- Japan

- /

- Consumer Durables

- /

- TSE:6758

Sony Group (TSE:6758) Files $78.87M Shelf Registration Amid Strong Earnings and AI Growth Prospects

Reviewed by Simply Wall St

Navigate through the intricacies of Sony Group with our comprehensive report here.

Unique Capabilities Enhancing Sony Group's Market Position

With earnings growth of 27.6% over the past year, Sony has significantly outpaced its 5-year average, showcasing strong financial health. The company's net profit margin improved to 8.5%, indicating enhanced profitability. This performance is underpinned by high-quality earnings, reflecting strong operational efficiency. In the latest earnings call, Sadahiko Hayakawa, CFO, highlighted record-level consolidated sales, emphasizing the demand for Sony's products and services. Hiroki Totoki, CEO, pointed to new product lines as a catalyst for market position enhancement, further supported by improved customer satisfaction metrics.

Strategic Gaps That Could Affect Sony Group

Despite these strengths, Sony faces challenges with a Return on Equity (ROE) of 14.2%, below the desired 20% threshold. Forecasted earnings growth of 2.6% per year lags behind the JP market average of 8%. Operational inefficiencies, such as production delays mentioned by Hiroki Totoki, could hinder growth. Additionally, competitive pressures, especially in the gaming sector, and rising material costs are putting pressure on margins, necessitating improved cost management strategies.

Growth Avenues Awaiting Sony Group

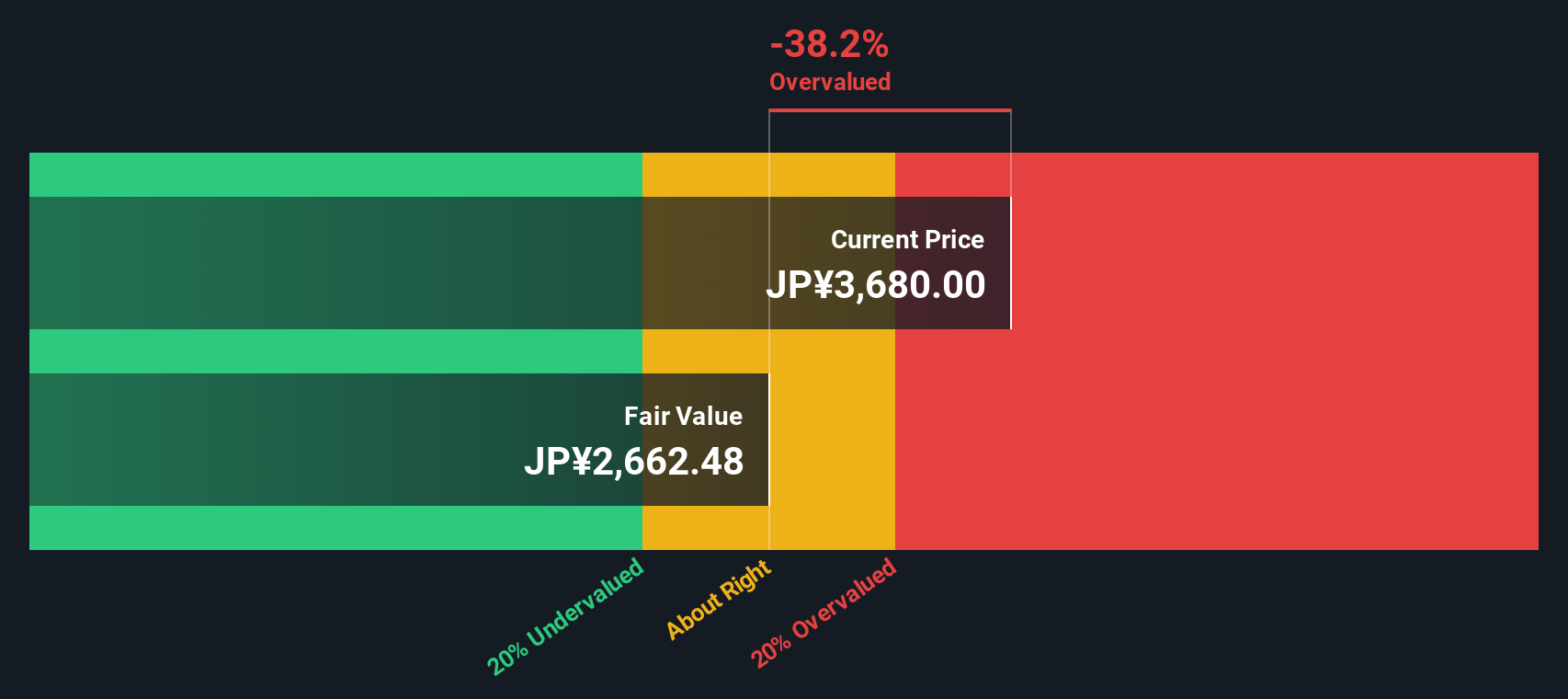

The company is exploring opportunities in AI technologies, as noted by Hiroki Totoki, which could enhance current offerings and open new markets. Entry into emerging markets has shown promising results, indicating potential for significant revenue growth. Strategic partnerships in content creation are also being explored, which could bolster Sony's competitive edge in the media sector. Trading at 7.3% below its estimated fair value presents a potential for price appreciation, aligning well with these growth initiatives.

Market Volatility Affecting Sony Group's Position

Economic uncertainties pose a threat to consumer spending, as highlighted by Sadahiko Hayakawa. Regulatory changes could impact operations, and recent supply chain disruptions necessitate strategic reevaluation to ensure continuity. The company's high net debt to equity ratio of 40.9% could also impact financial stability, deterring potential investors despite its strong market presence.

Conclusion

Sony's impressive earnings growth of 27.6% and improved net profit margin of 8.5% highlight its strong financial performance, driven by operational efficiency and high demand for its products. However, challenges such as a lower-than-desired ROE of 14.2%, lagging earnings growth forecasts, and competitive pressures necessitate strategic improvements, particularly in cost management and production efficiency. Despite these hurdles, Sony's exploration of AI technologies, entry into emerging markets, and strategic partnerships in content creation present promising avenues for future growth. Trading at 7.3% below its estimated fair value, Sony offers a potential investment opportunity, suggesting that its current market price does not fully reflect these growth prospects and strategic initiatives, providing a compelling case for investors considering its future performance.

Where To Now?

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:6758

Sony Group

Designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives