- Japan

- /

- Food and Staples Retail

- /

- TSE:8242

Unveiling Three Undiscovered Gems On None Exchange

Reviewed by Simply Wall St

As global markets experience a mix of record highs and inflation-driven uncertainties, small-cap stocks have notably lagged behind their larger counterparts, with the Russell 2000 trailing the S&P 500 by a significant margin. In this environment of volatility and opportunity, identifying undiscovered gems can be particularly rewarding for investors seeking to capitalize on unique growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Changsha Tongcheng HoldingsLtd | 7.91% | -11.02% | -6.79% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

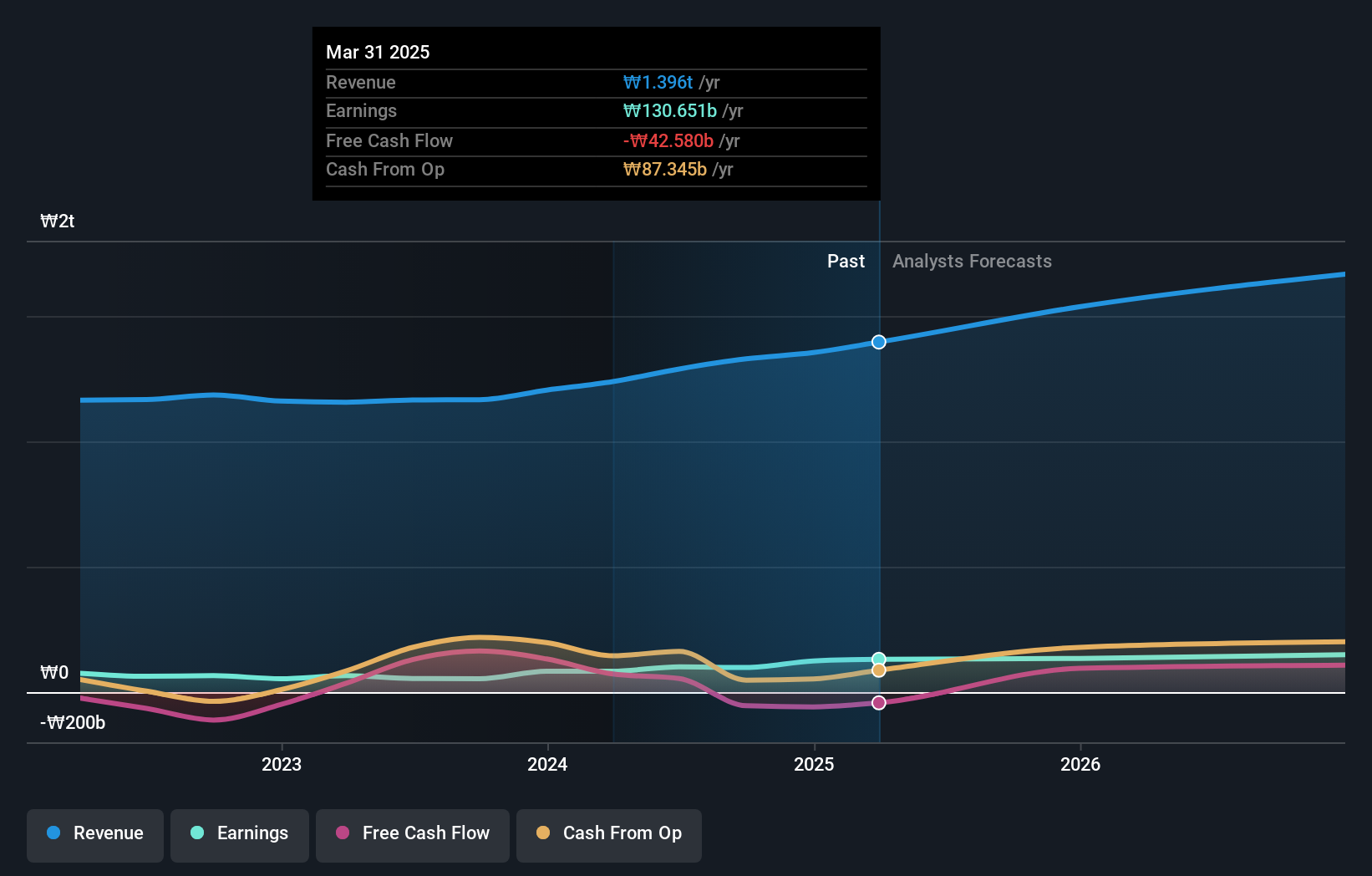

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. is a South Korean company that specializes in the manufacturing and sale of machinery and heat combustion equipment, with a market cap of ₩1.17 trillion.

Operations: Kyung Dong Navien generates revenue primarily from the air conditioning manufacturing and sale segment, contributing approximately ₩1.33 billion. The company's financial performance is reflected in its market capitalization of ₩1.17 trillion.

Kyung Dong Navien, a small cap player in the heating solutions industry, seems to be trading at an attractive 41.6% below its estimated fair value. Over the past year, its earnings skyrocketed by 83.2%, significantly outpacing the building industry's -9.2%. With a debt-to-equity ratio reduced from 52.1% to 36.3% over five years and interest payments well-covered at 31.8 times EBIT, financial stability appears solid. Despite not being free cash flow positive, future prospects look promising with earnings forecasted to grow annually by 19.55%. A recent dividend announcement of ₩650 further highlights shareholder returns potential.

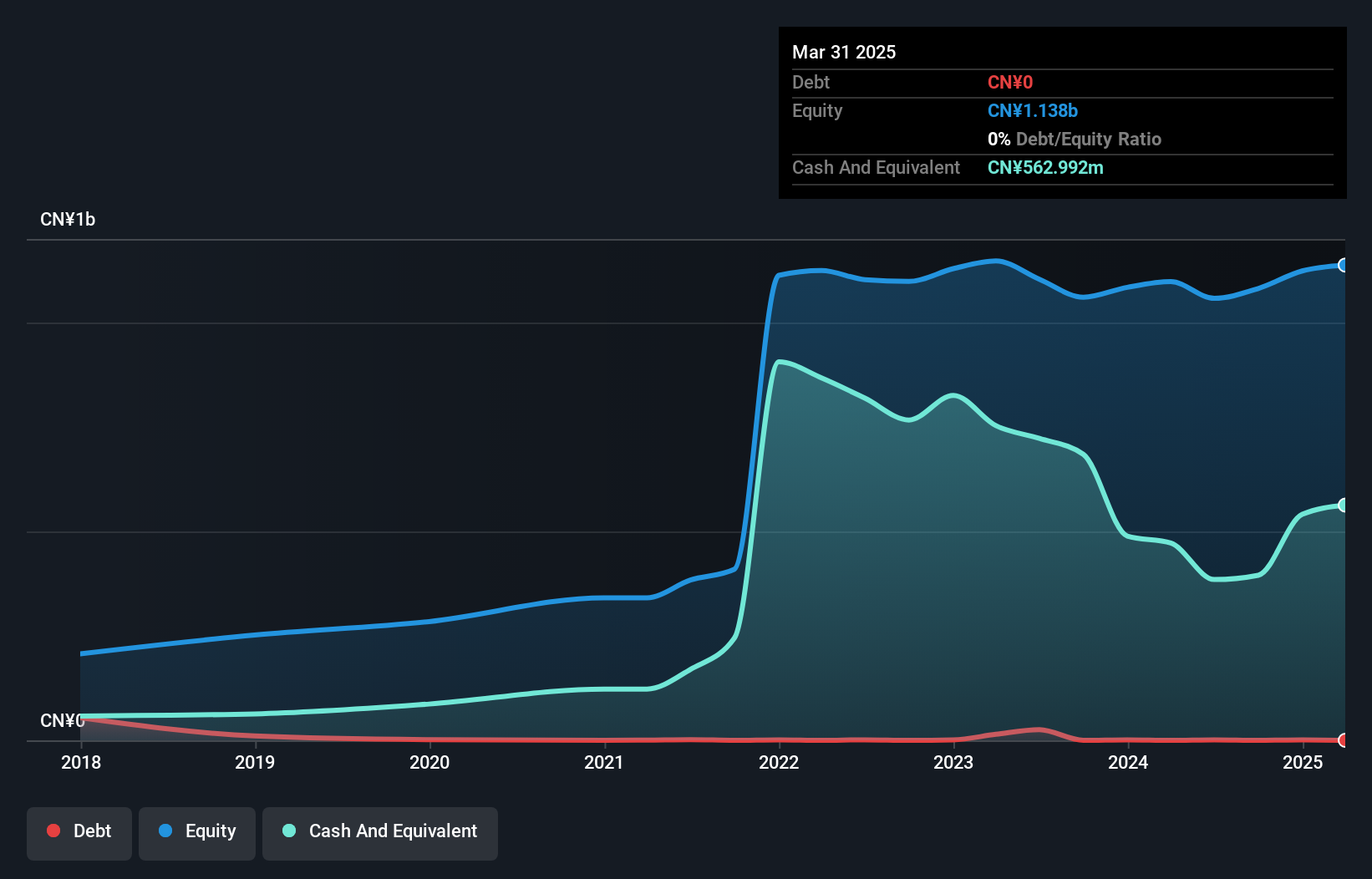

Guangzhou Huayan Precision MachineryLtd (SZSE:301138)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangzhou Huayan Precision Machinery Co., Ltd. operates in the precision machinery industry and has a market cap of CN¥3.51 billion.

Operations: Guangzhou Huayan Precision Machinery generates revenue primarily from its precision machinery products. The company's net profit margin is noted at 12.5%, reflecting its profitability relative to total revenue.

Guangzhou Huayan Precision Machinery Ltd has shown resilience with earnings growth of 3.6% over the past year, outperforming the broader machinery sector's -0.06%. This company, which operates without debt, has significantly improved its financial health from five years ago when it had a debt-to-equity ratio of 1.4%. Despite this progress, its earnings have declined by an average of 1.1% annually over the last five years. While free cash flow remains negative recently at -US$24 million in September 2024, the firm seems to maintain high-quality earnings and profitability is not a concern given its current operations without leverage.

- Navigate through the intricacies of Guangzhou Huayan Precision MachineryLtd with our comprehensive health report here.

Understand Guangzhou Huayan Precision MachineryLtd's track record by examining our Past report.

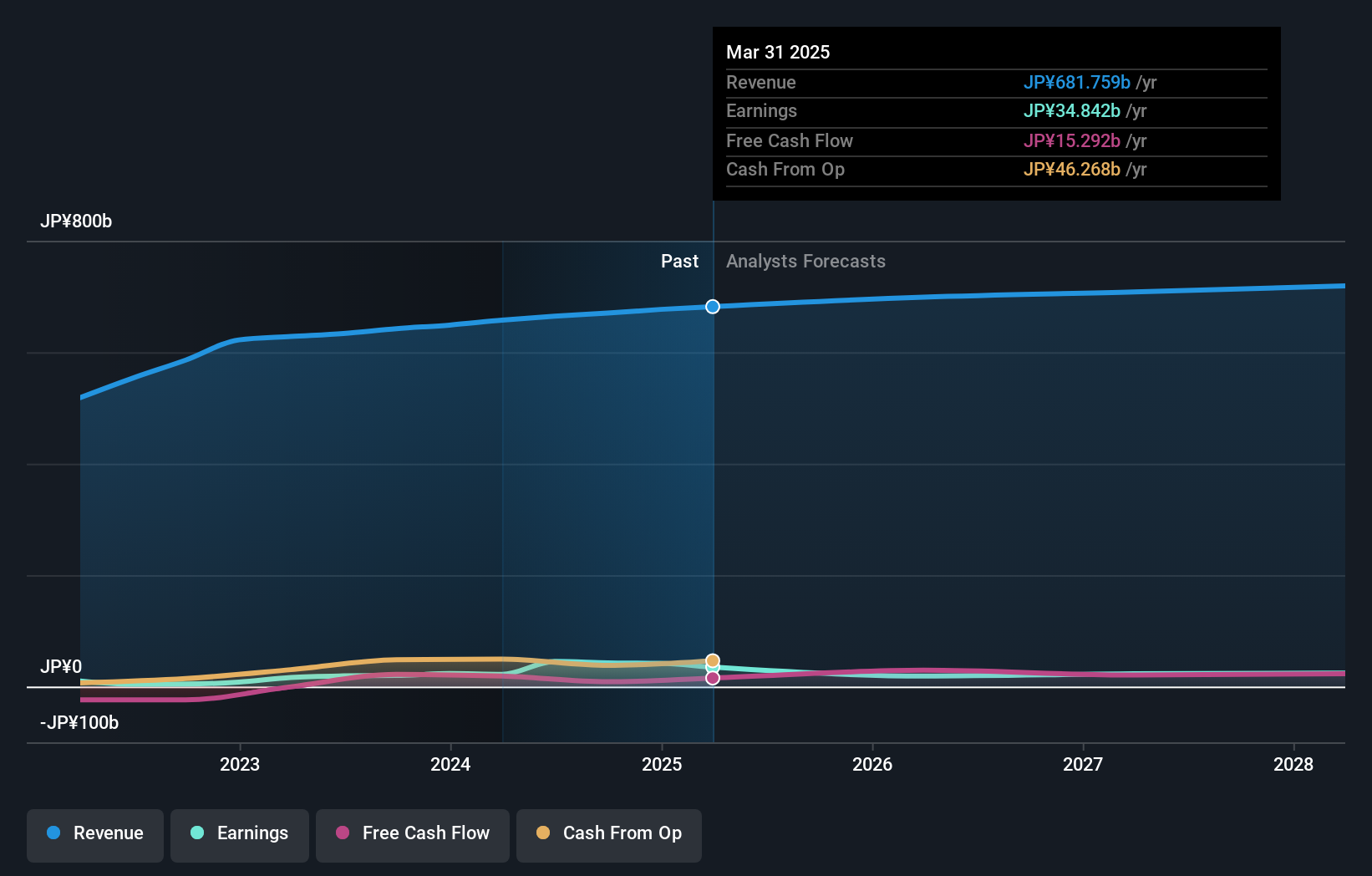

H2O Retailing (TSE:8242)

Simply Wall St Value Rating: ★★★★☆☆

Overview: H2O Retailing Corporation operates department stores, supermarkets, and shopping centers in Japan with a market capitalization of ¥281.41 billion.

Operations: H2O Retailing generates revenue primarily from its food business, which accounts for ¥413.28 billion, followed by department stores at ¥192.46 billion and commercial facilities at ¥41.10 billion. The company's net profit margin is a critical metric to consider when evaluating its financial performance over time.

H2O Retailing, a nimble player in the retail sector, has seen its earnings surge by 79% over the past year, outpacing industry growth of 10%. A noteworthy ¥16.2 billion one-off gain bolstered recent financial results. The company is trading at an enticing value, reportedly 81% below fair value estimates. Its debt profile has improved with a reduction in the debt-to-equity ratio from 58% to 50.5% over five years. Recently, H2O completed a share buyback of approximately ¥3.62 billion for about 1.35% of its shares, highlighting strong shareholder returns and confidence in future performance.

- Click to explore a detailed breakdown of our findings in H2O Retailing's health report.

Assess H2O Retailing's past performance with our detailed historical performance reports.

Key Takeaways

- Click this link to deep-dive into the 4733 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if H2O Retailing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8242

H2O Retailing

Engages in the development, operation, and management of commercial facilities in Japan.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion