Onward Holdings Co., Ltd. Just Recorded A 17% EPS Beat: Here's What Analysts Are Forecasting Next

It's been a pretty great week for Onward Holdings Co., Ltd. (TSE:8016) shareholders, with its shares surging 16% to JP¥660 in the week since its latest full-year results. Revenues were JP¥190b, approximately in line with expectations, although statutory earnings per share (EPS) performed substantially better. EPS of JP¥48.72 were also better than expected, beating analyst predictions by 17%. Earnings are an important time for investors, as they can track a company's performance, look at what the analyst is forecasting for next year, and see if there's been a change in sentiment towards the company. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analyst has changed their mind on Onward Holdings after the latest results.

See our latest analysis for Onward Holdings

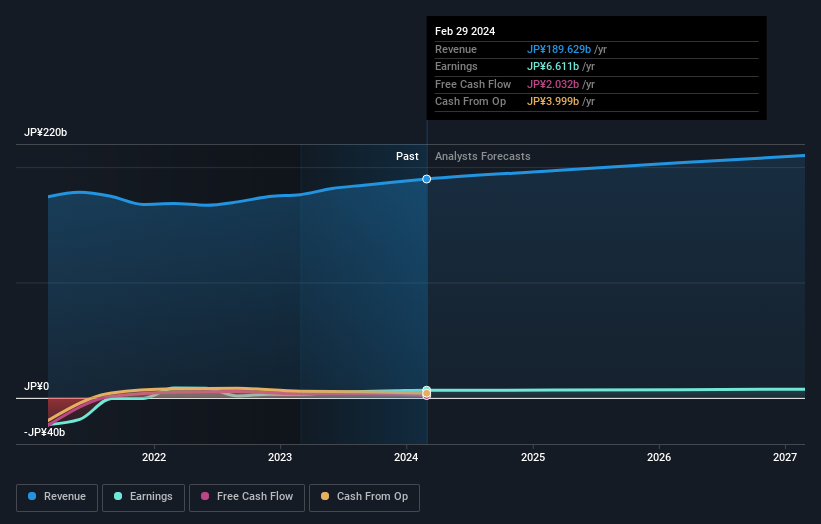

Taking into account the latest results, the current consensus from Onward Holdings' lone analyst is for revenues of JP¥196.8b in 2025. This would reflect a credible 3.8% increase on its revenue over the past 12 months. Statutory per-share earnings are expected to be JP¥49.32, roughly flat on the last 12 months. Yet prior to the latest earnings, the analyst had been anticipated revenues of JP¥195.8b and earnings per share (EPS) of JP¥43.17 in 2025. Although the revenue estimates have not really changed, we can see there's been a nice increase in earnings per share expectations, suggesting that the analyst has become more bullish after the latest result.

The consensus price target rose 8.6% to JP¥630, suggesting that higher earnings estimates flow through to the stock's valuation as well.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. For example, we noticed that Onward Holdings' rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 3.8% growth to the end of 2025 on an annualised basis. That is well above its historical decline of 7.7% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 5.8% per year. Although Onward Holdings' revenues are expected to improve, it seems that the analyst is still bearish on the business, forecasting it to grow slower than the broader industry.

The Bottom Line

The most important thing here is that the analyst upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Onward Holdings following these results. Fortunately, the analyst also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Onward Holdings' revenue is expected to perform worse than the wider industry. There was also a nice increase in the price target, with the analyst clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2027, which can be seen for free on our platform here.

Before you take the next step you should know about the 3 warning signs for Onward Holdings that we have uncovered.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8016

Onward Holdings

Engages in the planning, production, and sale of men’s, women’s, and children’s apparel in Japan and worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success