- Japan

- /

- Consumer Durables

- /

- TSE:6758

Sony Group (TSE:6758) Is Up 5.2% After Boosting Outlook and Launching Share Buyback—What's Changed

Reviewed by Sasha Jovanovic

- Sony Group recently raised its full-year profit outlook and approved a new share buyback program after strong results in its entertainment and semiconductor divisions, including the global success of an anime release and robust demand for image sensors.

- In addition, Sony AI unveiled the Fair Human-Centric Image Benchmark (FHIBE) dataset, advancing industry standards for fairness and ethical AI data collection on a global scale.

- Next, we explore how Sony's profit outlook upgrade and share buyback plan influence its overall investment case and future prospects.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Sony Group Investment Narrative Recap

To be a Sony shareholder today, you need confidence in the company's ability to drive profitable growth across entertainment, gaming, and advanced technology despite risks from global supply chain tensions and heightened competition in imaging. The recent profit outlook upgrade and buyback announcement reinforce management’s near-term confidence, aligning with investor attention on semiconductor demand as a catalyst; however, supply chain and tariff uncertainties remain a material risk and have not been alleviated by these updates.

Among this month’s news, the significant share buyback plan stands out most directly. While capital returns can signal balance sheet strength and support share prices, they do little to address the ongoing risk of operating cost pressures from global supply chain disruptions, which still represent the key threat to margins and profitability in the coming quarters.

Yet investors should also keep in mind that, in contrast, supply chain risks remain unresolved and could have far-reaching effects on future results if...

Read the full narrative on Sony Group (it's free!)

Sony Group's narrative projects ¥12,813.1 billion revenue and ¥1,265.8 billion earnings by 2028. This requires a 0.5% annual revenue decline and a ¥75.3 billion earnings increase from ¥1,190.5 billion currently.

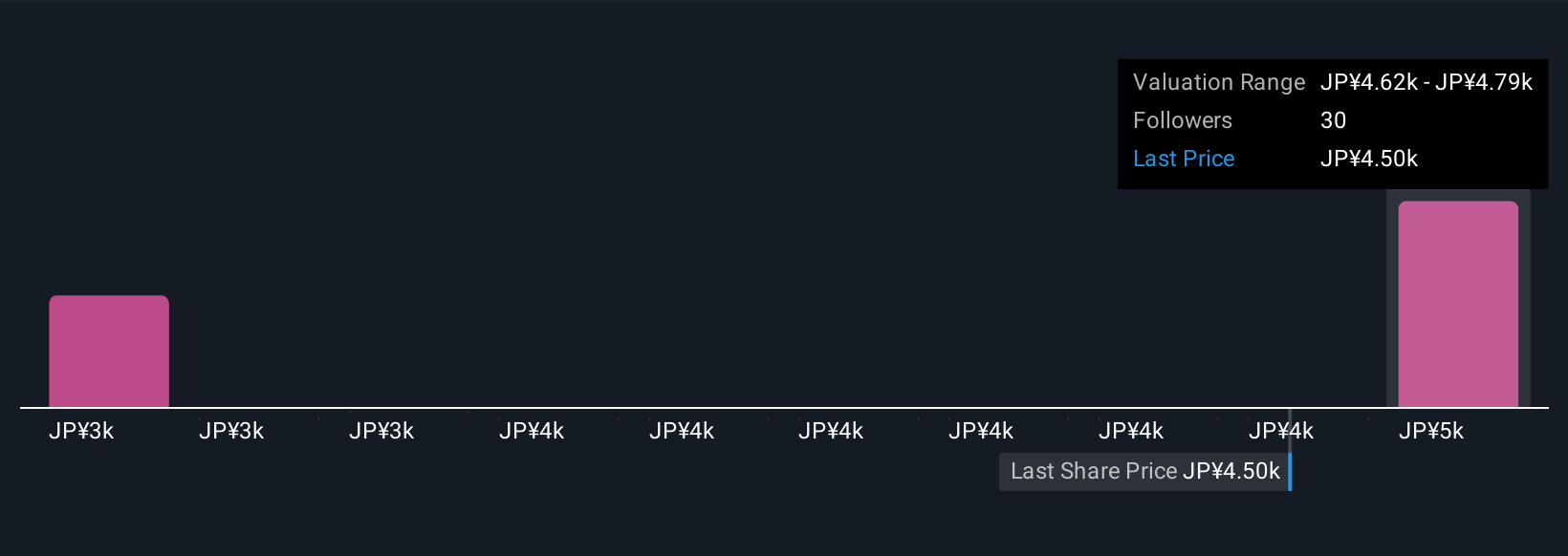

Uncover how Sony Group's forecasts yield a ¥4868 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have posted fair value estimates for Sony ranging from ¥2,521.48 to ¥4,867.50 across five opinions. While many see upside from robust sensor demand and buybacks, you should be mindful of the continued risk from global supply chain volatility highlighted by analysts, be sure to review several community viewpoints.

Explore 5 other fair value estimates on Sony Group - why the stock might be worth 44% less than the current price!

Build Your Own Sony Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sony Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Sony Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sony Group's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6758

Sony Group

Designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives