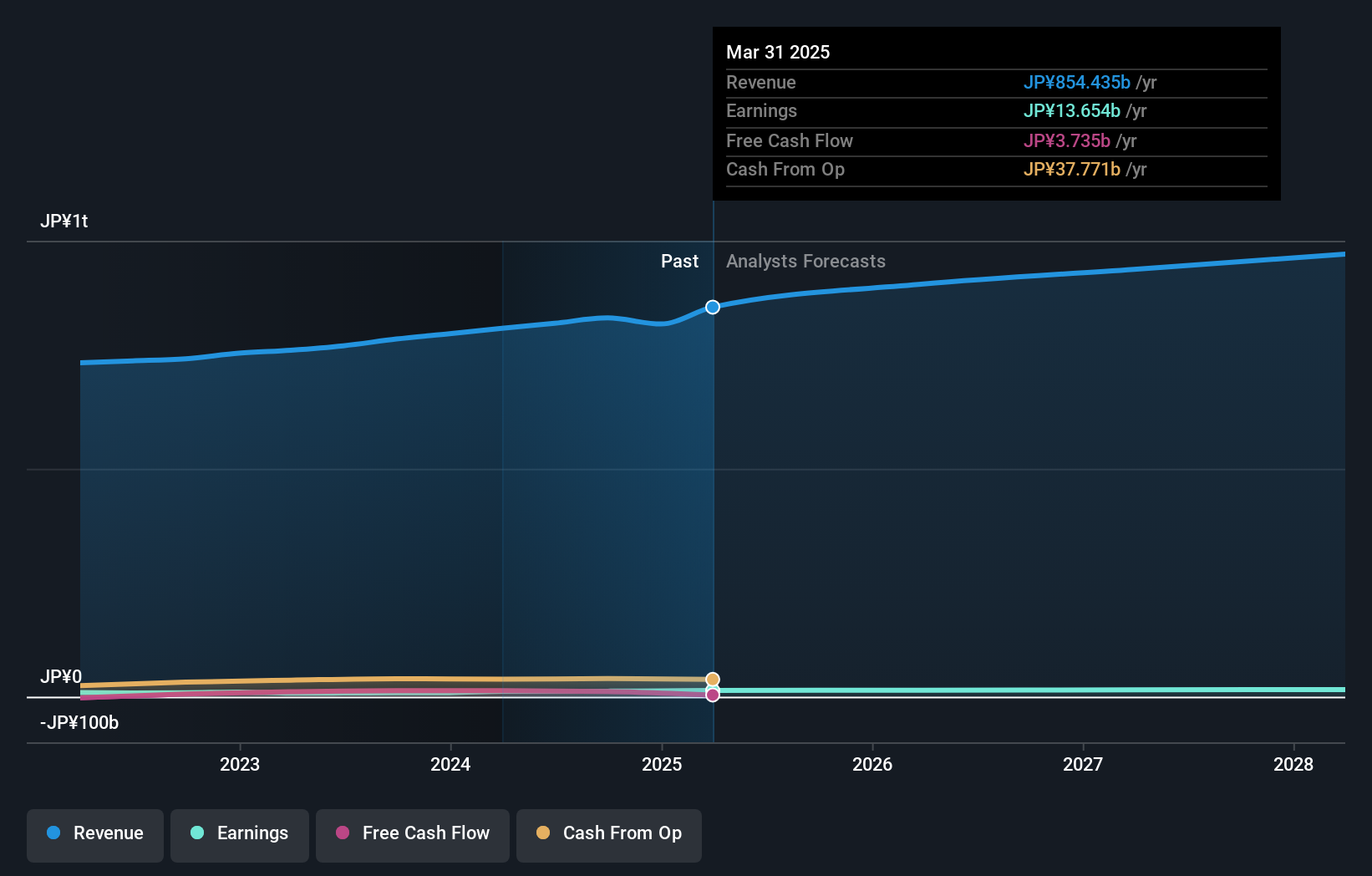

Valor Holdings (TSE:9956)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Valor Holdings Co., Ltd. operates supermarkets and home centers in Japan, with a market capitalization of ¥118.82 billion.

Operations: Valor Holdings generates revenue primarily from its Supermarket Business, which contributes ¥474.33 billion, and its Home Center Business, adding ¥128.72 billion. The Drug Store segment also plays a significant role with ¥174.80 billion in revenue.

Valor Holdings, a relatively small player in the market, has been making waves with an impressive 41.9% earnings growth over the past year, outpacing the Consumer Retailing industry average of 10.5%. Trading at a good value compared to peers and industry standards, it's currently priced 28% below our fair value estimate. While Valor's net debt to equity ratio stands at a high 46.6%, its interest payments are well covered by EBIT with a coverage of 61 times. The company's profitability ensures that cash runway isn't an issue, suggesting solid footing for future endeavors.

- Take a closer look at Valor Holdings' potential here in our health report.

Assess Valor Holdings' past performance with our detailed historical performance reports.

Summing It All Up

- Click this link to deep-dive into the 4708 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000419

Changsha Tongcheng HoldingsLtd

Engages in the commercial retail, business in China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives