Shimano (TSE:7309): Valuation Spotlight as Board Weighs Treasury Stock Cancellation

Reviewed by Simply Wall St

Shimano (TSE:7309) has called a board meeting for November 18, 2025, with its agenda focused on considering the cancellation of treasury stock, along with other business items. Investors often pay attention to these moves because of their possible long-term impact on shareholder value.

See our latest analysis for Shimano.

Shimano’s share price briefly rebounded this week, gaining over 8% in the past seven days, as investors responded to talk of a possible treasury stock cancellation and ongoing speculation around the company’s future strategy. Even with this bump, the stock’s long-term momentum remains muted, with a year-to-date share price return of -21.5% and a 1-year total shareholder return of -20.0%, showing challenges for those holding on for the long haul.

If the latest corporate shift has you thinking about other opportunities in the sector, now’s a perfect time to broaden your search and discover See the full list for free.

With the stock trading at a considerable discount to analysts’ targets but still facing lackluster longer-term returns, investors are left to wonder if this is a real buying opportunity or if future growth is already being priced in.

Price-to-Earnings of 27.9x: Is it justified?

Shimano is currently trading at a price-to-earnings ratio of 27.9x, well above both its peers and industry averages, despite the recent price drop. This premium requires investors to believe in the company’s capacity for future growth and robust earnings, even as market performance has struggled.

The price-to-earnings ratio (P/E) represents how much investors are willing to pay today for a unit of current earnings. It is a widely used metric in the consumer durables sector to benchmark valuation against earnings power, and it can reflect optimism about future company prospects or sector leadership.

At 27.9x, Shimano trades well above the JP Leisure industry average of 13.3x and the peer average of 23.2x, indicating that the market is assigning a notable premium. However, compared to the estimated fair price-to-earnings ratio of 25.7x, the stock’s current valuation may be considered ambitious by cautious investors. If the market moves closer to the sector's fair P/E level, Shimano could experience additional pressure on its stock price.

Explore the SWS fair ratio for Shimano

Result: Price-to-Earnings of 27.9x (OVERVALUED)

However, ongoing subdued long-term returns and market pressure toward fair valuation could challenge the investment case if growth expectations are not met.

Find out about the key risks to this Shimano narrative.

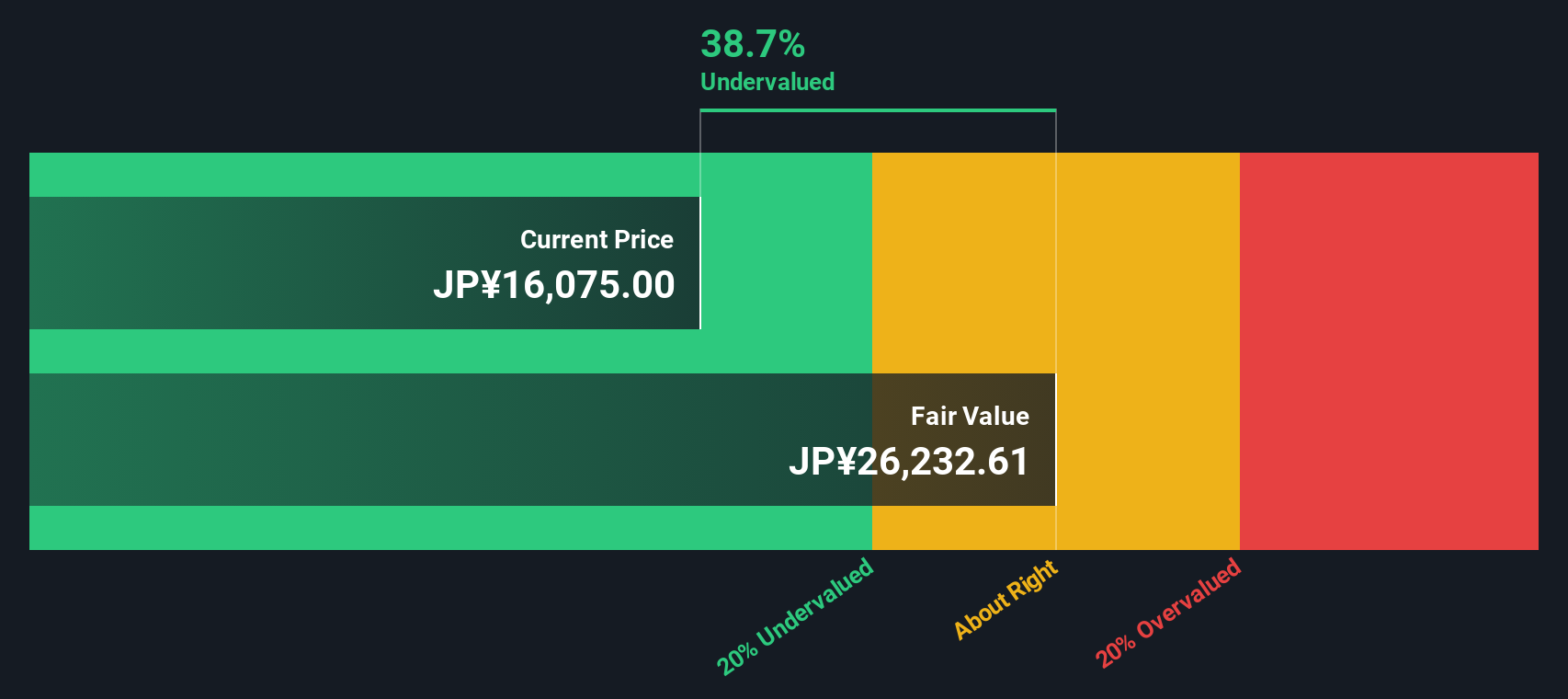

Another View: Discounted Cash Flow Tells a Different Story

Looking from another perspective, our DCF model estimates Shimano’s fair value at ¥25,977, which is about 36.5% higher than its current share price. By this measure, the stock appears undervalued. Is the market missing something, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shimano for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shimano Narrative

If you see things differently or want to dive into the numbers yourself, you can easily craft your own view and conclusions in just a few minutes. Do it your way

A great starting point for your Shimano research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their options open by tapping into fresh trends and hidden market opportunities. Don’t let the chance to strengthen your portfolio pass you by.

- Uncover future market leaders by exploring these 25 AI penny stocks, which are positioned for breakthroughs in artificial intelligence and automation.

- Accelerate your dividend strategy by reviewing these 15 dividend stocks with yields > 3%, which offers reliable income above 3% yields and provides steady growth potential.

- Identify undervalued bargains before the crowd with these 920 undervalued stocks based on cash flows, designed to highlight stocks trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7309

Shimano

Develops, produces, and distributes bicycle components, fishing tackles, and rowing equipment.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.