- Japan

- /

- Food and Staples Retail

- /

- TSE:9948

ARCS (TSE:9948): Assessing Valuation Following New Buyback and Strong Half-Year Results

Reviewed by Kshitija Bhandaru

ARCS (TSE:9948) just rolled out a new share buyback program, planning to repurchase 700,000 shares by January 2026. This move comes alongside stronger half-year results and a clear focus on shareholder returns.

See our latest analysis for ARCS.

ARCS has attracted fresh attention lately, following its strong half-year growth and new buyback initiative. The momentum is clear, with a 25% share price return year to date and a robust 33.9% total shareholder return over the past 12 months, showcasing steady gains for long-term holders as well.

If you’re curious where else value and momentum are aligning, now is the perfect moment to expand your search and discover fast growing stocks with high insider ownership

With ARCS delivering upbeat earnings and announcing a sizable buyback while still trading at a discount to its intrinsic value, investors have to wonder if there is a genuine opportunity here or if future growth is already reflected in the price.

Price-to-Earnings of 14.8x: Is it justified?

ARCS trades on a price-to-earnings (P/E) ratio of 14.8x, which puts it at the lower end of the valuation spectrum versus peers. This suggests the market may be pricing in cautious expectations for future earnings at the current share price of ¥3,220.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings. In the consumer retailing sector, this is a key valuation yardstick that shows how confident the market is in a company's profit outlook.

On this metric, ARCS stands out as good value compared with both its peer average of 41.5x and its estimated fair ratio of 14.9x. This signals that the current market price may not fully reflect the company's true earning power. If market sentiment catches up, there is room for a re-rating.

Both peer and fair ratio comparisons highlight compelling relative value. The stock's P/E is not just below the sector average, it is also nearly aligned with our estimate of fair value. This could potentially signal a level institutional investors may consider.

Explore the SWS fair ratio for ARCS

Result: Price-to-Earnings of 14.8x (UNDERVALUED)

However, softer revenue and net income growth or a sustained discount to analyst price targets could limit upside, even as value signals remain supportive.

Find out about the key risks to this ARCS narrative.

Another View: Discounted Cash Flow Perspective

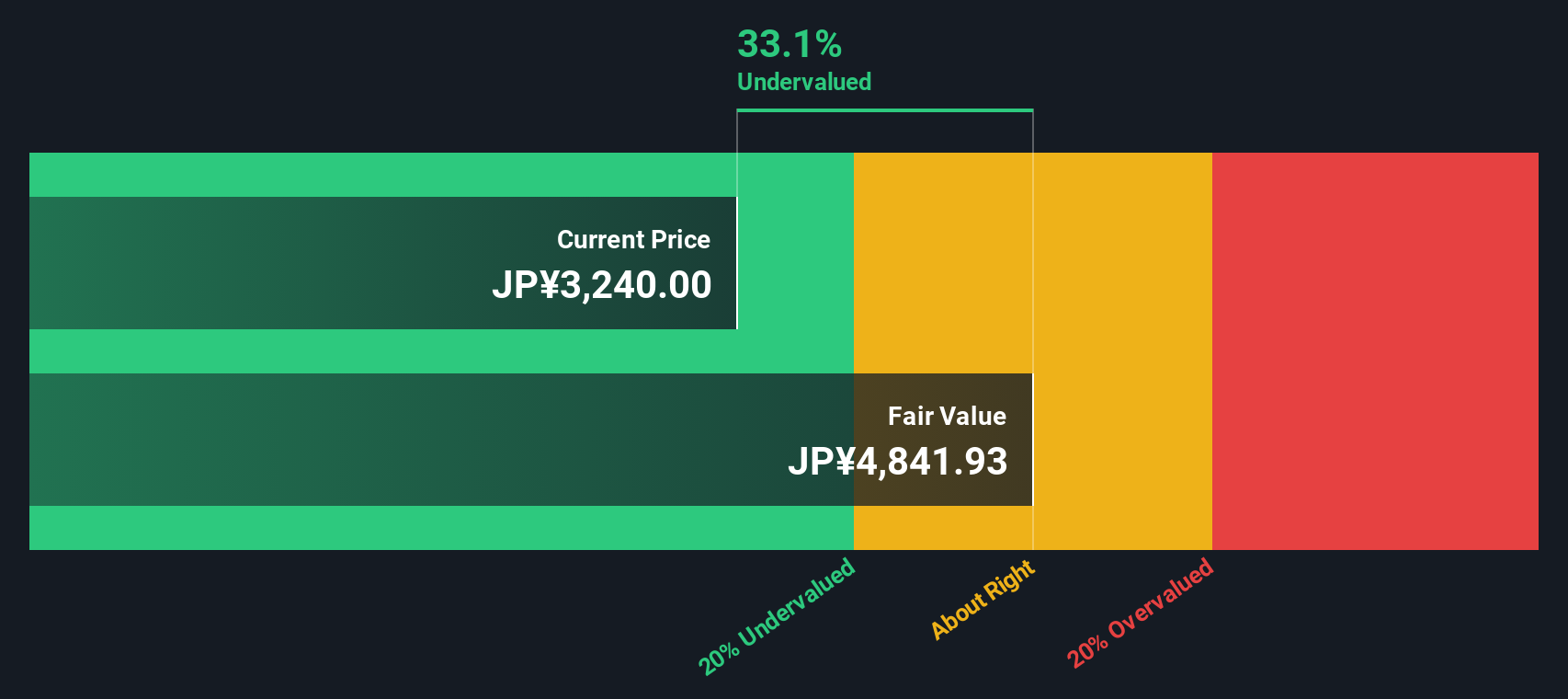

While valuation based on earnings ratios suggests ARCS is attractively priced, our SWS DCF model points to even greater value. With shares trading nearly 33% below estimated fair value, this method highlights how market sentiment may be underestimating ARCS's longer-term cash flow potential. However, this raises the question of whether this signals a potential opportunity, or if certain risks could explain the discrepancy.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ARCS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ARCS Narrative

If you see the data differently or want to dive into your own research, building your personal ARCS narrative takes less than three minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ARCS.

Looking for more investment ideas?

Broaden your portfolio with opportunities that most investors overlook. The right technology or sector leader could be next on your list, but only if you act now.

- Boost your returns and secure recurring income by checking out these 20 dividend stocks with yields > 3%, where high-yield opportunities are waiting for savvy investors like you.

- Tap into tomorrow’s breakthroughs and cutting-edge innovation when you browse these 24 AI penny stocks, which are reshaping entire industries with artificial intelligence.

- Expand into digital frontiers and ride the next big wave by reviewing these 79 cryptocurrency and blockchain stocks, featuring game-changers in cryptocurrency and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9948

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives