- Japan

- /

- Construction

- /

- TSE:1946

Undiscovered Gems with Strong Foundations To Explore This December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are navigating a complex landscape characterized by fluctuating consumer confidence and mixed economic indicators. Despite these challenges, major stock indices have shown moderate gains, with large-cap growth stocks initially leading the charge before a mid-week reversal. In such an environment, identifying stocks with strong foundations becomes crucial; these are companies that demonstrate resilience through solid financial health and strategic positioning in their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jih Lin Technology | 56.44% | 4.23% | 3.89% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Indeks Bilgisayar Sistemleri Mühendislik Sanayi ve Ticaret Anonim Sirketi | 56.22% | 44.24% | 26.23% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wealth First Portfolio Managers | 4.08% | -43.42% | 42.63% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 14.19% | 33.12% | 44.33% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Zhejiang Chinastars New Materials Group (SZSE:301077)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Chinastars New Materials Group Co., Ltd. operates in the new materials industry with a market cap of CN¥3.22 billion.

Operations: Chinastars generates revenue primarily from its operations in the new materials industry. The company has a market capitalization of CN¥3.22 billion, reflecting its scale within the sector.

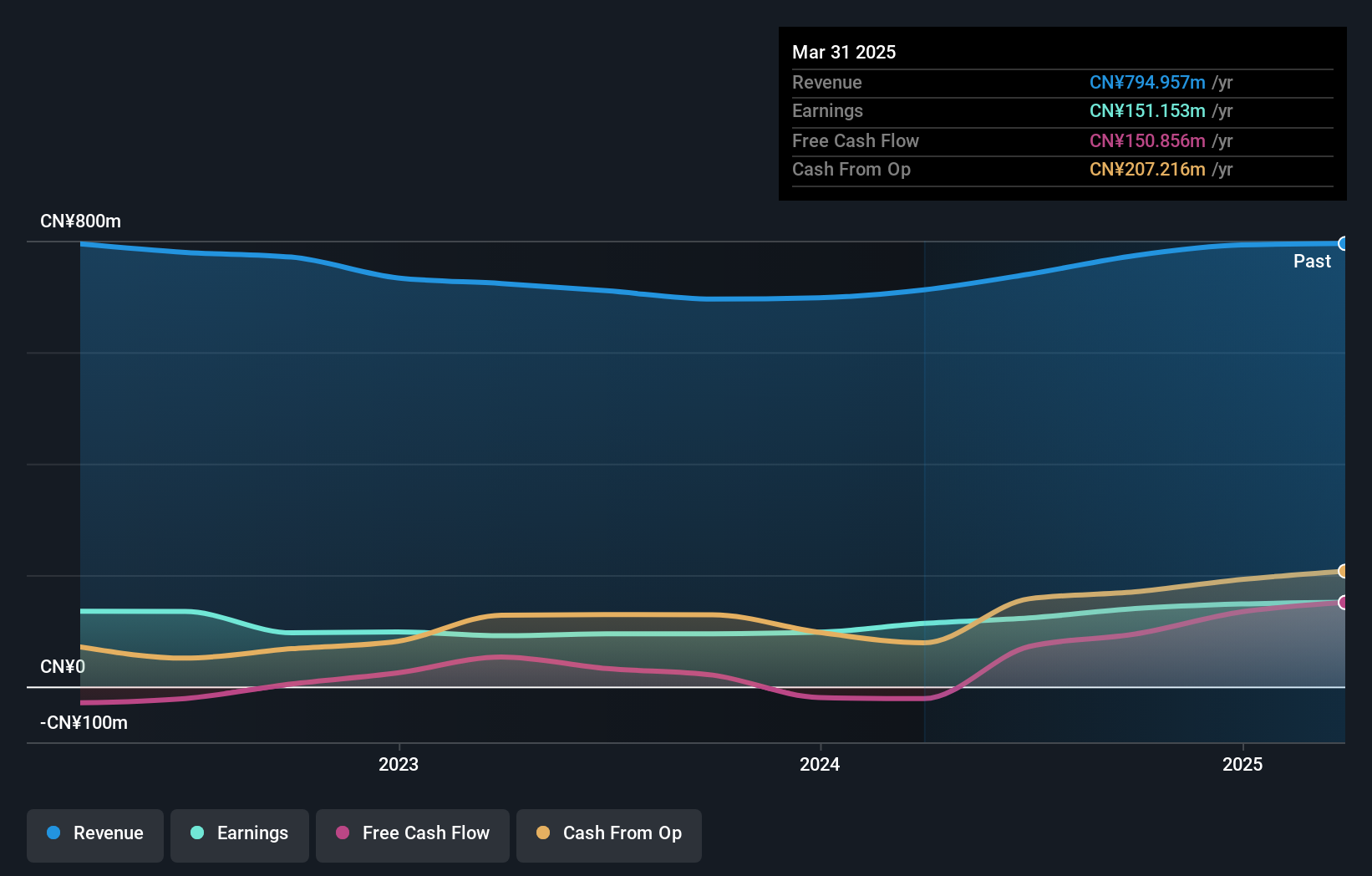

Zhejiang Chinastars, a relatively smaller player in the market, has shown impressive growth with earnings surging by 47.7% over the past year, outpacing the Luxury industry's average of 3.3%. Its price-to-earnings ratio stands at 23x, which is appealing compared to the broader CN market's 36.1x. Recently, it announced a share repurchase program worth up to CNY 100 million to reduce registered capital. The company's net income for nine months ended September 2024 was CNY 105.93 million, up from CNY 63.46 million last year, reflecting strong operational performance and strategic financial maneuvers like buybacks and dividends.

Toenec (TSE:1946)

Simply Wall St Value Rating: ★★★★★★

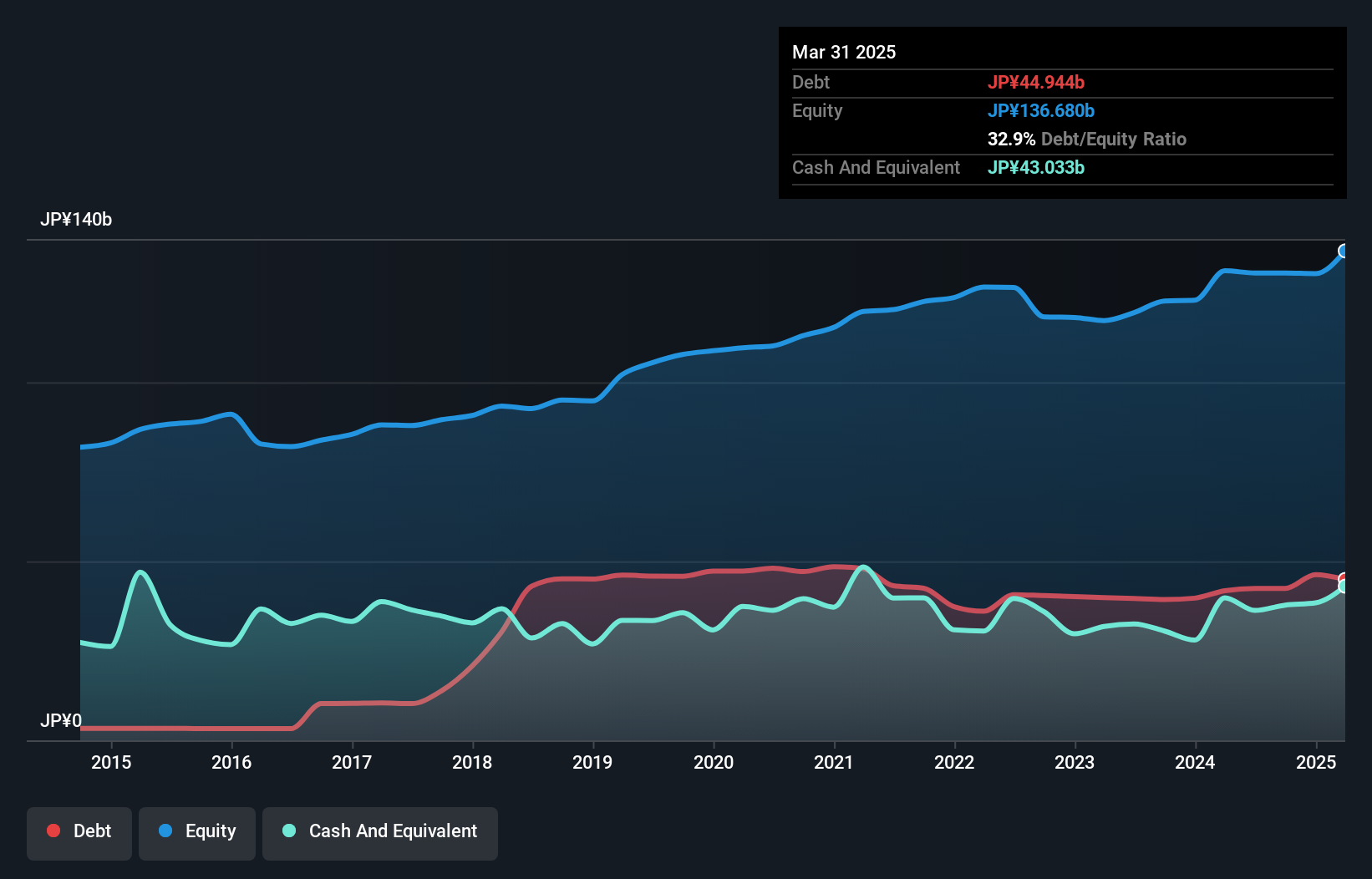

Overview: Toenec Corporation is an integrated facility company involved in the construction and enhancement of social infrastructure across energy, environment, and information technology sectors in Japan, with a market cap of approximately ¥89.27 billion.

Operations: Toenec generates revenue primarily from its operations in the energy, environment, and information technology sectors. The company's cost structure includes expenses related to construction and infrastructure development.

Toenec seems to be catching the eye with its recent performance, despite a challenging past five years where earnings fell by 15.8% annually. This year, however, earnings surged by 43.8%, outpacing the construction industry's growth of 20.7%. Trading at a significant discount—75.2% below estimated fair value—suggests potential undervaluation in the market's eyes. The company repurchased 125,200 shares for ¥593 million recently and announced dividends reflecting a share split adjustment, indicating shareholder-friendly actions amid financial restructuring efforts like reducing its debt-to-equity ratio from 42.5% to 32.5% over five years.

- Unlock comprehensive insights into our analysis of Toenec stock in this health report.

Assess Toenec's past performance with our detailed historical performance reports.

G-7 Holdings (TSE:7508)

Simply Wall St Value Rating: ★★★★★☆

Overview: G-7 Holdings Inc. operates in the food retail sector both in Japan and internationally, with a market capitalization of approximately ¥65.49 billion.

Operations: G-7 Holdings generates revenue primarily from its Business Supermarket Business and Automotive related business, with figures of ¥114.44 billion and ¥44.62 billion respectively. The Meat Business also contributes significantly to the overall revenue at ¥21.03 billion.

G-7 Holdings, a promising player in its sector, is trading at 8.2% below its estimated fair value, indicating potential undervaluation. The company has more cash than total debt, suggesting a robust financial position. Over the past year, earnings surged by 27.9%, outpacing the Consumer Retailing industry's growth of 11.8%. With high-quality past earnings and EBIT covering interest payments 183 times over, G-7 Holdings seems well-equipped to manage debt obligations effectively. Additionally, a dividend of JPY 20 per share was recently affirmed for shareholders, reflecting confidence in future cash flows and profitability prospects.

- Get an in-depth perspective on G-7 Holdings' performance by reading our health report here.

Evaluate G-7 Holdings' historical performance by accessing our past performance report.

Next Steps

- Access the full spectrum of 4630 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toenec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1946

Toenec

An integrated facility company, engages in the construction and improvement of social infrastructure in the energy, environment, and information technology fields in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives