- Japan

- /

- Food and Staples Retail

- /

- TSE:9823

We Think Mammy Mart's (TSE:9823) Robust Earnings Are Conservative

When companies post strong earnings, the stock generally performs well, just like Mammy Mart Corporation's (TSE:9823) stock has recently. Our analysis found some more factors that we think are good for shareholders.

View our latest analysis for Mammy Mart

Examining Cashflow Against Mammy Mart's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

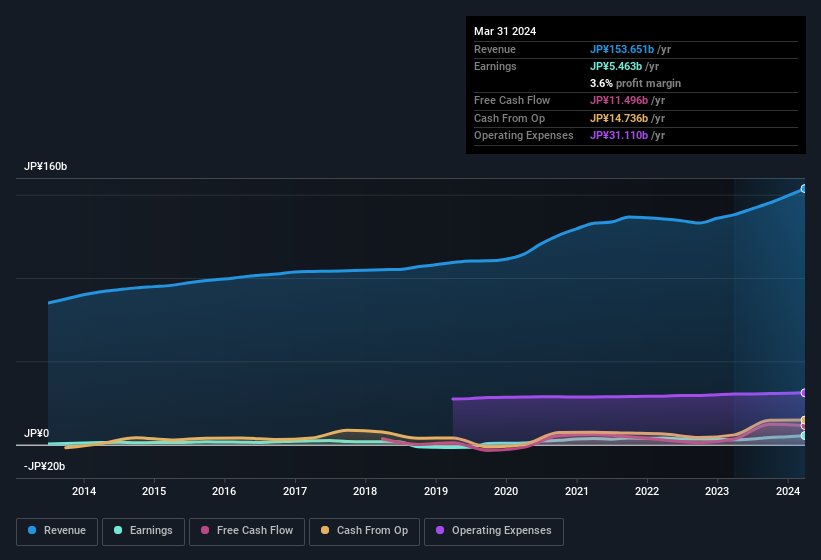

Over the twelve months to March 2024, Mammy Mart recorded an accrual ratio of -0.19. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. To wit, it produced free cash flow of JP¥11b during the period, dwarfing its reported profit of JP¥5.46b. Mammy Mart shareholders are no doubt pleased that free cash flow improved over the last twelve months.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Mammy Mart.

Our Take On Mammy Mart's Profit Performance

Happily for shareholders, Mammy Mart produced plenty of free cash flow to back up its statutory profit numbers. Based on this observation, we consider it possible that Mammy Mart's statutory profit actually understates its earnings potential! Furthermore, it has done a great job growing EPS over the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. While earnings are important, another area to consider is the balance sheet. If you're interested we have a graphic representation of Mammy Mart's balance sheet.

This note has only looked at a single factor that sheds light on the nature of Mammy Mart's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9823

Mammy Mart Holdings

Operates a chain of fresh food based supermarkets in Japan.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives