- Japan

- /

- Consumer Durables

- /

- TSE:6758

Sony (TSE:6758) Valuation After Profit Outlook Upgrade and Share Buyback Following Entertainment, Chip Success

Reviewed by Simply Wall St

Sony Group (TSE:6758) caught investor attention after it raised its profit outlook for fiscal 2026. The company cited healthy demand for its semiconductors and the recent blockbuster success of the Demon Slayer movie.

See our latest analysis for Sony Group.

Sony Group's recent run has been impressive, with a 5.5% rally following its profit outlook upgrade. This was buoyed further by the new 100 billion yen share buyback and dividend hike. These moves have fueled momentum in the share price, delivering a year-to-date share price return of over 42% and pushing the one-year total shareholder return to 71%. Sony’s strong business performance has clearly translated into renewed investor enthusiasm over both the short and long term.

Looking for other companies with growth catalysts or strong momentum? Take your next step and discover See the full list for free.

With such a rapid run-up and bullish forecasts, the key question now is whether Sony’s momentum still leaves room for upside or if investors have already priced in the projected growth and improving fundamentals.

Most Popular Narrative: 3.4% Undervalued

With Sony Group's fair value pegged at ¥4,867.50, which is slightly above the current closing price of ¥4,700, the latest narrative points to modest potential upside, underpinned by robust margin and content catalysts.

The accelerating monetization of proprietary content IP, including music catalogs, blockbuster anime (such as Demon Slayer), and cross-platform franchises, together with strategic partnerships (for example, Bandai Namco), positions Sony to capitalize on global entertainment demand and improve both revenue growth and margin profile.

Curious how Sony’s aggressive push into global entertainment unlocks a higher valuation? The narrative’s foundation? Profits and margins forecast to outpace expectations. Find out which bold financial projections drive this valuation and why they’re sparking debate among market followers.

Result: Fair Value of ¥4,867.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing geopolitical tensions and rising competition in imaging and sensors could easily disrupt Sony’s growth projections and put pressure on its margins in the future.

Find out about the key risks to this Sony Group narrative.

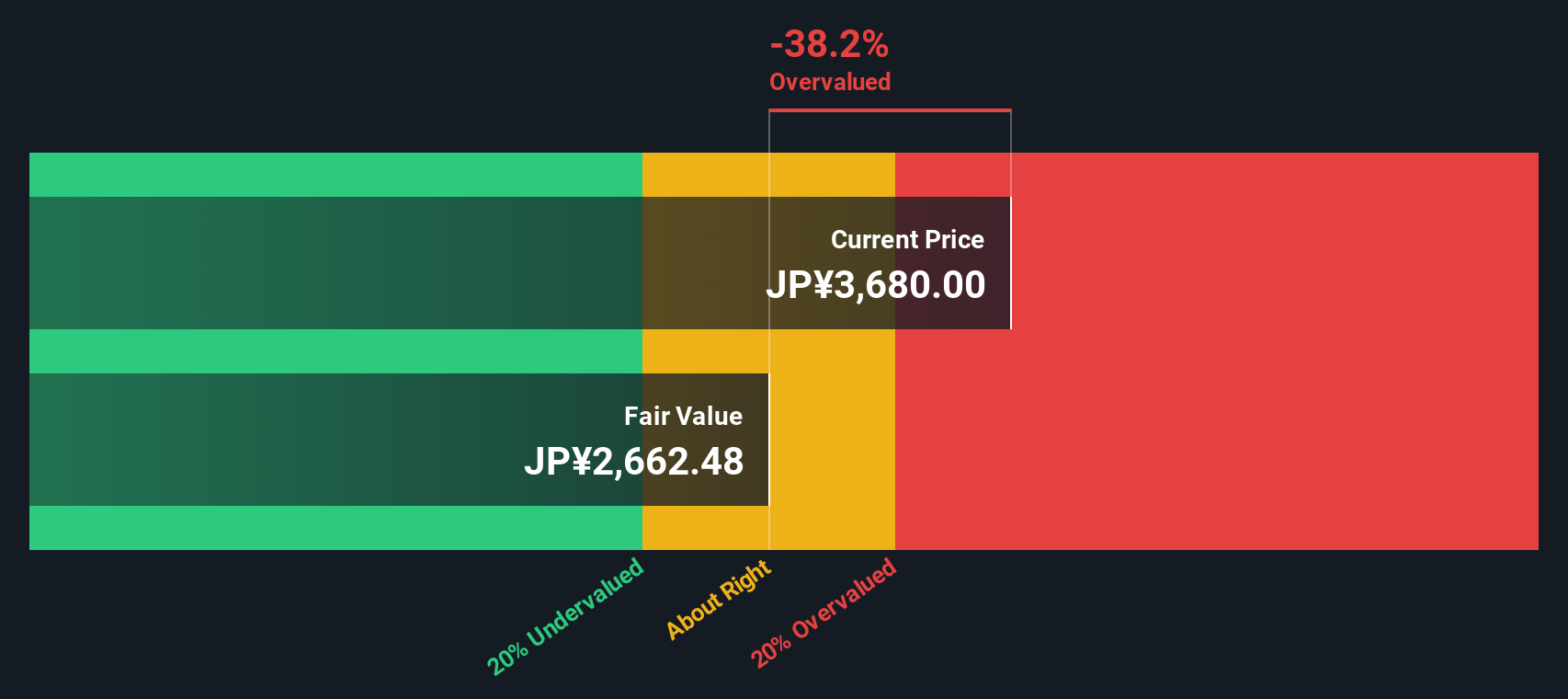

Another View: The SWS DCF Model

While analysts see Sony Group as modestly undervalued on price targets, our DCF model offers a different perspective. Based on projected cash flows, Sony trades above its fair value estimate, which may signal overvaluation if future earnings or margins do not accelerate as anticipated. Is the market's optimism justified, or does caution make more sense in this situation?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sony Group Narrative

If you want to dig into Sony Group’s numbers firsthand or bring your own perspective to the table, you can craft your own narrative in just minutes, start to finish. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sony Group.

Looking for More Investment Ideas?

Don’t let your next winning opportunity slip by. Start your search for smart stocks using these hand-picked screens designed to match bold ambition with real potential.

- Spot high-potential turnarounds by evaluating these 3584 penny stocks with strong financials with proven financial strength and strategic momentum in emerging sectors.

- Get ahead of the AI curve by targeting leaders among these 26 AI penny stocks who are positioned to benefit from breakthroughs in machine learning and automation.

- Secure consistent income streams by reviewing these 15 dividend stocks with yields > 3% that offer robust yields above 3% and resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6758

Sony Group

Designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives