Japan's stock markets have shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% while the broader TOPIX Index declined by 1.0%. Amid this backdrop, investors are paying close attention to dividend stocks as a potential source of stable income. In light of ongoing economic adjustments and currency fluctuations, identifying strong dividend-paying stocks can be a prudent strategy for those looking to balance growth and income in their portfolios.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Globeride (TSE:7990) | 4.44% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.84% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.96% | ★★★★★★ |

| Kondotec (TSE:7438) | 3.86% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.03% | ★★★★★★ |

| Innotech (TSE:9880) | 4.88% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.74% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

Click here to see the full list of 474 stocks from our Top Japanese Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Asahi PrintingLtd (TSE:3951)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asahi Printing Co., Ltd. (TSE:3951) manufactures and sells printing and packaging materials for the pharmaceutical and cosmetic markets primarily in Japan, with a market cap of ¥19.97 billion.

Operations: Asahi Printing Co., Ltd. (TSE:3951) generates revenue from the manufacture and sale of printing and packaging materials for the pharmaceutical and cosmetic markets in Japan.

Dividend Yield: 4%

Asahi Printing Ltd.'s dividend payments have been volatile and unreliable over the past decade, despite being in the top 25% of dividend payers in Japan with a 4.04% yield. The dividends are well-covered by earnings due to a low payout ratio of 47.3%, but not by free cash flows, indicated by a high cash payout ratio of 124.1%. Investors should note that Q1, 2025 results will be reported on August 9, 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Asahi PrintingLtd.

- Our valuation report unveils the possibility Asahi PrintingLtd's shares may be trading at a premium.

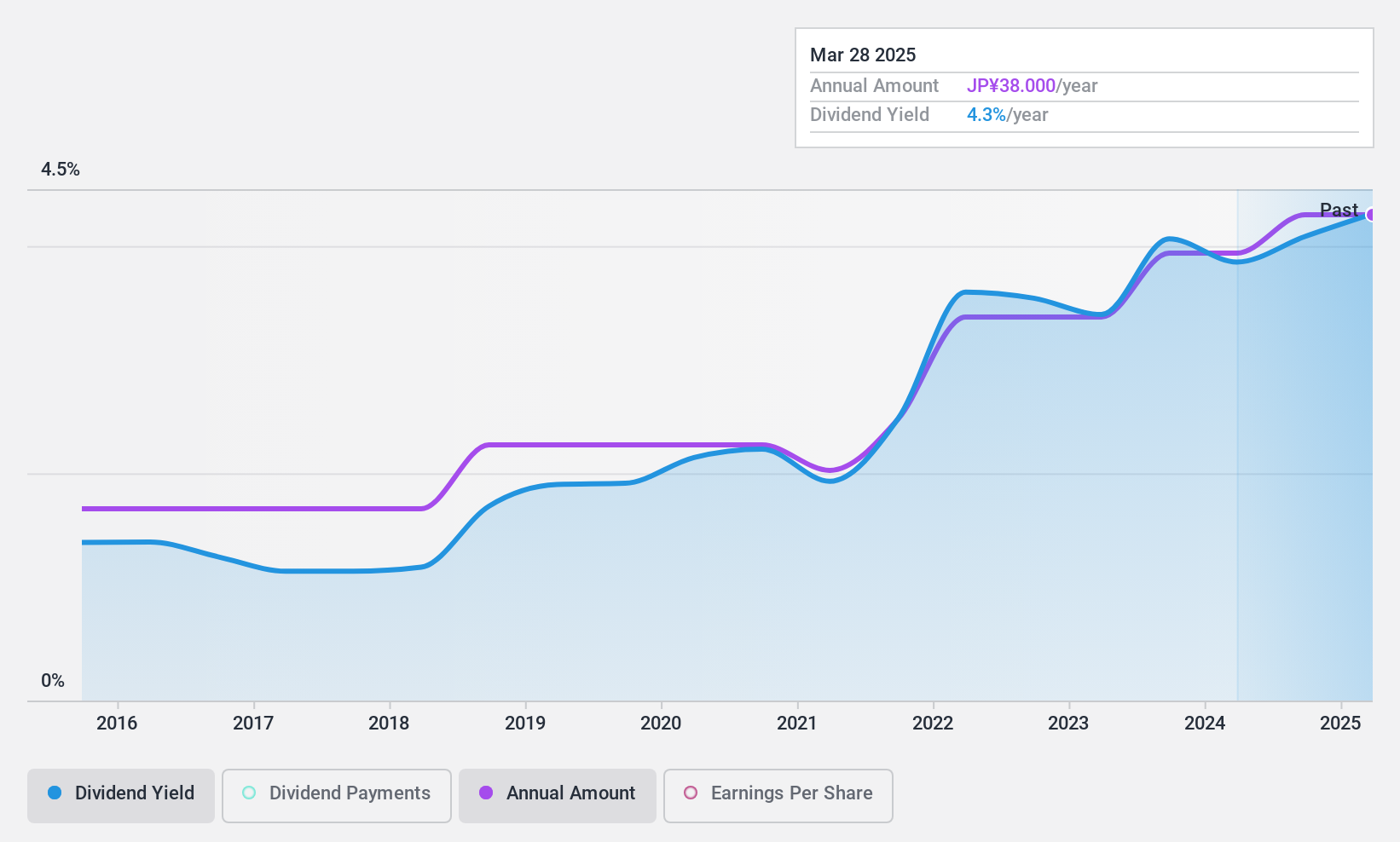

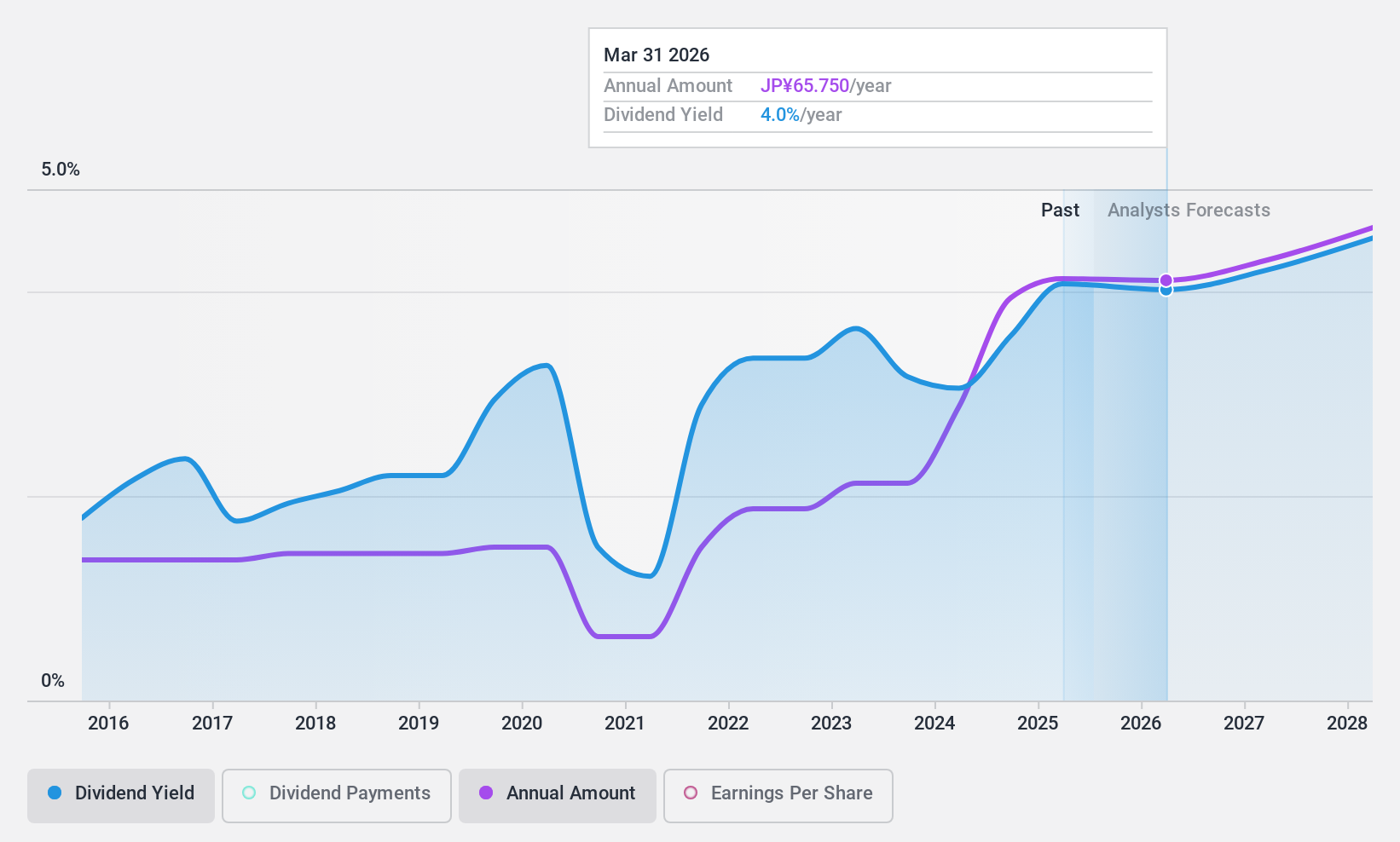

NHK Spring (TSE:5991)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NHK Spring Co., Ltd. operates in Japan, offering automobile, data communications, and industry and lifestyle products with a market cap of ¥367.77 billion.

Operations: NHK Spring Co., Ltd.'s revenue segments include Automotive Seating at ¥324.42 billion, Disk Drive Suspension (DDS) at ¥74.46 billion, Automotive Suspension Springs at ¥176.61 billion, and Industrial Machinery and Equipment along with other operations totaling ¥123.86 billion.

Dividend Yield: 3.7%

NHK Spring's dividend payments have been volatile over the past decade but are well-covered by earnings (payout ratio: 20%) and cash flows (cash payout ratio: 41.3%). Recent board decisions increased the annual dividend forecast to ¥63 per share, reflecting an upward revision in earnings guidance due to strong DDS business performance and a weaker yen. Despite trading at 44% below estimated fair value, its share price has been highly volatile recently.

- Navigate through the intricacies of NHK Spring with our comprehensive dividend report here.

- Our valuation report here indicates NHK Spring may be undervalued.

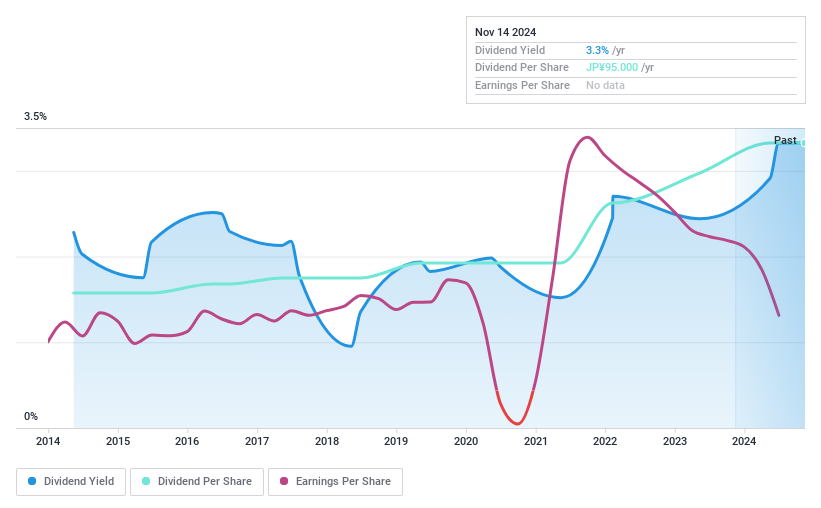

Kawai Musical Instruments Manufacturing (TSE:7952)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kawai Musical Instruments Manufacturing Co., Ltd. (TSE:7952) is a company specializing in the production of musical instruments, including pianos and electronic keyboards, with a market cap of ¥24.60 billion.

Operations: Kawai Musical Instruments Manufacturing Co., Ltd. generates revenue primarily from its Musical Instrument Education segment, which accounts for ¥63.66 billion, and Materials Processing segment, contributing ¥9.50 billion.

Dividend Yield: 3.3%

Kawai Musical Instruments Manufacturing's dividend payments have been stable and growing over the past decade, but they are not well covered by cash flows, with a high cash payout ratio of 716.6%. The company's profit margins have declined to 2.2% from last year's 4.1%, and its dividend yield of 3.32% is below the top quartile in Japan. Despite this, dividends are well-covered by earnings with a payout ratio of 47.4%.

- Unlock comprehensive insights into our analysis of Kawai Musical Instruments Manufacturing stock in this dividend report.

- The valuation report we've compiled suggests that Kawai Musical Instruments Manufacturing's current price could be inflated.

Seize The Opportunity

- Unlock our comprehensive list of 474 Top Japanese Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kawai Musical Instruments Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7952

Kawai Musical Instruments Manufacturing

Kawai Musical Instruments Manufacturing Co., Ltd.

Excellent balance sheet second-rate dividend payer.