- Japan

- /

- Food and Staples Retail

- /

- TSE:3382

Seven & i Holdings (TSE:3382): Assessing Valuation After Guidance Upgrade and Higher Interim Dividend

Reviewed by Kshitija Bhandaru

Seven & i Holdings (TSE:3382) is making headlines after releasing an updated earnings forecast and announcing a higher interim dividend compared to last year. Both moves indicate greater confidence from management about the year ahead.

See our latest analysis for Seven & i Holdings.

While Seven & i Holdings has announced a bigger interim dividend and revised earnings guidance, the moves come during a year when momentum has been somewhat uneven. The share price closed at ¥1,991 and, despite a recent bump, is down 18.4% year-to-date. However, the five-year total shareholder return stands out at a robust 92.4%, which points to significant long-term value creation. Short-term price action remains choppy.

If you’re interested in spotting other stocks with compelling growth and strong insider commitment, now’s the perfect time to check out fast growing stocks with high insider ownership

But does the company’s stronger outlook and improving dividend mean Seven & i Holdings is trading at a discount, or has the market already accounted for these gains in its current valuation? Could there still be a buying opportunity here?

Most Popular Narrative: 12.8% Undervalued

With Seven & i Holdings last closing at ¥1,991, the most widely followed narrative estimates fair value at ¥2,282, setting expectations notably above current trading levels. This outlook draws from a blend of operational shifts and ambitious modernization initiatives, hinting that recent strategic changes could drive significant impact.

Ongoing global urbanization and changing consumer behaviors are driving demand for accessible, high-convenience retail. Seven & i's continued investment in expanding and modernizing its store networks, especially through new standard stores with enhanced food offerings in North America and digital integration (7NOW Nationwide rollout), positions the company to capture incremental revenue and diversify earnings streams.

Want to see what’s powering that bullish valuation? The narrative reveals a key Group-wide pivot aimed at profit expansion and margin improvement. But which strategic projections are tipping the scales in favor of a higher fair value? The numbers behind these headline moves might surprise you. Dive in to unpack the full set of drivers.

Result: Fair Value of ¥2,282 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in store traffic and rising operational expenses could undermine profit growth. This casts doubt on the sustainability of the bullish outlook.

Find out about the key risks to this Seven & i Holdings narrative.

Another View: Multiple-Based Valuation

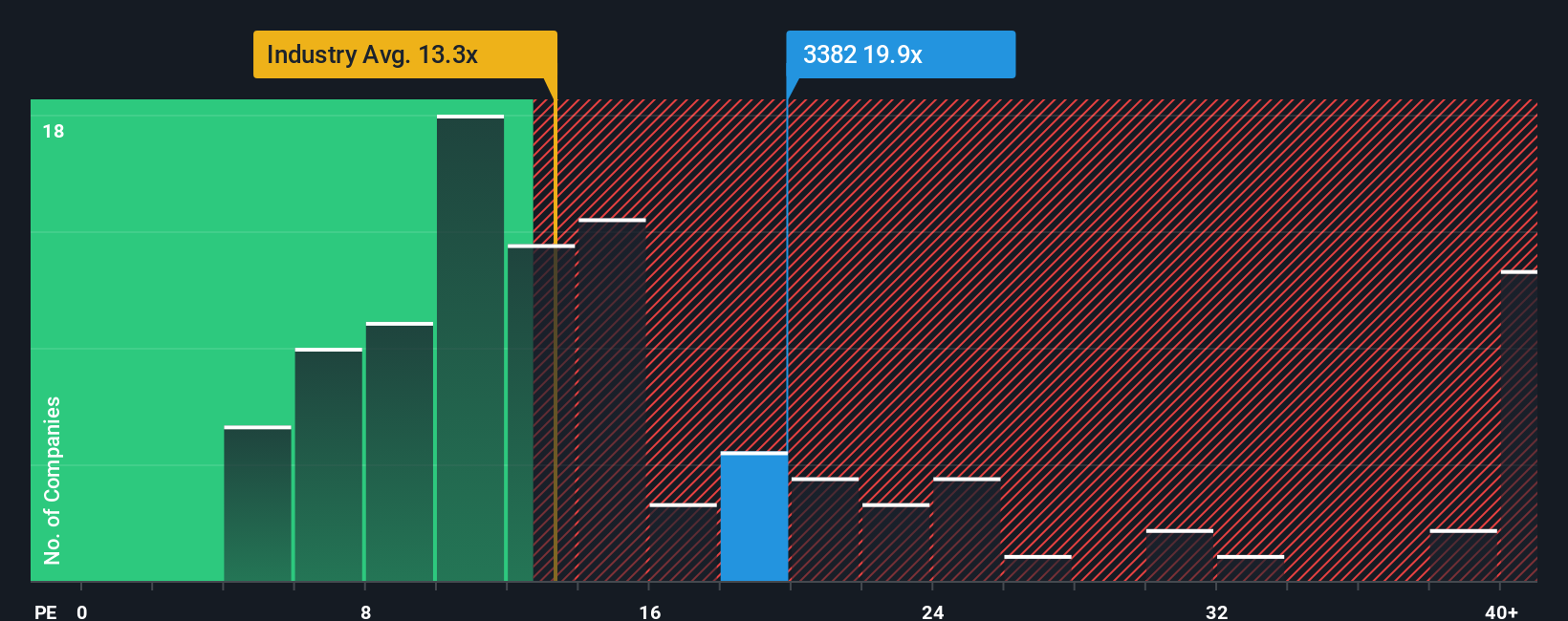

Looking through the lens of the price-to-earnings ratio, Seven & i Holdings is trading at 19.9x, which is above both its peers' 18.5x and the industry average of 13.3x. Even so, the current valuation is below what our fair ratio analysis suggests: a P/E of 25.2x. Does this gap flag an opportunity, or could it reflect heightened valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Seven & i Holdings Narrative

If you see things differently, or want to dig into the numbers for yourself, crafting your own narrative is quick and straightforward. Just take a few minutes to explore your perspective and Do it your way

A great starting point for your Seven & i Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Broaden your portfolio and unlock fresh opportunities by tapping into stock ideas you simply can’t afford to miss. Level up your research now.

- Uncover fresh opportunities by tracking these 878 undervalued stocks based on cash flows, as market sentiment shifts in their favor and they may be poised for a rebound.

- Capitalize on surging trends by targeting these 24 AI penny stocks, which are leading the development of tomorrow’s most advanced technologies.

- Reap the rewards of consistent income by considering these 18 dividend stocks with yields > 3%, which outpace the market with their strong yields and stable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3382

Seven & i Holdings

Operates convenience stores, superstores, and department stores in Japan, North America, and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives