Investors Still Aren't Entirely Convinced By Mamiya-OP Co., Ltd.'s (TSE:7991) Earnings Despite 27% Price Jump

Despite an already strong run, Mamiya-OP Co., Ltd. (TSE:7991) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 41% in the last year.

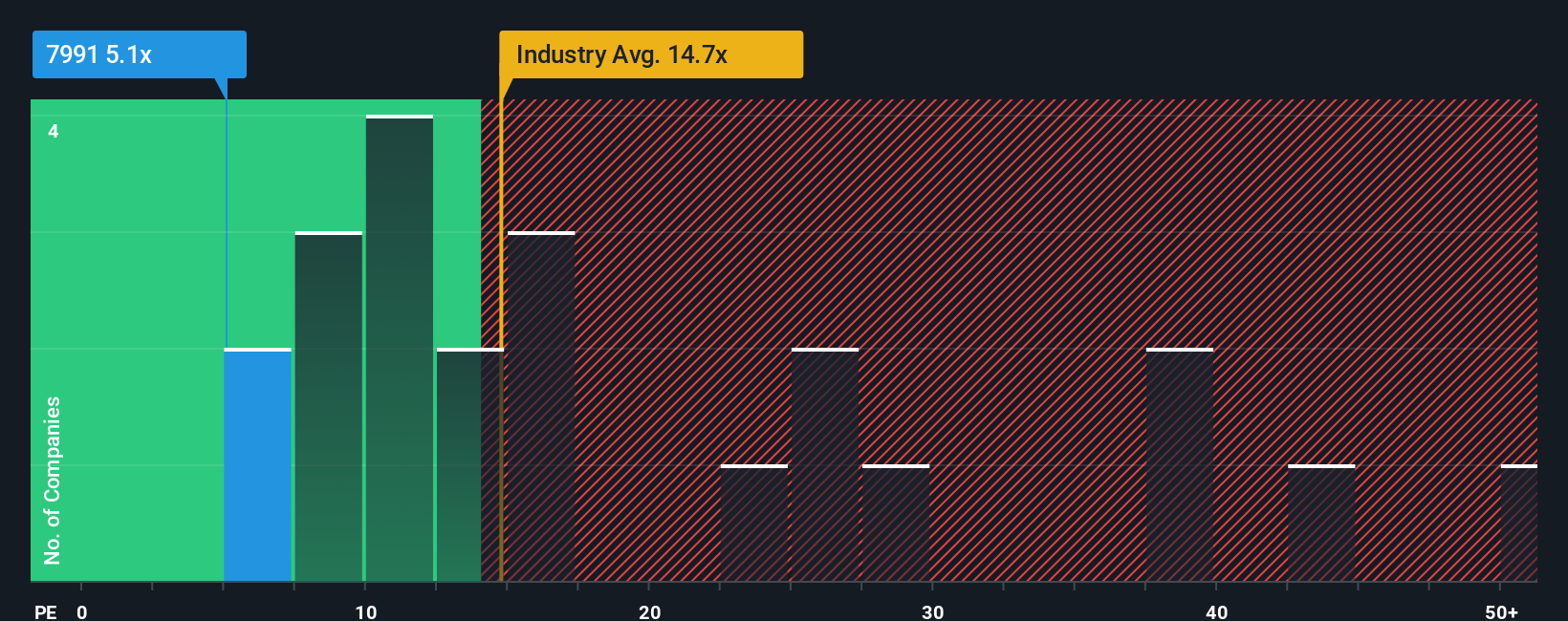

Although its price has surged higher, Mamiya-OP may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5.1x, since almost half of all companies in Japan have P/E ratios greater than 15x and even P/E's higher than 23x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For example, consider that Mamiya-OP's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Mamiya-OP

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Mamiya-OP would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 222% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 11% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Mamiya-OP's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Shares in Mamiya-OP are going to need a lot more upward momentum to get the company's P/E out of its slump. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Mamiya-OP currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Mamiya-OP you should know about.

If these risks are making you reconsider your opinion on Mamiya-OP, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7991

Mamiya-OP

Manufactures and sells electronic and sports equipment in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.