- Japan

- /

- Consumer Durables

- /

- TSE:7731

Is Ending Its Alliance With Healios Reshaping Nikon’s Healthcare Strategy and Outlook (TSE:7731)?

Reviewed by Sasha Jovanovic

- On October 14, 2025, Healios K.K. announced the termination of its business and capital alliance with Nikon Corporation, ending an agreement made in 2017 to advance regenerative medicine initiatives.

- This move signals a shift in both companies’ approaches, with each now aiming to independently expand their respective strengths in healthcare and life sciences.

- We’ll examine how Nikon’s decision to end its partnership with Healios and focus on its own healthcare strategies could influence its investment outlook.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Nikon Investment Narrative Recap

To be a shareholder in Nikon, one needs to believe in the company’s ability to deliver value from its diversified portfolio across imaging, precision equipment, and healthcare, especially through market-driven product innovation. The termination of the Healios alliance is not expected to be material to Nikon’s immediate catalysts or to its biggest existing risk, the prolonged recovery in its semiconductor-related business and deferred customer investments.

Against the backdrop of this healthcare partnership ending, Nikon’s reaffirmation of the DSP-100 Digital Lithography System’s availability is particularly relevant. As the semiconductor sector’s slow rebound remains the primary concern, developments in advanced packaging technology continue to represent the most immediate potential driver for business performance.

Yet, in contrast to product innovation, the prolonged delays and soft demand in Nikon’s semiconductor-related business remain a critical risk investors should be aware of...

Read the full narrative on Nikon (it's free!)

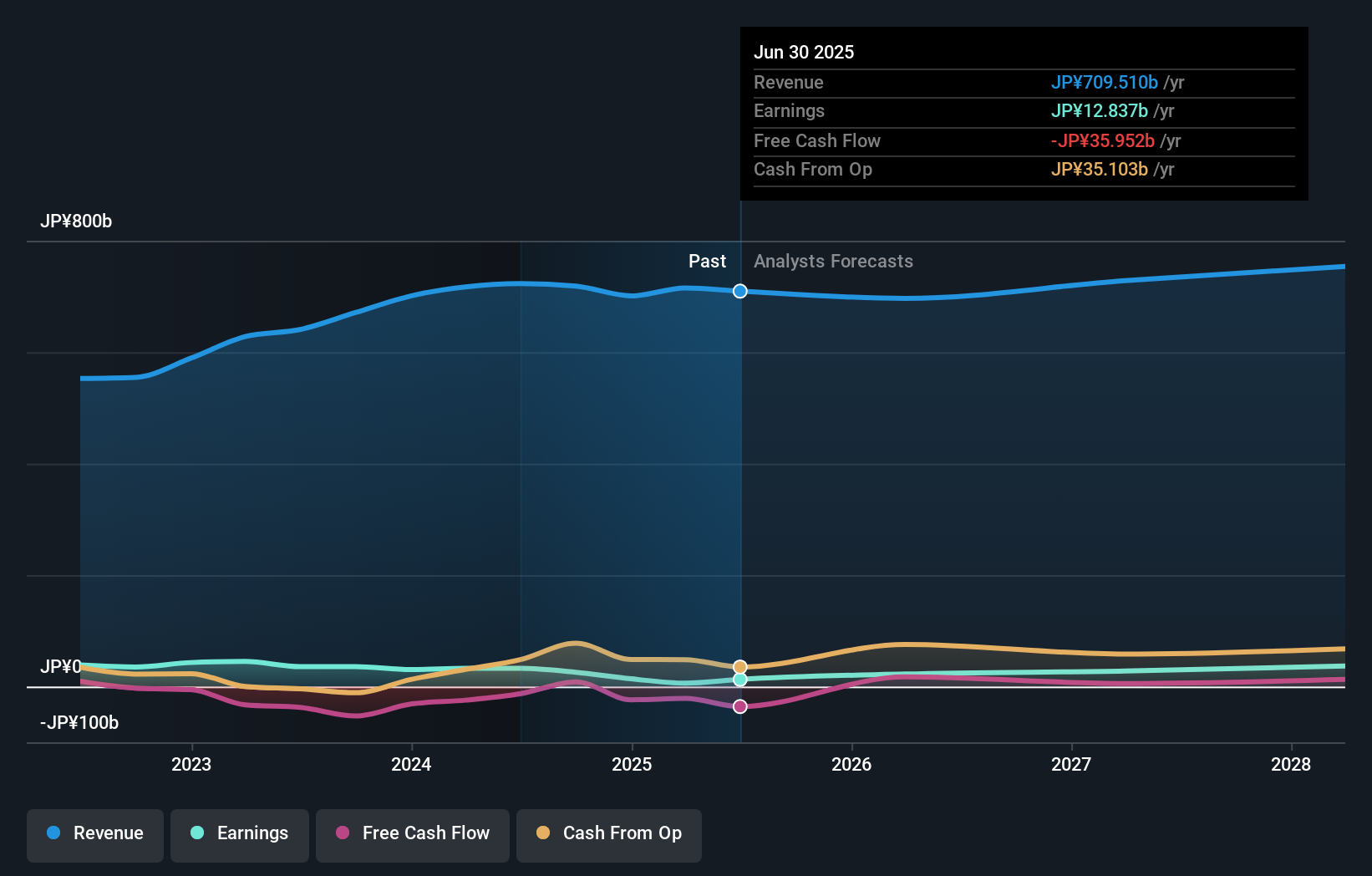

Nikon's outlook anticipates ¥753.2 billion in revenue and ¥41.0 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 2.0% and a ¥28.2 billion increase in earnings from the current level of ¥12.8 billion.

Uncover how Nikon's forecasts yield a ¥1473 fair value, a 22% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided only one fair value estimate for Nikon, at ¥1,473 per share. While community perspectives are limited, current analyst concerns about revenue risks from delayed semiconductor sector recovery give you several angles to consider before making your own conclusion.

Explore another fair value estimate on Nikon - why the stock might be worth as much as ¥1473!

Build Your Own Nikon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nikon research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Nikon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nikon's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nikon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7731

Nikon

Manufactures and sells optical instruments in Japan, North America, Europe, China, Thailand, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives