Assessing Yamaha (TSE:7951) Valuation: Is There Untapped Value After Recent Flat Trading?

Reviewed by Kshitija Bhandaru

Yamaha (TSE:7951) has shown steady movement in recent trading sessions, which has caught the attention of some investors who are considering its longer-term performance. While recent gains are modest, the stock's past year has been challenging.

See our latest analysis for Yamaha.

Yamaha’s share price has shown only minimal movement lately, reflecting a broader trend of sluggish momentum. Over the past year, the total shareholder return remains negative, suggesting that confidence is recovering slowly rather than surging, even as the business reports pockets of growth.

If you’re interested in what else is trending beyond this sector, now is an ideal time to discover fast growing stocks with high insider ownership

With shares still trading well below analyst targets and clear signs of growth in core financials, the essential question for investors is whether Yamaha remains undervalued or if the market has already accounted for all potential upside.

Most Popular Narrative: 10.9% Undervalued

With Yamaha’s fair value assessment coming in notably above the recent close price, expectations for the company’s future prospects are front and center for investors seeking value amid uncertainty.

Recent investments in digital transformation, including new product launches (digital pianos, electronic drums, and music tech from the Silicon Valley base), are set to capitalize on global growth in digital music creation and music education. These initiatives support higher-margin revenue streams and future earnings growth.

Curious about the bold strategy fueling this price target? The narrative’s calculus leans heavily on accelerating profit margins and shrinking share count. The real surprise, though, is how analysts envision Yamaha’s transition from a premium multiple today to a remarkably lean one in just a few years. Want to uncover the quantitative engine powering this outlook? The key assumptions might change how you view Yamaha’s true potential.

Result: Fair Value of ¥1,132.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency headwinds and weaker-than-expected sales in Yamaha’s key audio and piano segments could undermine the optimistic earnings outlook.

Find out about the key risks to this Yamaha narrative.

Another View: A Multiple-Based Perspective

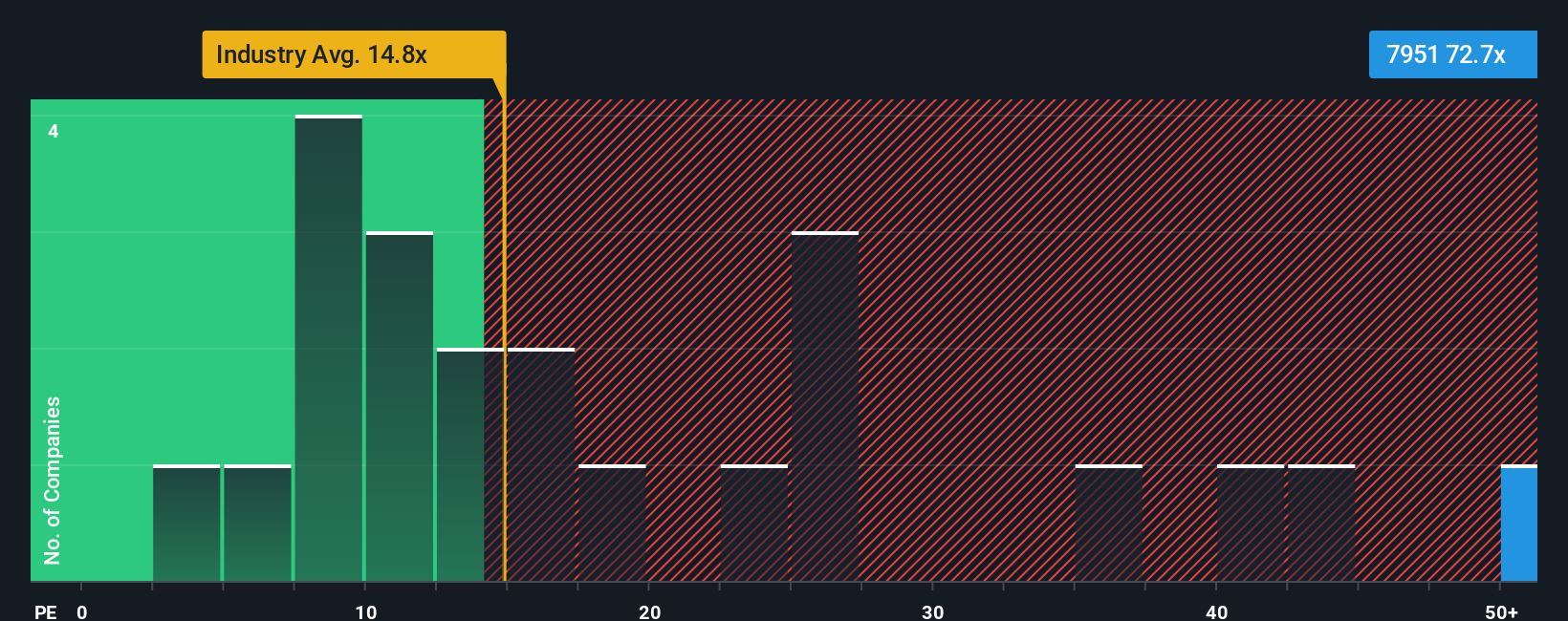

While the fair value estimate points to Yamaha being undervalued, a look at its current price-to-earnings ratio tells a different story. Yamaha trades at around 72.5 times earnings, which is far higher than the industry average of 15 times and its fair ratio of 24.9 times. This gap suggests today's price tags on the stock are demanding compared to peers and the broader market.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yamaha Narrative

If you want to take a different angle or dig into the numbers yourself, it’s straightforward to build your own view in just a few minutes. Do it your way.

A great starting point for your Yamaha research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Uncover opportunities you may be missing. Fuel your portfolio with fresh investment angles and insights using the powerful Simply Wall Street Screener today.

- Tap into the innovation wave and seize growth potential by checking out these 24 AI penny stocks shaping the future with next-generation AI breakthroughs.

- Capture steady income streams and strengthen your long-term outlook by reviewing these 19 dividend stocks with yields > 3% that consistently deliver yields above 3%.

- Ride the frontier of finance and gain exposure to disruptive trends with these 78 cryptocurrency and blockchain stocks fueling advances in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7951

Yamaha

Engages in the musical instruments, audio equipment, and other businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives