With Mizuno Corporation (TSE:8022) It Looks Like You'll Get What You Pay For

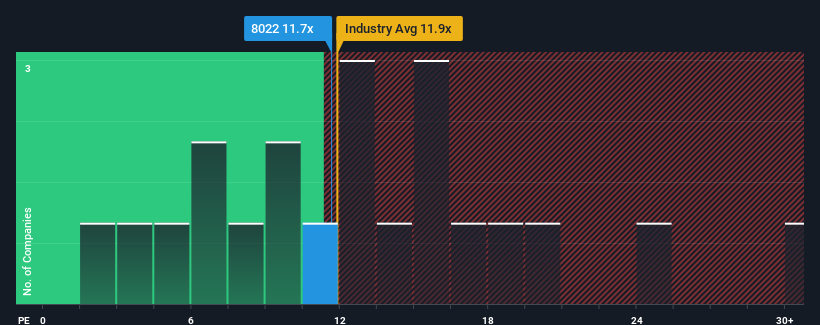

There wouldn't be many who think Mizuno Corporation's (TSE:8022) price-to-earnings (or "P/E") ratio of 11.6x is worth a mention when the median P/E in Japan is similar at about 12x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's superior to most other companies of late, Mizuno has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Mizuno

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Mizuno's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 16%. The strong recent performance means it was also able to grow EPS by 97% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 9.2% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 9.7% per year, which is not materially different.

In light of this, it's understandable that Mizuno's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Mizuno maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Mizuno with six simple checks.

If these risks are making you reconsider your opinion on Mizuno, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8022

Mizuno

Manufactures and sells sports products in Japan, the rest of Asia, Europe, the Americas, and Oceania.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives