- Japan

- /

- Food and Staples Retail

- /

- TSE:9946

MINISTOP (TSE:9946): Valuation Premium Persists as Net Margins Show No Improvement

Reviewed by Simply Wall St

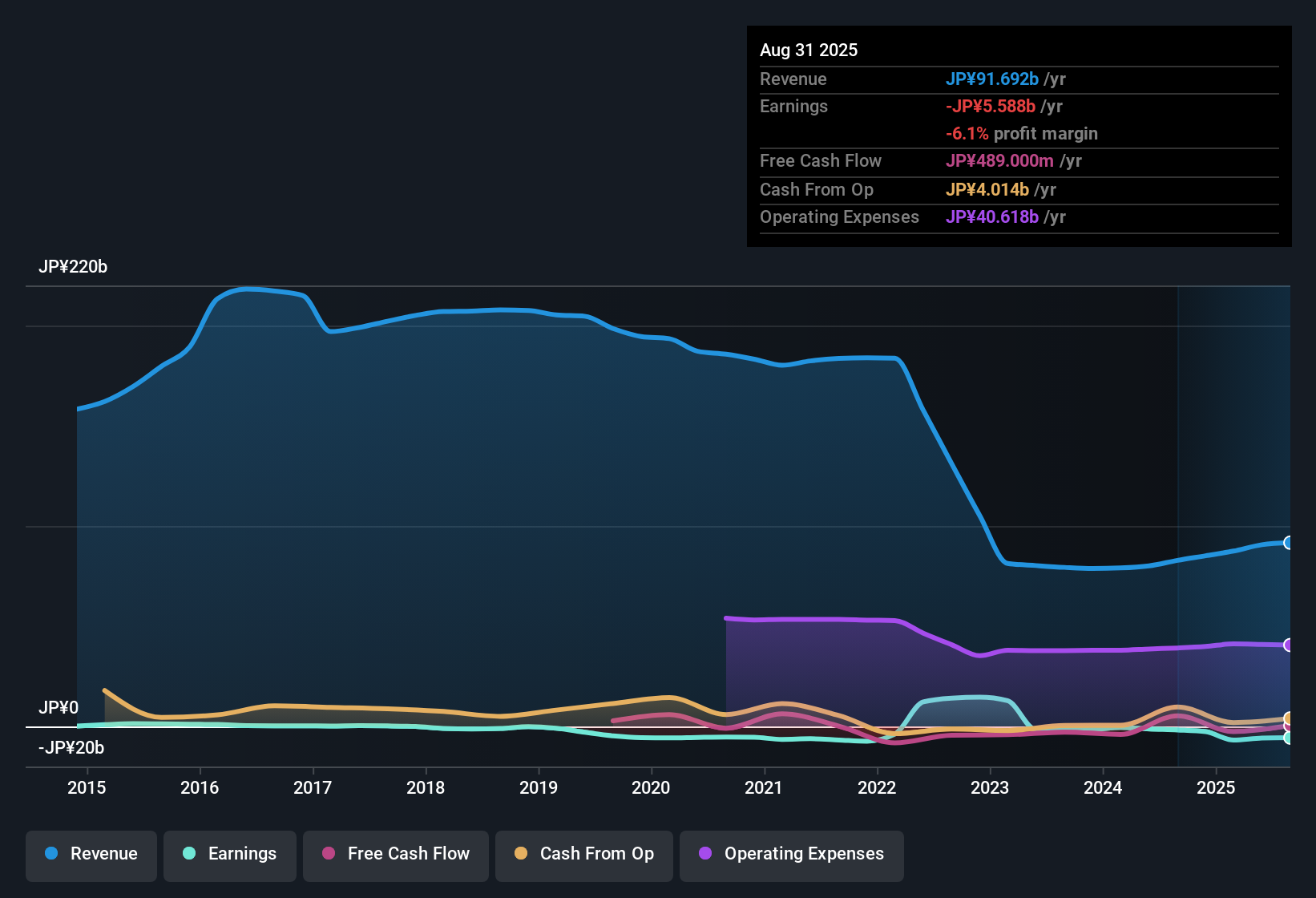

MINISTOP (TSE:9946) remains unprofitable, with net profit margins showing no improvement over the past year, despite reducing its losses by 0.07% per year on average over the last five years. Revenue is projected to grow at just 1.5% per year, lagging behind the broader Japanese market’s 4.4% annual growth rate. However, earnings are forecast to surge by 118.27% annually and the company is expected to achieve profitability within three years. Investors face a trade-off as MINISTOP trades at a premium compared to peers, yet accelerating earnings could deliver upside for those focused on future growth potential.

See our full analysis for MINISTOP.Next up, we’ll see how these headline numbers measure against the dominant narratives in the investor community, with some surprises likely in store.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margins Stuck Near Zero

- MINISTOP’s net profit margins have shown no signs of improvement over the past year, remaining firmly in negative territory as confirmed in recent statements.

- Despite plans for a turnaround, the business is still not profitable. This supports the concern that bottom-line challenges persist even as headline numbers show reduced losses.

- Loss reductions have averaged just 0.07% per year over the last five years, suggesting only incremental progress.

- The fact that positive earnings are expected only within a three-year window means investors still face a period without reliable profit generation from this segment.

Revenue Growth Trails Market Average

- Revenue is forecast to rise at a modest 1.5% per year, significantly lagging the Japanese market’s 4.4% annual growth rate for comparable companies.

- It is notable that, while the growth forecast signals ongoing demand, the underlying story points to MINISTOP struggling to gain share or outperform sector peers in a competitive environment.

- Investors hoping for meaningful top-line momentum may be disappointed, given that broader digitalization and innovation trends in the sector do not translate into above-market expansion for MINISTOP.

- This gap reinforces the idea that MINISTOP’s initiatives, while potentially valuable, are not yet delivering transformative results relative to leading rivals.

Valuation Premium Despite Low Profitability

- MINISTOP trades at a Price-To-Sales ratio of 0.7x, far above both peer and industry averages of 0.2x, and sits well above its DCF fair value of 214.46, compared to a current share price of 2,109.00.

- The prevailing market view is that MINISTOP’s valuation premium, despite weak margins and slow revenue growth, suggests that investors are pricing in a significant turnaround ahead. This optimism may not be fully justified unless profitability improves more quickly.

- A premium multiple can be sustained if the forecasted 118.27% annual earnings growth materializes and consistently outpaces sector norms.

- However, if profitability continues to lag, the current valuation leaves little room for disappointment, raising the stakes for management to deliver on promised improvements.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on MINISTOP's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

MINISTOP’s weak net profit margins, slow revenue growth, and stretched valuation indicate that investors face ongoing uncertainty and the risk of underperformance compared to more stable opportunities.

If you want to focus on companies delivering reliable expansion instead of volatility, our stable growth stocks screener highlights those consistently growing in both sales and earnings, so you can invest with more confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9946

MINISTOP

Engages in the development and franchising of convenience store chains under the MINISTOP brand name in Japan and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives