- Japan

- /

- Food and Staples Retail

- /

- TSE:7544

Why You Might Be Interested In Three F Co.,Ltd. (TSE:7544) For Its Upcoming Dividend

It looks like Three F Co.,Ltd. (TSE:7544) is about to go ex-dividend in the next 4 days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Meaning, you will need to purchase Three FLtd's shares before the 27th of February to receive the dividend, which will be paid on the 13th of May.

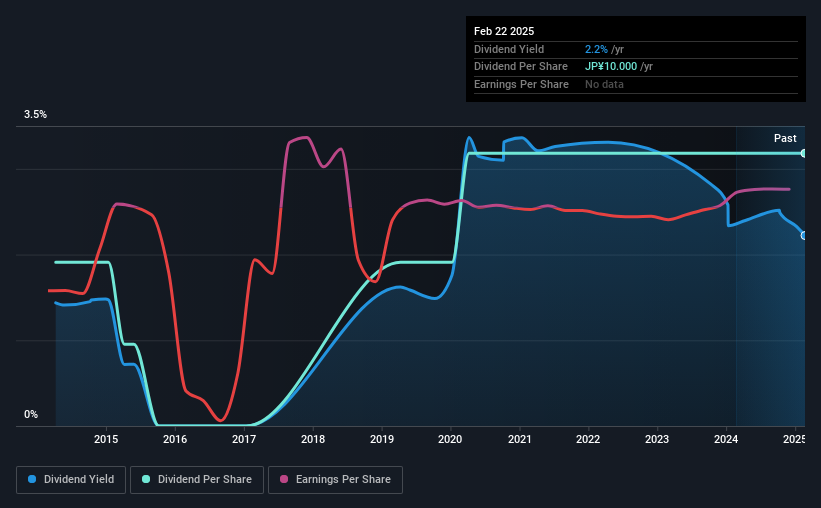

The company's next dividend payment will be JP¥5.00 per share, and in the last 12 months, the company paid a total of JP¥10.00 per share. Looking at the last 12 months of distributions, Three FLtd has a trailing yield of approximately 2.2% on its current stock price of JP¥450.00. If you buy this business for its dividend, you should have an idea of whether Three FLtd's dividend is reliable and sustainable. As a result, readers should always check whether Three FLtd has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Three FLtd

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. That's why it's good to see Three FLtd paying out a modest 29% of its earnings. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. What's good is that dividends were well covered by free cash flow, with the company paying out 11% of its cash flow last year.

It's positive to see that Three FLtd's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Three FLtd paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. It's encouraging to see Three FLtd has grown its earnings rapidly, up 31% a year for the past five years. Earnings per share have been growing very quickly, and the company is paying out a relatively low percentage of its profit and cash flow. This is a very favourable combination that can often lead to the dividend multiplying over the long term, if earnings grow and the company pays out a higher percentage of its earnings.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last 10 years, Three FLtd has lifted its dividend by approximately 5.2% a year on average. It's good to see both earnings and the dividend have improved - although the former has been rising much quicker than the latter, possibly due to the company reinvesting more of its profits in growth.

The Bottom Line

Is Three FLtd worth buying for its dividend? Three FLtd has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past 10 years, but the conservative payout ratio makes the current dividend look sustainable. There's a lot to like about Three FLtd, and we would prioritise taking a closer look at it.

In light of that, while Three FLtd has an appealing dividend, it's worth knowing the risks involved with this stock. Our analysis shows 2 warning signs for Three FLtd and you should be aware of these before buying any shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Three FLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7544

Three FLtd

Manages and operates convenience, franchise, and managed stores in Japan.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion