- China

- /

- Auto Components

- /

- SHSE:605319

Undiscovered Gems in Asia to Explore This March 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and persistent inflation, Asian economies are under the spotlight with investors keenly observing their resilience amid U.S. tariff escalations and shifts in monetary policies. In this dynamic environment, identifying stocks that demonstrate robust fundamentals and adaptability to economic shifts can offer intriguing opportunities for those looking to diversify their portfolios with small-cap gems from Asia.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | 3.15% | 3.67% | 9.94% | ★★★★★★ |

| Ningbo United GroupLtd | 11.97% | -19.47% | -30.66% | ★★★★★★ |

| Pro-Hawk | 17.03% | -6.66% | -2.75% | ★★★★★★ |

| Shenzhen Tongye TechnologyLtd | 5.14% | 3.26% | -17.09% | ★★★★★★ |

| Suzhou Highfine Biotech | NA | 8.38% | 9.44% | ★★★★★★ |

| Suzhou Nanomicro Technology | 6.31% | 23.88% | -2.17% | ★★★★★★ |

| Co-Tech Development | 21.93% | 1.57% | 4.27% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 31.26% | 0.80% | 0.71% | ★★★★☆☆ |

| Changshu Fengfan Power Equipment | 91.61% | 6.89% | 31.92% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Medlive Technology (SEHK:2192)

Simply Wall St Value Rating: ★★★★★★

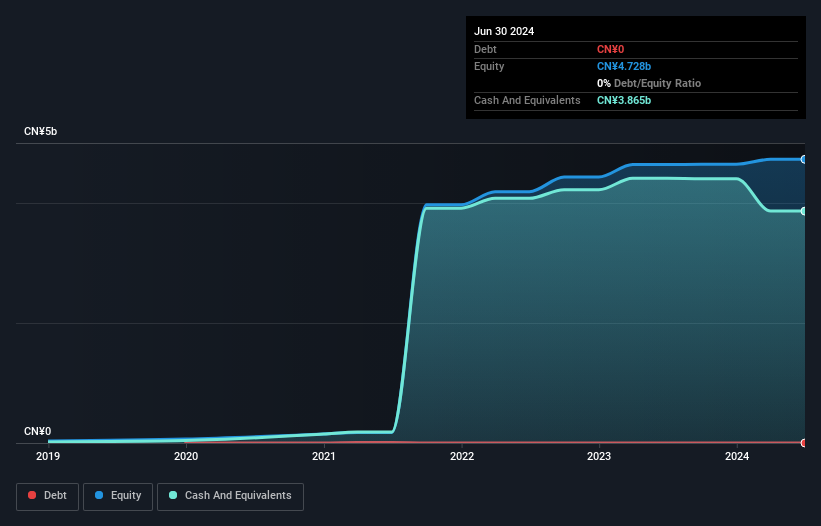

Overview: Medlive Technology Co., Ltd. operates an online professional physician platform in Mainland China and internationally, with a market cap of HK$10.48 billion.

Operations: The company generates revenue primarily from its healthcare software segment, amounting to CN¥481.94 million.

Medlive Technology, a nimble player in the healthcare sector, has shown impressive earnings growth of 53.5% over the past year, outpacing the industry average of 9.8%. This growth is supported by high-quality non-cash earnings and a debt-free balance sheet, enhancing financial stability. Despite recent share price volatility, Medlive's profitability remains robust with levered free cash flow reaching US$69 million as of December 2023. Capital expenditures have been minimal at under US$1 million recently, suggesting efficient capital management. With earnings forecasted to grow annually by 14%, Medlive seems poised for continued expansion in its niche market space.

- Take a closer look at Medlive Technology's potential here in our health report.

Explore historical data to track Medlive Technology's performance over time in our Past section.

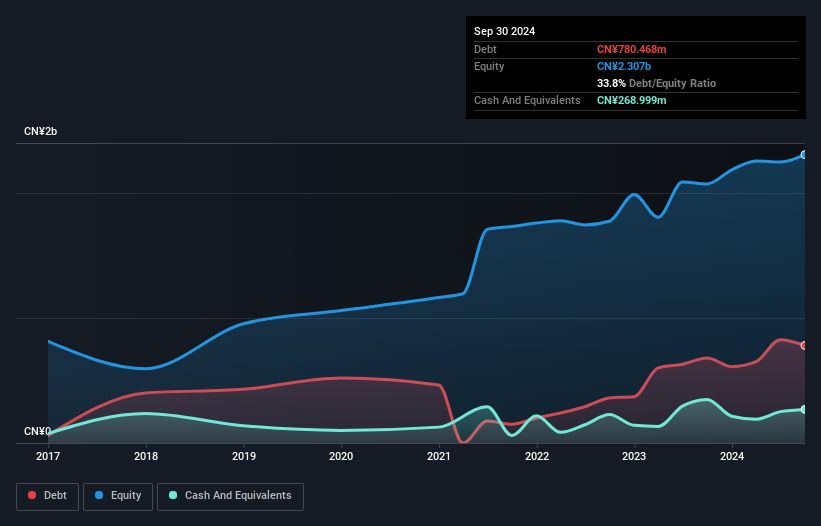

Wuxi Zhenhua Auto PartsLtd (SHSE:605319)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi Zhenhua Auto Parts Co., Ltd. manufactures and sells auto parts in China, with a market capitalization of CN¥8.58 billion.

Operations: The company generates revenue through the manufacture and sale of auto parts in China. It has a market capitalization of CN¥8.58 billion.

Wuxi Zhenhua Auto Parts Ltd, a smaller player in the auto components industry, boasts impressive earnings growth of 62.9% over the past year, outpacing the industry's 11%. The company's net debt to equity ratio stands at a satisfactory 22.2%, reflecting prudent financial management as it reduced from 48.2% to 33.8% in five years. Despite not being free cash flow positive recently, its interest payments are well covered by EBIT at a robust 17.4x coverage. With high-quality past earnings and a P/E ratio of 23.8x below the CN market average of 37.9x, future growth prospects seem promising with forecasts predicting annual earnings growth of nearly 17%.

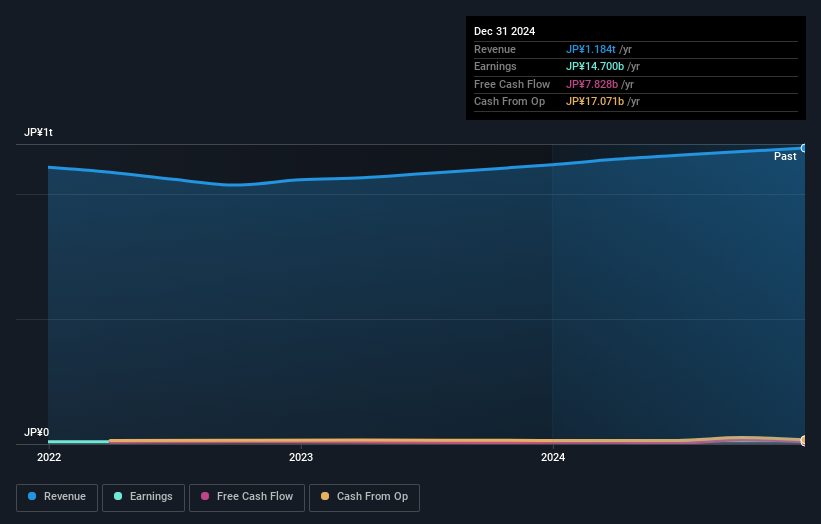

Kato Sangyo (TSE:9869)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kato Sangyo Co., Ltd. operates in the general food wholesaling business both domestically and internationally, with a market capitalization of ¥148.30 billion.

Operations: Kato Sangyo generates revenue primarily through its Room Temperature Distribution Business, which contributes ¥723.82 billion, and its Liquor Logistic Business, adding ¥247.12 billion. The Low Temperature Logistic Business also plays a significant role with ¥115.25 billion in revenue. The net profit margin reflects the company's profitability trends and operational efficiency over time.

Kato Sangyo, a promising player in the consumer retailing sector, has seen its earnings grow by 18.6% over the past year, outpacing the industry average of 10.4%. Despite a significant one-off gain of ¥5 billion affecting recent results, it trades at an attractive 36.8% below estimated fair value. The company's debt to equity ratio has risen from 1.7 to 3.5 over five years but remains manageable with more cash than total debt and interest payments comfortably covered by profits. Upcoming dividends are set to increase, reflecting confidence in sustained profitability and growth prospects for fiscal year-end September 2025.

- Get an in-depth perspective on Kato Sangyo's performance by reading our health report here.

Review our historical performance report to gain insights into Kato Sangyo's's past performance.

Seize The Opportunity

- Embark on your investment journey to our 2588 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Wuxi Zhenhua Auto PartsLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wuxi Zhenhua Auto PartsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605319

Solid track record with excellent balance sheet.

Market Insights

Community Narratives