How Recent Stock Surge and Industry Trends Are Shaping Yamaha’s Outlook in 2025

Reviewed by Bailey Pemberton

If you have been following Yamaha’s stock lately, you are probably wondering whether now is the right time to get in, get out, or simply hold tight. It is a question on many investors’ minds, especially after watching shares pop 5.2% in just the past week. That fresh burst comes after a tough longer run, though, with the stock still down 17.4% over the past year and sitting nearly 33% below where it was five years ago. Clearly, the market’s view of Yamaha has shifted, at least for the short term, even as the longer trend remains challenging.

Some recent market developments within the broader sector have helped renew interest in Yamaha, as investors look for opportunities where the risk perception might be overdone and growth potential undervalued. However, caution still lingers, as many are aware of the big-picture declines and are looking for the bottom to be confirmed before committing fresh capital.

Turning to the numbers, Yamaha currently earns a valuation score of 2 out of 6, meaning it is undervalued only in 2 of the valuation checks analysts like to use. That score suggests there is some value to be found, but perhaps not across the board just yet. This raises the stakes for a careful dive into the company’s fundamentals.

In the next section, we will break down each valuation approach to see where Yamaha stands and what the numbers can really tell us. And if you stick around to the end, we will take it a step further and show you a smarter way to think about the stock’s true worth.

Yamaha scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Yamaha Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation approach used to estimate a company’s intrinsic value by projecting its future cash flows and then discounting them back to reflect today’s worth. For Yamaha, this means looking at how much cash the business is expected to generate each year moving forward and translating that into what those future yen are worth now.

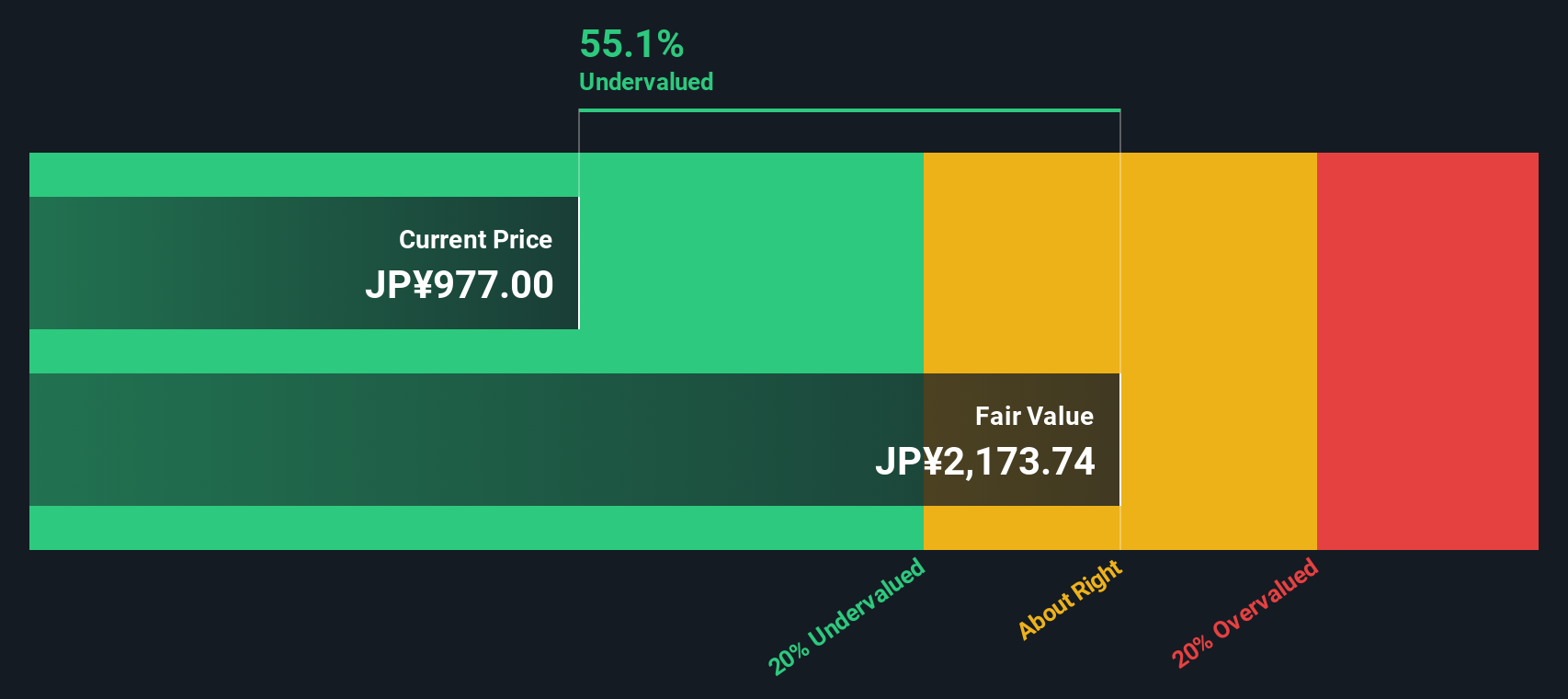

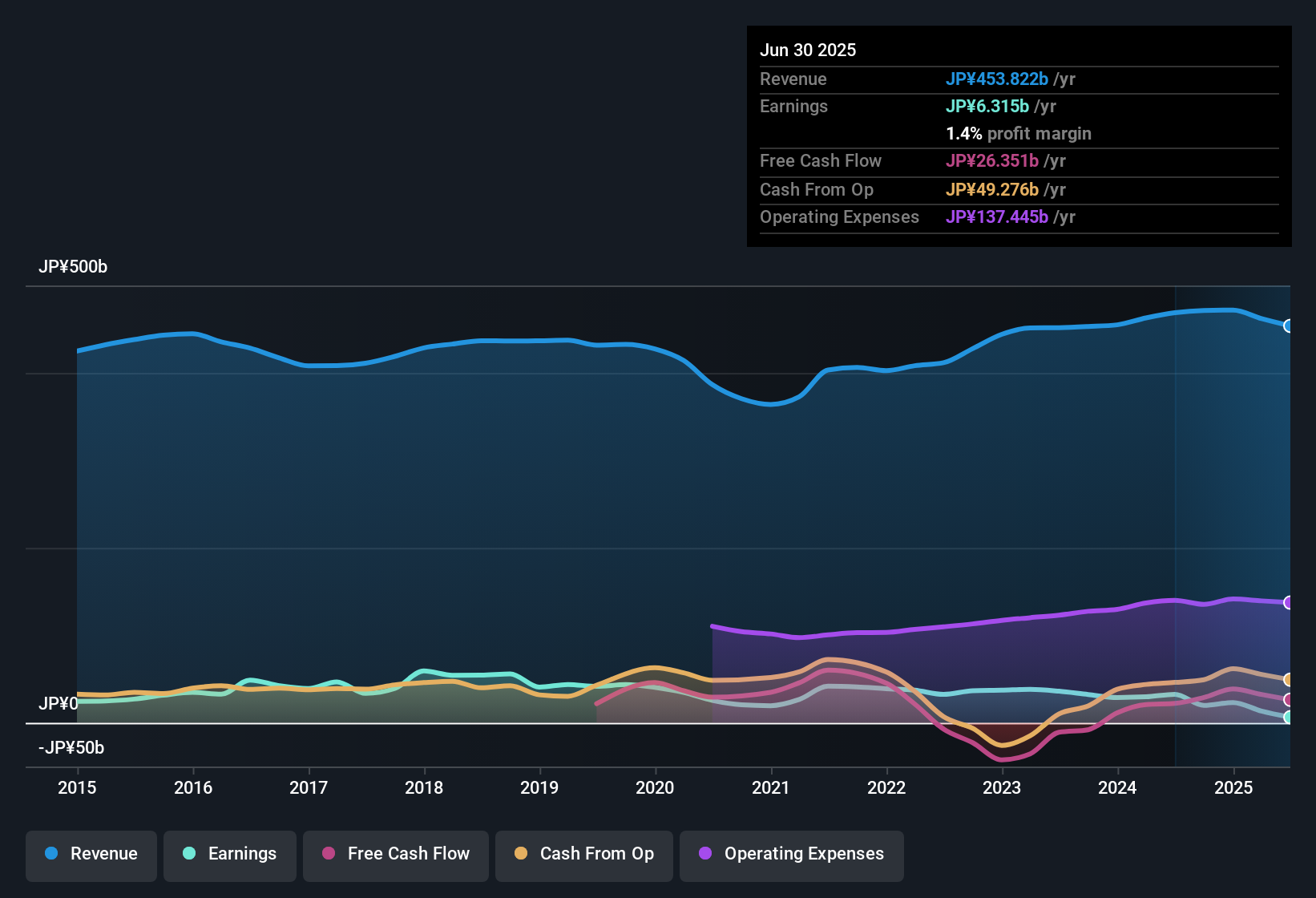

Currently, Yamaha’s last twelve months’ Free Cash Flow stands at approximately ¥26.8 billion. Analysts project steady growth ahead, with FCF estimates pointing toward ¥46.0 billion by 2030. The first five years of projections come from analyst models, while additional years are more cautiously extrapolated. These healthy increases suggest a business that is expected to ramp up its cash generation capability over the coming decade.

Based on this two-stage cash flow model, the estimated intrinsic value per share comes out to ¥2,181. At current market prices, this implies that Yamaha is trading at a steep 52.5% discount to its underlying value according to the DCF analysis. In other words, the market may be overlooking the company’s ability to grow its future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Yamaha is undervalued by 52.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Yamaha Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Yamaha because it allows investors to see how much the market is willing to pay for each unit of current earnings. This makes it particularly useful for evaluating established businesses with steady profit streams.

Determining what counts as a "fair" PE ratio depends on factors such as the company’s expected growth, its risk profile, and how it compares to others in the same industry. Higher growth firms or those with lower risk typically command higher PE ratios, while slower growth or riskier businesses tend to trade at a discount.

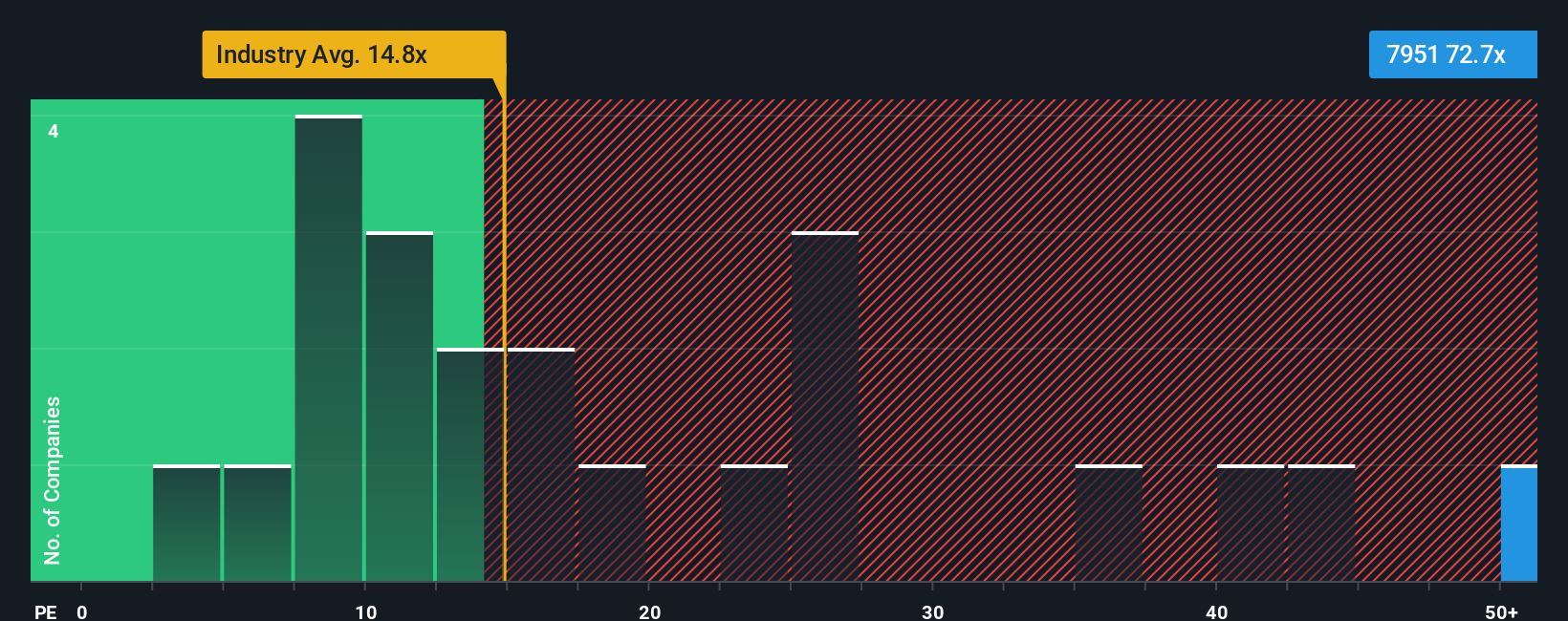

Currently, Yamaha’s PE ratio stands at 74.3x. This is substantially higher than both the industry average of 14.9x and the average of its direct peers at 22.6x. However, rather than just comparing to these benchmarks, Simply Wall St also calculates a tailored “Fair Ratio” for Yamaha. This ratio incorporates a broader set of considerations, including its unique earnings growth forecasts, profit margins, market cap, risk characteristics, and the specific dynamics of the leisure industry.

Simply Wall St’s Fair Ratio for Yamaha is 24.9x. Since Yamaha’s current PE ratio is much higher than the Fair Ratio, this suggests the stock is valued above what these combined fundamentals might justify, even when considering all growth and risk factors.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Yamaha Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story or perspective you create about a company, such as Yamaha, anchored in your expectations for its business, future earnings, and profit margins, all fed into a financial forecast that leads directly to your fair value for the stock.

Unlike traditional valuation ratios, Narratives connect the dots between what you believe (the company’s story), what you expect (future revenue or earnings), and what you calculate the stock is really worth. On Simply Wall St’s Community page, millions of investors use Narratives to build and share their outlooks, making it simple and accessible for anyone to translate a company’s numbers into an actionable investment view.

Using Narratives puts you in charge, helping you decide when to buy or sell by letting you compare your (or the community’s) calculated Fair Value with today’s share price. This approach makes investment decisions more personal and grounded. In addition, Narratives update automatically when new information comes in, such as news or earnings announcements, so your view always reflects the latest data.

For Yamaha, for example, one widely shared Narrative is bullish, projecting a ¥1400 fair value thanks to optimism about growth in digital music technologies. A more cautious view sets fair value at ¥1000, citing margin pressures and currency risks. This is a vivid illustration of how Narratives help different investors bring their own conviction to each buy or sell decision.

Do you think there's more to the story for Yamaha? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7951

Yamaha

Engages in the musical instruments, audio equipment, and other businesses in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026