- Japan

- /

- Food and Staples Retail

- /

- TSE:8267

Aeon (TSE:8267) Valuation in Focus After Strong Earnings and Dividend Hike

Reviewed by Simply Wall St

Aeon (TSE:8267) just announced its half-year earnings, reporting higher sales, revenue, and net income compared to last year. The company also declared a dividend increase for the second quarter, which has caught investors’ attention.

See our latest analysis for Aeon.

Aeon's latest half-year results and the boost to its dividend seem to have sparked fresh momentum. After a notable bump in the past week, the share price is now up over 21% for the month and a remarkable 83% year-to-date. Over the past year, the total shareholder return stands at 76%, with strong longer-term gains hinting that sentiment and business prospects have both improved recently.

If the surge around Aeon’s earnings has you curious about other rising stars, it might be the perfect moment to discover fast growing stocks with high insider ownership

With Aeon's shares soaring to multi-year highs, investors may be wondering whether the current rally still offers value or if expectations for future growth are already fully priced in.

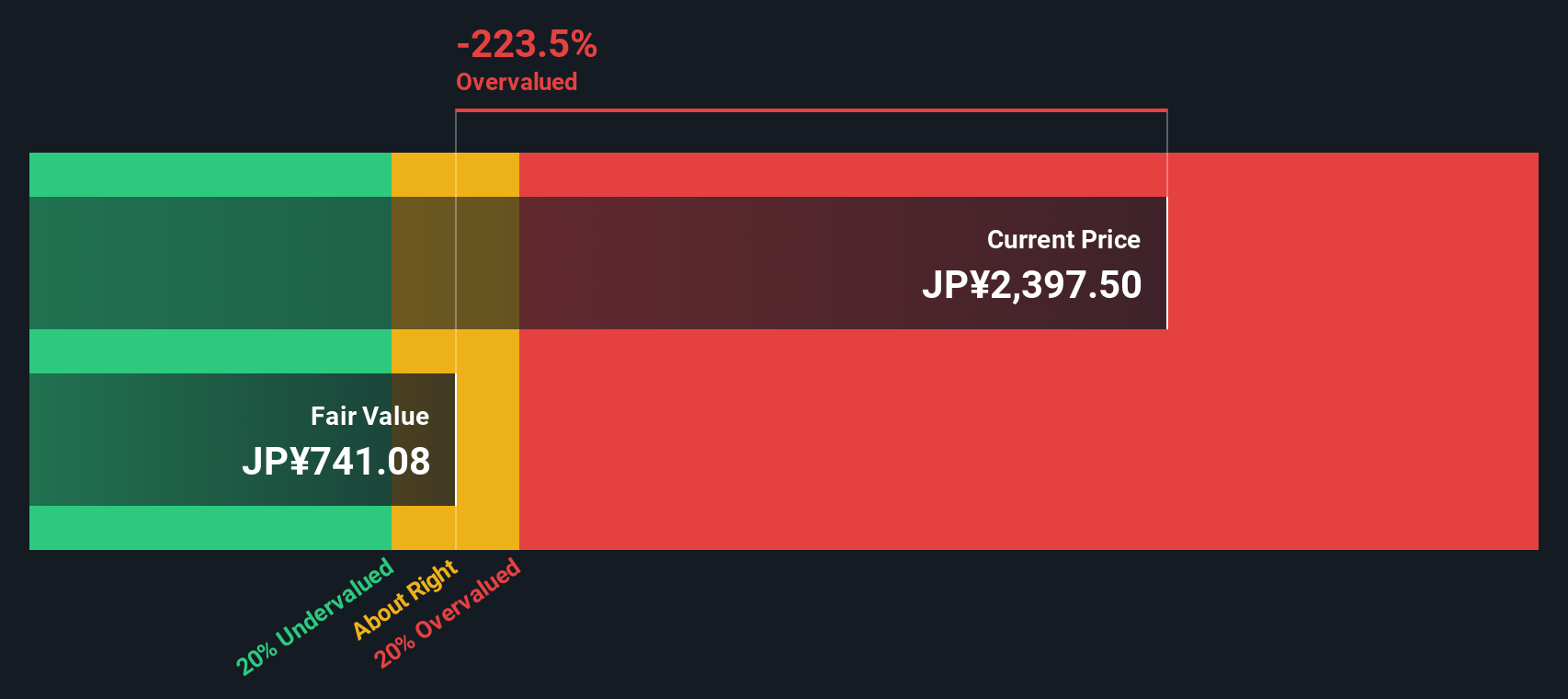

Most Popular Narrative: 66% Overvalued

The fair value in the most followed narrative stands well below Aeon's last close price. This raises questions about the degree of optimism now baked into the stock. The gap between current market price and this consensus sets the stage for a robust debate among investors.

"The rapid acceleration of digitalization and e-commerce across Asia is likely to further erode traditional brick-and-mortar market share, especially as global and domestic online marketplaces gain traction. Aeon's ongoing efforts in digital transformation may not be sufficient to offset margin pressure and revenue leakage if they cannot match or outpace digital-native competitors."

Curious how bold growth forecasts and ambitious future profit margins form the backbone of the valuation? The story hinges on major leaps in efficiency and earnings. What assumptions drive such a high bar for future results? Only the full narrative reveals the aggressive targets and why that optimism may be built on shifting ground.

Result: Fair Value of ¥1,331 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong gains from digital investments, or rapid growth in international markets, could challenge the current cautious view on Aeon's future prospects.

Find out about the key risks to this Aeon narrative.

Another View: What Does the SWS DCF Model Say?

While the current market price looks high relative to fair value estimates from multiples, our SWS DCF model also signals Aeon is overvalued. According to this approach, the company’s intrinsic value is estimated at ¥728.13, which is well below the present share price. Does this suggest optimism has gone too far, or are analysts too cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Aeon Narrative

If you see the story differently or want to follow your own path, you can dive in and build your perspective in just a few minutes. Do it your way

A great starting point for your Aeon research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by constantly tracking emerging opportunities. Don’t let game-changing stocks pass you by when these innovative investing angles are within reach:

- Uncover growth stories with high potential by reviewing these 3587 penny stocks with strong financials, which show resilience with strong financials and standout momentum.

- Accelerate your portfolio with these 24 AI penny stocks, as these leverage the AI revolution where machine learning, automation, and data power tomorrow’s winners.

- Boost your income strategy and enjoy attractive yields through these 17 dividend stocks with yields > 3%, featuring companies consistently rewarding shareholders above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8267

Aeon

Operates in the retail industry in Japan, China, ASEAN countries, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives