- Japan

- /

- Food and Staples Retail

- /

- TSE:8041

Three Top Dividend Stocks To Consider

Reviewed by Simply Wall St

In recent weeks, global markets have faced a mix of geopolitical tensions and consumer spending concerns, leading to fluctuating indices and cautious investor sentiment. Amidst this backdrop, dividend stocks can offer a measure of stability by providing regular income streams, making them an attractive option for investors seeking resilience in uncertain economic climates.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.43% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.75% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.24% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.40% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

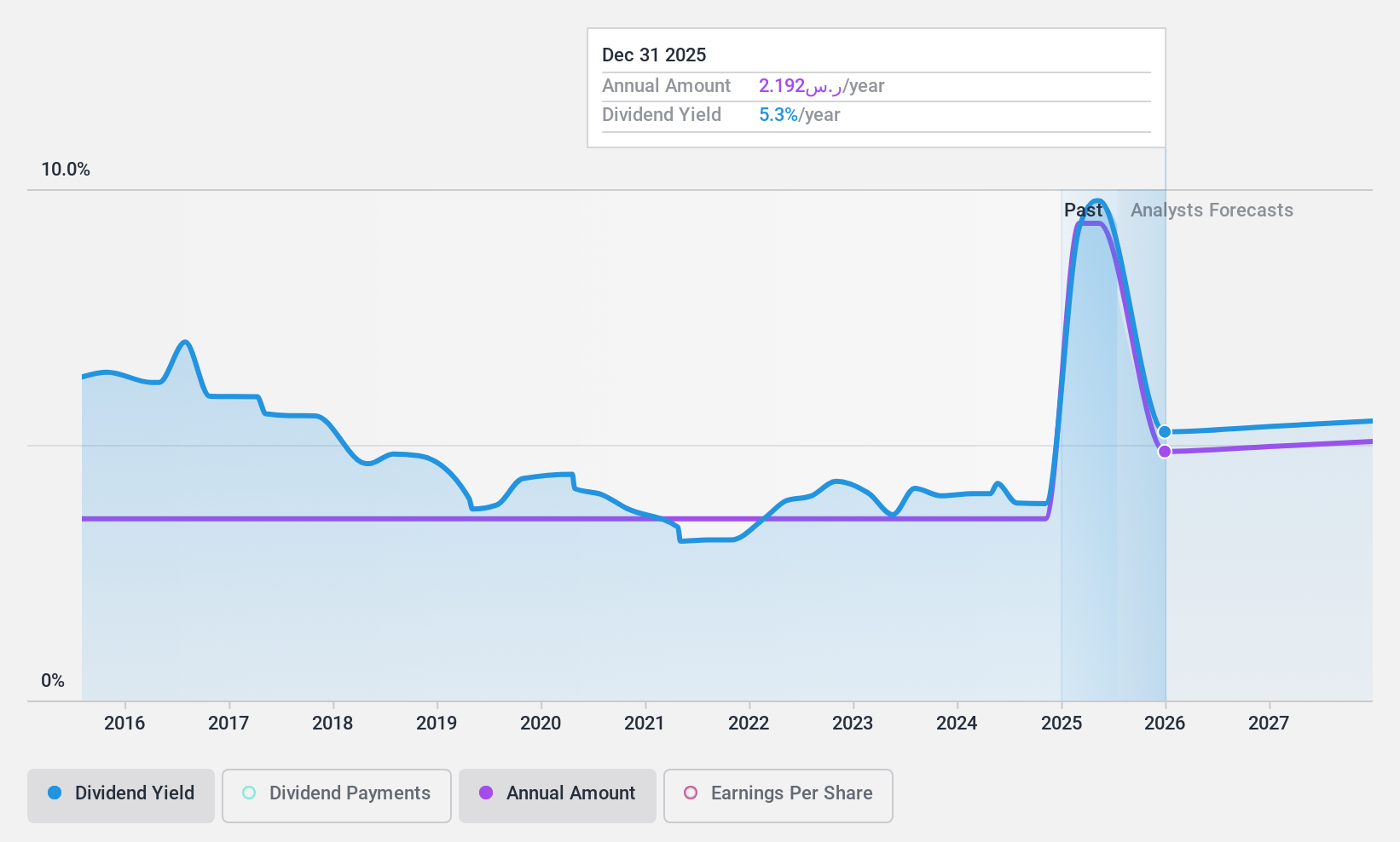

Saudi Telecom (SASE:7010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Saudi Telecom Company, along with its subsidiaries, offers telecommunications, information, media, and digital payment services both in Saudi Arabia and internationally, with a market cap of SAR223.41 billion.

Operations: Saudi Telecom's revenue segments include SAR49.43 billion from Saudi Telecom Company, SAR15.03 billion from Saudi Telecom Channels Company, SAR11.20 billion from Arabian Internet and Communications Services Company (Solutions), SAR4.33 billion from Kuwait Telecommunications Company (Stc Kuwait), SAR1.92 billion from STC Bahrain BSC (C) (Stc Bahrain), and contributions of smaller amounts from other subsidiaries such as STC Bank, Public Telecommunications Company (Specialized), Advanced Technology and Cybersecurity Company (Sirar), and Gulf Digital Media Model Company LTD (Intigral).

Dividend Yield: 3.6%

Saudi Telecom offers a stable dividend profile with a payout ratio of 60%, indicating dividends are well-covered by earnings. The cash payout ratio stands at 58.4%, ensuring coverage by cash flows as well. While the dividend yield is lower than the top quartile in Saudi Arabia, it remains reliable and has grown over the past decade. Recent collaboration with Huawei on AI-driven 5G solutions may enhance future revenue streams, supporting continued dividend stability.

- Take a closer look at Saudi Telecom's potential here in our dividend report.

- Upon reviewing our latest valuation report, Saudi Telecom's share price might be too optimistic.

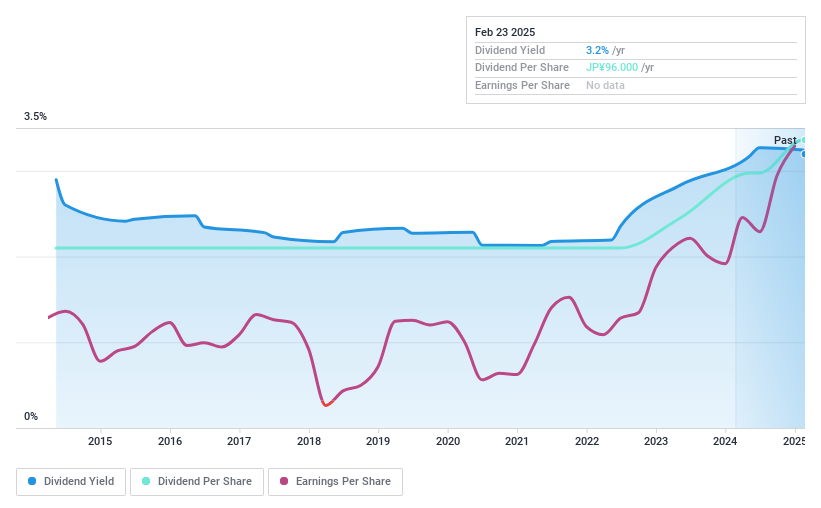

OUG Holdings (TSE:8041)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: OUG Holdings Inc., with a market cap of ¥16.22 billion, operates through its subsidiaries to engage in the wholesale distribution of marine products in Japan.

Operations: OUG Holdings Inc. generates revenue through its subsidiaries by engaging in the wholesale distribution of marine products within Japan.

Dividend Yield: 3.2%

OUG Holdings maintains a robust dividend profile with a low payout ratio of 6.4%, indicating strong earnings coverage, while its cash payout ratio of 61.6% ensures dividends are supported by cash flows. Although the yield of 3.19% is below Japan's top quartile, dividends have been stable and growing over the past decade. However, debt coverage by operating cash flow remains a concern. The stock's price-to-earnings ratio of 3.2x suggests potential undervaluation in the market.

- Get an in-depth perspective on OUG Holdings' performance by reading our dividend report here.

- The analysis detailed in our OUG Holdings valuation report hints at an inflated share price compared to its estimated value.

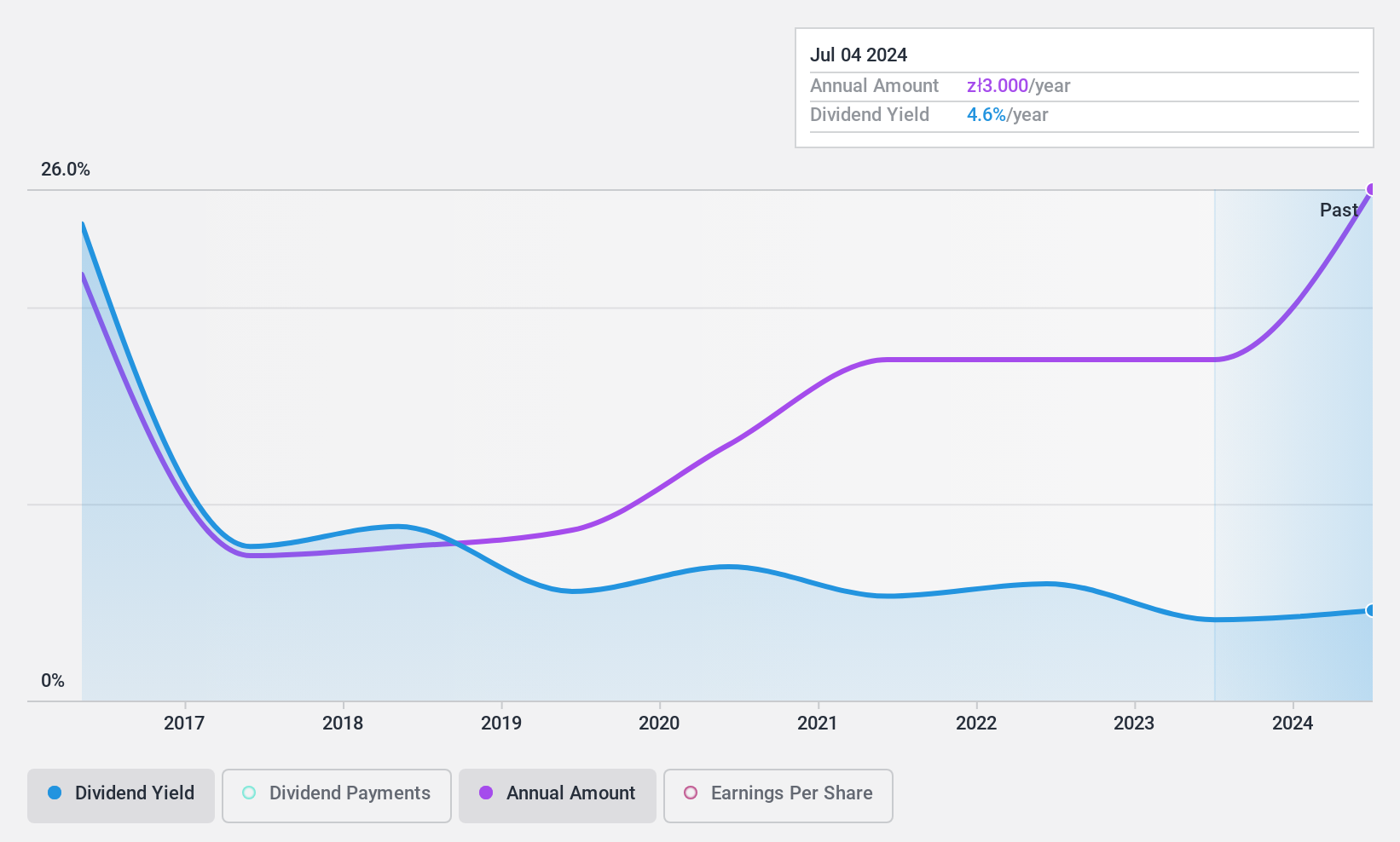

Decora (WSE:DCR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Decora S.A. is involved in the production, distribution, sale, and export of flooring products and accessories in Poland with a market cap of PLN812.12 million.

Operations: Decora S.A.'s revenue segments include PLN128.58 million from Wall products and PLN439.84 million from Flooring products.

Dividend Yield: 3.9%

Decora's dividend sustainability is supported by a low payout ratio of 38.1% and a cash payout ratio of 42%, indicating strong coverage by both earnings and cash flows. However, the dividend yield of 3.9% is modest compared to top Polish payers, and the company's dividend history over the past decade has been unreliable with volatility exceeding annual drops of 20%. Despite this, Decora trades at a significant discount to its estimated fair value.

- Click to explore a detailed breakdown of our findings in Decora's dividend report.

- Our expertly prepared valuation report Decora implies its share price may be lower than expected.

Seize The Opportunity

- Click through to start exploring the rest of the 2004 Top Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8041

OUG Holdings

Through its subsidiaries, engages in the wholesale of marine products in Japan.

Solid track record established dividend payer.

Market Insights

Community Narratives