- South Korea

- /

- Insurance

- /

- KOSE:A000370

Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are climbing toward record highs, with growth stocks notably outperforming value shares. In this environment, dividend stocks can offer a compelling option for investors seeking steady income streams and potential resilience amid market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.00% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.86% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.33% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Hanwha General Insurance (KOSE:A000370)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanwha General Insurance Co., Ltd. operates as an insurance service provider in South Korea with a market cap of approximately ₩460.75 billion.

Operations: Hanwha General Insurance Co., Ltd. generates its revenue primarily from its Property & Casualty insurance segment, amounting to approximately ₩5.55 billion.

Dividend Yield: 4.8%

Hanwha General Insurance offers a compelling dividend profile with a payout ratio of 9.5%, indicating strong coverage by earnings. The cash payout ratio is also low at 1.9%, ensuring dividends are well-supported by cash flows. Despite its top-tier dividend yield of 4.82% in the KR market, the company's track record shows volatility and unreliability over six years of payments, posing risks for investors seeking consistent income streams.

- Click here to discover the nuances of Hanwha General Insurance with our detailed analytical dividend report.

- Our valuation report here indicates Hanwha General Insurance may be undervalued.

Nihon Trim (TSE:6788)

Simply Wall St Dividend Rating: ★★★★☆☆

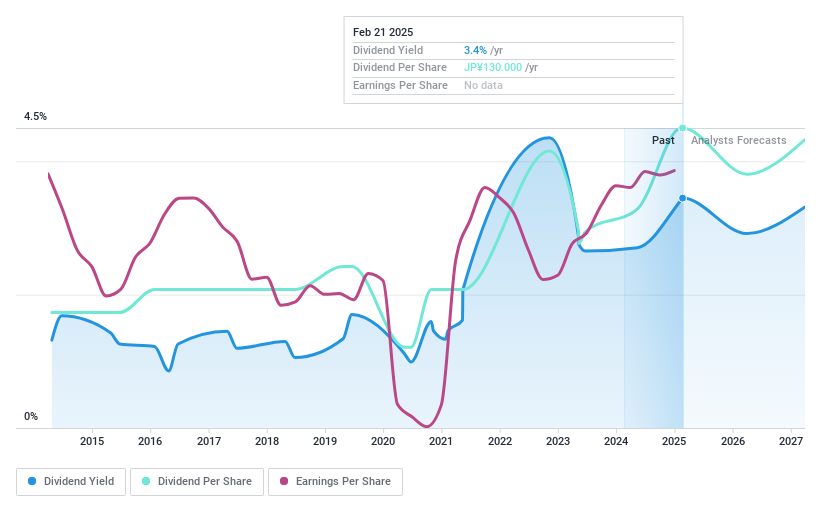

Overview: Nihon Trim Co., Ltd. develops and sells electrolyzed hydrogen water systems both in Japan and internationally, with a market cap of ¥28.82 billion.

Operations: Nihon Trim Co., Ltd.'s revenue is primarily derived from its Water Healthcare Business, which accounts for ¥18.97 billion, and its Medical Related Business, contributing ¥2.79 billion.

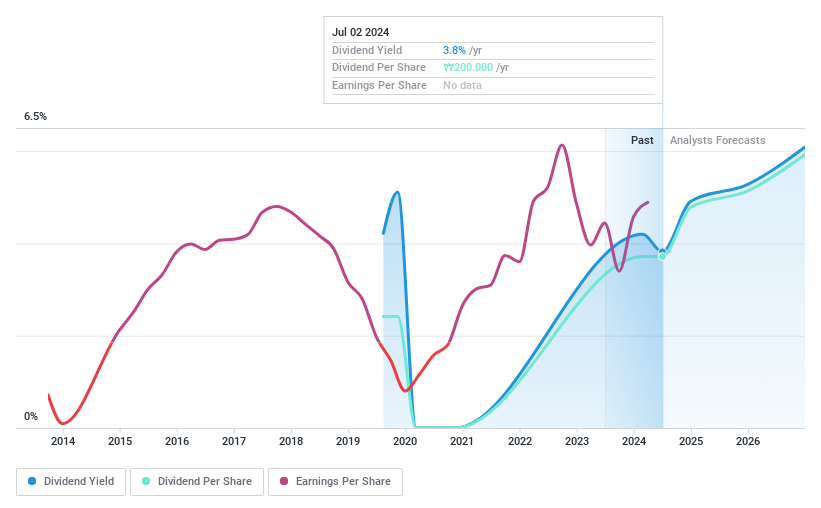

Dividend Yield: 3.4%

Nihon Trim's dividend payments are well-supported by earnings and cash flows, with a payout ratio of 28.3% and a cash payout ratio of 44.3%. However, its dividends have been volatile over the past decade, showing an annual drop of over 20%, which may concern investors seeking stability. Recent board meetings have focused on shareholder returns and strategic mergers, potentially impacting future dividend policies. The current yield is below top-tier levels in Japan at 3.43%.

- Unlock comprehensive insights into our analysis of Nihon Trim stock in this dividend report.

- Upon reviewing our latest valuation report, Nihon Trim's share price might be too pessimistic.

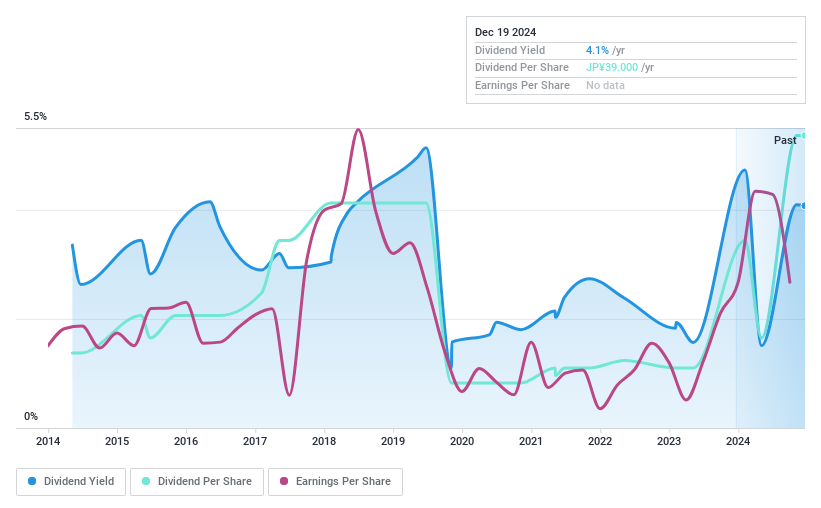

Helios Techno Holding (TSE:6927)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Helios Techno Holding Co., Ltd. operates in the lamp and manufacturing equipment sectors in Japan, with a market cap of ¥15.72 billion.

Operations: Helios Techno Holding Co., Ltd. generates revenue primarily from its operations in the lamp and manufacturing equipment sectors within Japan.

Dividend Yield: 3.9%

Helios Techno Holding's dividend yield is in the top 25% of the JP market, supported by a payout ratio of 49.2% and cash payout ratio of 25.5%, indicating strong earnings and cash flow coverage. However, dividends have been volatile over the past decade, with drops exceeding 20%, raising concerns about stability for income-focused investors. Profit margins have declined from last year, which may impact future payouts as they prepare to report Q3 results on February 7, 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Helios Techno Holding.

- Our valuation report unveils the possibility Helios Techno Holding's shares may be trading at a premium.

Key Takeaways

- Access the full spectrum of 1976 Top Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanwha General Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000370

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives