- Japan

- /

- Food and Staples Retail

- /

- TSE:3391

Is Tsuruha Holdings' Sustained Sales Growth Shaping Its Competitive Edge in Japan (TSE:3391)?

Reviewed by Sasha Jovanovic

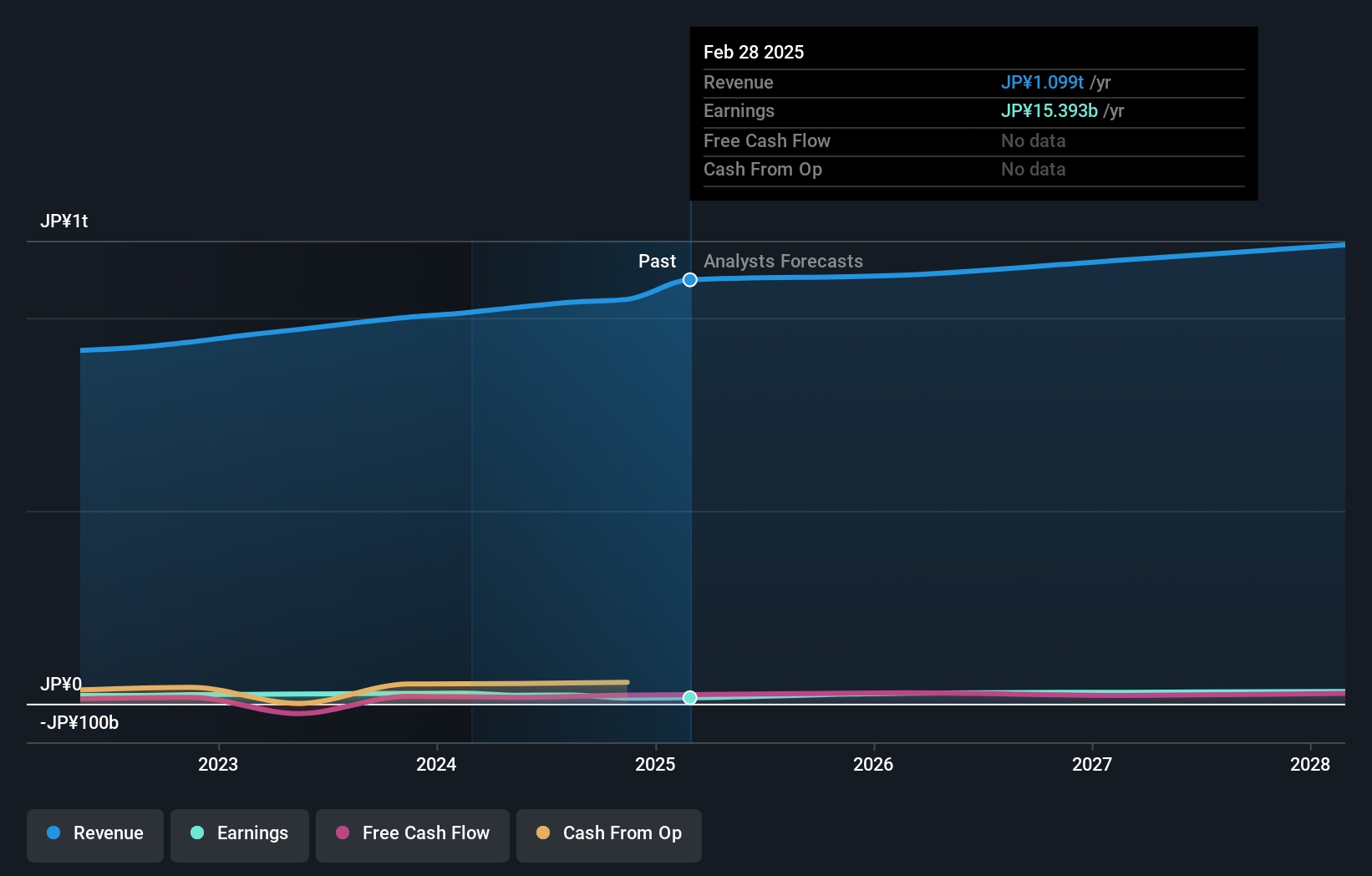

- Tsuruha Holdings recently reported its preliminary consolidated sales results for October 2025, showing all store net sales grew 5.1% year over year, with year-to-date sales up 4.2% from the previous year.

- This sustained sales growth highlights ongoing consumer demand for the company’s offerings in a competitive retail landscape.

- We’ll explore how the consistent sales momentum underpins Tsuruha Holdings' investment narrative amid evolving market conditions.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Tsuruha Holdings' Investment Narrative?

At the heart of the Tsuruha Holdings story is a retail business in flux, caught between robust sales momentum and the complexities of corporate maneuvering. The recent announcement of 5.1% year-on-year sales growth for October 2025 reinforces the company’s ability to keep customers engaged, suggesting that near-term revenue catalysts remain intact and may help bolster confidence after a period of negative earnings growth. However, this positive sales update arrives in the thick of transformative events, mainly the ongoing acquisition push from Aeon and continued shareholder activism challenging the value and fairness of proposed deals. There’s added opacity from incomplete integration developments, recent index exclusion, and past one-off financial losses. While the immediate sales uptick provides a welcome signal, it is unlikely to be a game-changer for the broader risks around integration uncertainty, governance debates, and concerns about the company’s valuation versus its earnings trajectory. But with activist investors highlighting governance risks, there’s more for shareholders to consider.

Tsuruha Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Tsuruha Holdings - why the stock might be worth over 4x more than the current price!

Build Your Own Tsuruha Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tsuruha Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Tsuruha Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tsuruha Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsuruha Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3391

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives