As global markets navigate a landscape marked by trade tensions and monetary policy shifts, Asian economies are experiencing their own set of challenges and opportunities. Amidst this backdrop, dividend stocks in Asia present an attractive option for investors seeking income stability; these stocks often offer robust yields and the potential for consistent payouts, making them appealing in volatile times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.22% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.02% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.82% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Daicel (TSE:4202) | 4.32% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.45% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.63% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.64% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.60% | ★★★★★★ |

Click here to see the full list of 1042 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

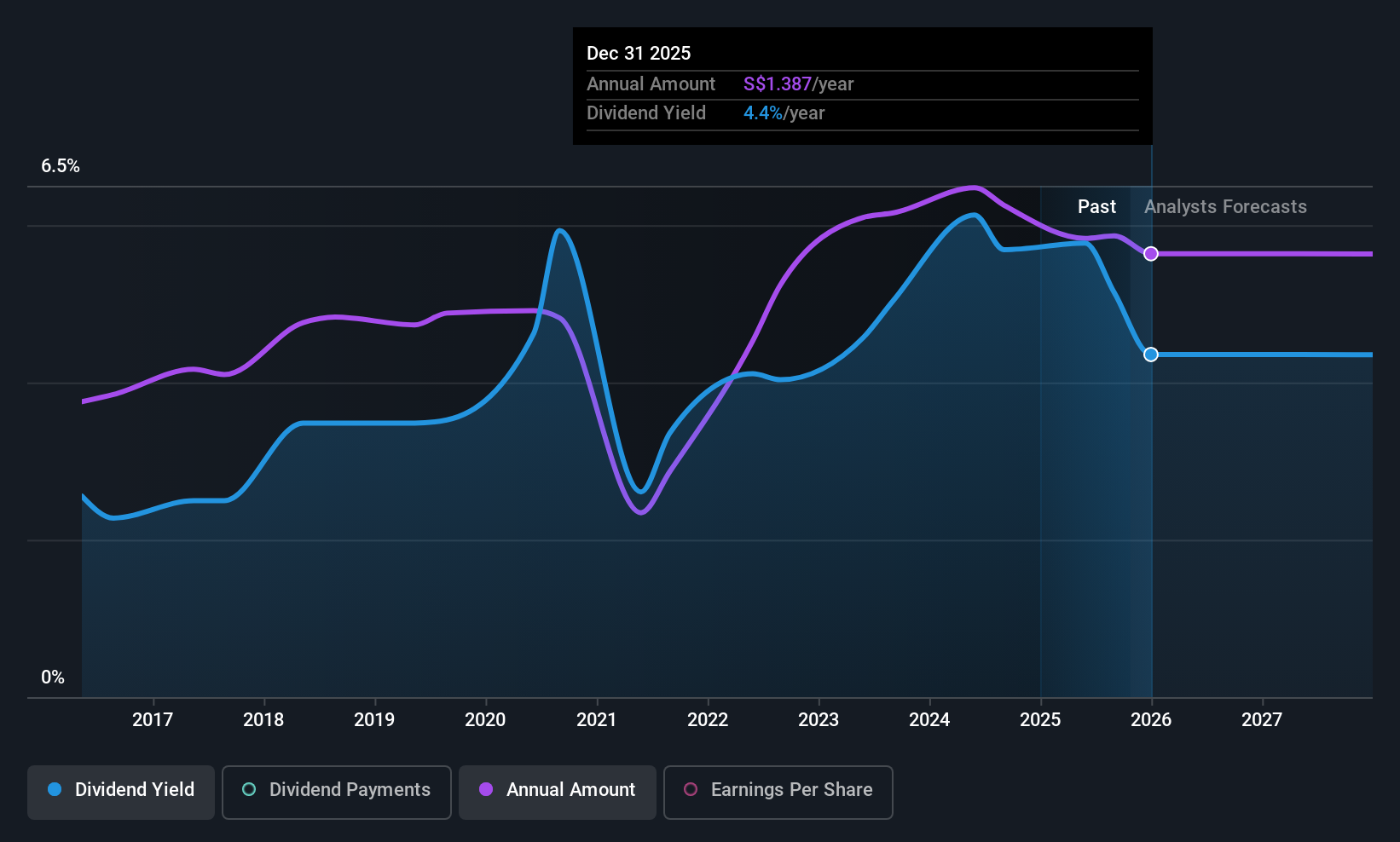

Jardine Cycle & Carriage (SGX:C07)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jardine Cycle & Carriage Limited is an investment holding company involved in financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property sectors across Indonesia, Singapore, and Malaysia, with a market cap of SGD12.28 billion.

Operations: Jardine Cycle & Carriage Limited generates its revenue primarily from its Indonesia-astra segment, which accounts for $20.65 billion, and its Regional Interests segment, contributing $1.74 billion.

Dividend Yield: 4.7%

Jardine Cycle & Carriage's dividend payments have been volatile and unreliable over the past decade, despite a modest increase. The payout ratio of 53.1% and cash payout ratio of 30.3% indicate dividends are well-covered by earnings and cash flows, respectively. However, the dividend yield of 4.68% is below top-tier levels in Singapore's market. Recent leadership changes with Samuel Tsien becoming Chairman may influence future strategic direction but do not directly impact current dividend stability or growth prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of Jardine Cycle & Carriage.

- According our valuation report, there's an indication that Jardine Cycle & Carriage's share price might be on the cheaper side.

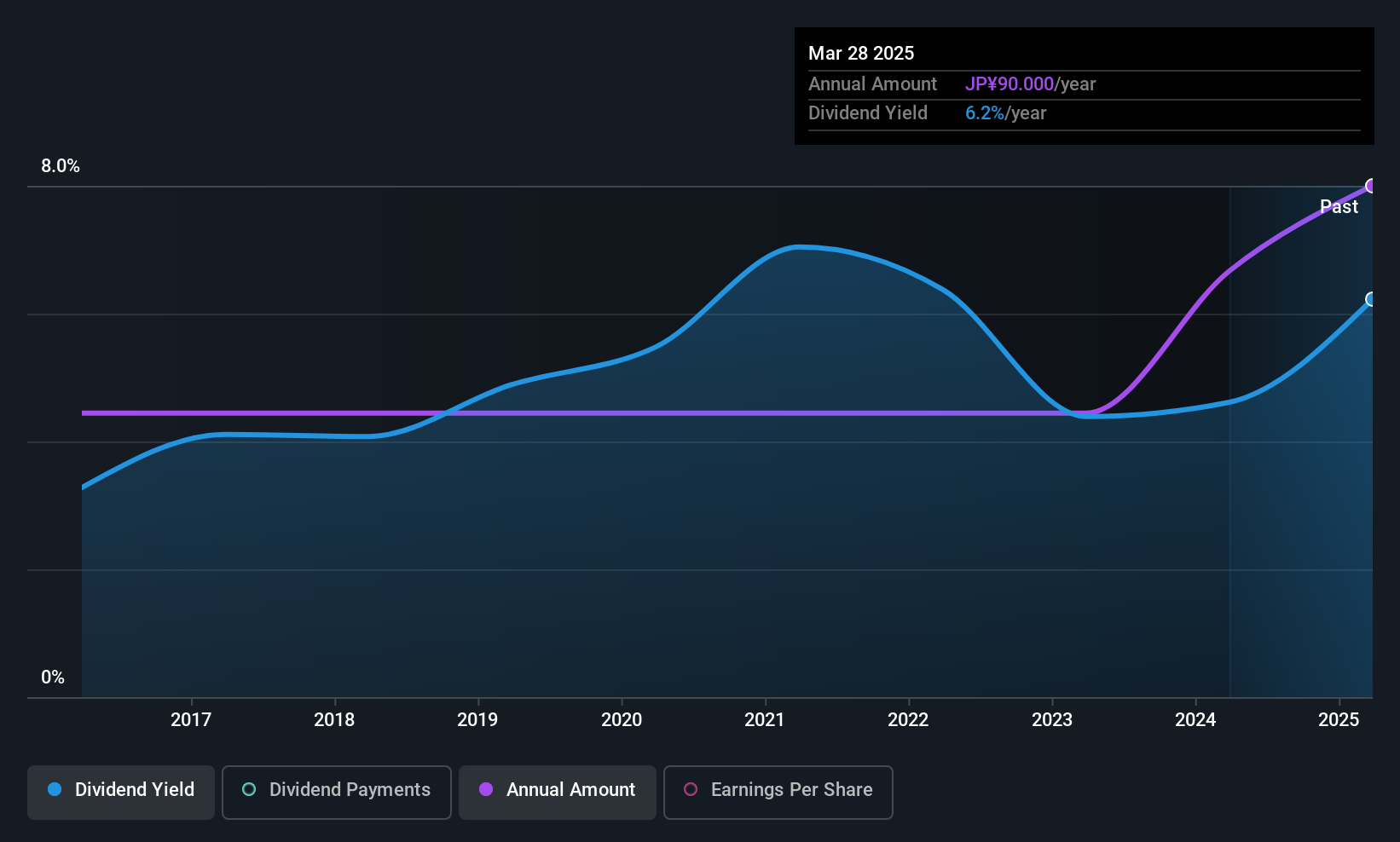

Mamiya-OP (TSE:7991)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mamiya-OP Co., Ltd. manufactures and sells electronic and sports equipment both in Japan and internationally, with a market cap of ¥19.85 billion.

Operations: Mamiya-OP Co., Ltd. generates revenue through its Electronic Equipment Business, contributing ¥25.53 billion, Sports Business at ¥5.50 billion, and Real Estate Business with ¥1.55 billion.

Dividend Yield: 4.7%

Mamiya-OP's dividend payments have increased over the past decade, yet they remain volatile and unreliable. The payout ratio of 23.8% and cash payout ratio of 15% suggest dividends are well-covered by earnings and cash flows, indicating sustainability despite instability. Trading at 83.4% below its estimated fair value, the stock offers a dividend yield of 4.68%, placing it in the top quartile among Japanese market dividend payers (3.65%).

- Take a closer look at Mamiya-OP's potential here in our dividend report.

- Our expertly prepared valuation report Mamiya-OP implies its share price may be lower than expected.

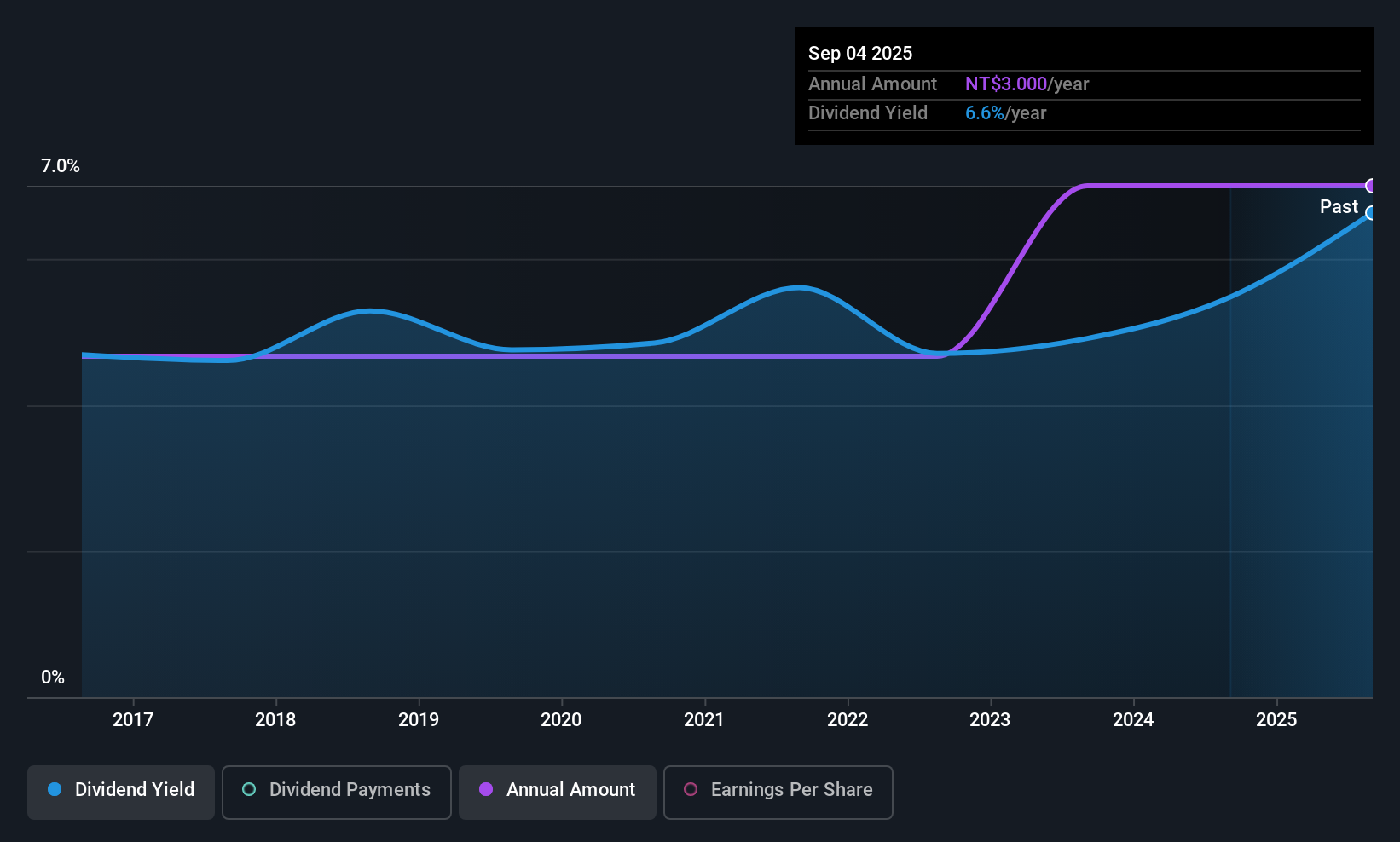

Y.C.C. Parts Mfg (TWSE:1339)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Y.C.C. Parts Mfg. Co., Ltd. manufactures and sells automotive plastic parts across various regions including North America, Central America, South America, Europe, Asia, and Taiwan with a market cap of NT$3.39 billion.

Operations: Y.C.C. Parts Mfg. Co., Ltd.'s revenue segments include Liaoning Hetai, contributing NT$318.16 million.

Dividend Yield: 6.6%

Y.C.C. Parts Mfg.'s dividends have been consistently reliable and growing over the past decade, yet their sustainability is questionable due to a high payout ratio of 136.1%, indicating dividends are not well covered by earnings despite being covered by cash flows with a 60.1% cash payout ratio. Recent financial results show declining sales and profits, with a net loss in the latest quarter, potentially impacting future dividend stability despite its top-tier yield of 6.55%.

- Unlock comprehensive insights into our analysis of Y.C.C. Parts Mfg stock in this dividend report.

- Our expertly prepared valuation report Y.C.C. Parts Mfg implies its share price may be too high.

Next Steps

- Get an in-depth perspective on all 1042 Top Asian Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7991

Mamiya-OP

Manufactures and sells electronic and sports equipment in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives