- Japan

- /

- Consumer Durables

- /

- TSE:6752

Panasonic (TSE:6752) Valuation: Assessing the Impact of Technics’ New Turntable Launch on Future Growth

Reviewed by Simply Wall St

If you’ve been watching Panasonic Holdings (TSE:6752) lately, the launch of the new Technics SL-40CBT and SL-50C Direct Drive Turntables at the CEDIA convention may have caught your eye for good reason. These innovative models blend Technics’ renowned audio quality with modern flair, including wireless connectivity and sleek design, aiming to capture the imagination of both seasoned Hi-Fi users and newcomers eager to upgrade. Anytime a legacy brand doubles down on a resurgent category like vinyl, it’s a move bound to attract attention from both music lovers and investors wondering what comes next for the company’s broader portfolio.

The timing of this product reveal adds another intriguing dimension, as shares in Panasonic Holdings have seen some swings this year. After a solid 7% gain over the past month and a 29% total return in the past year, the long-term trend looks positive, even if momentum has cooled in recent weeks. Combined with recent dividend stability and upbeat annual net income growth, these releases signal a company that’s leaning into product innovation amid a shifting consumer landscape.

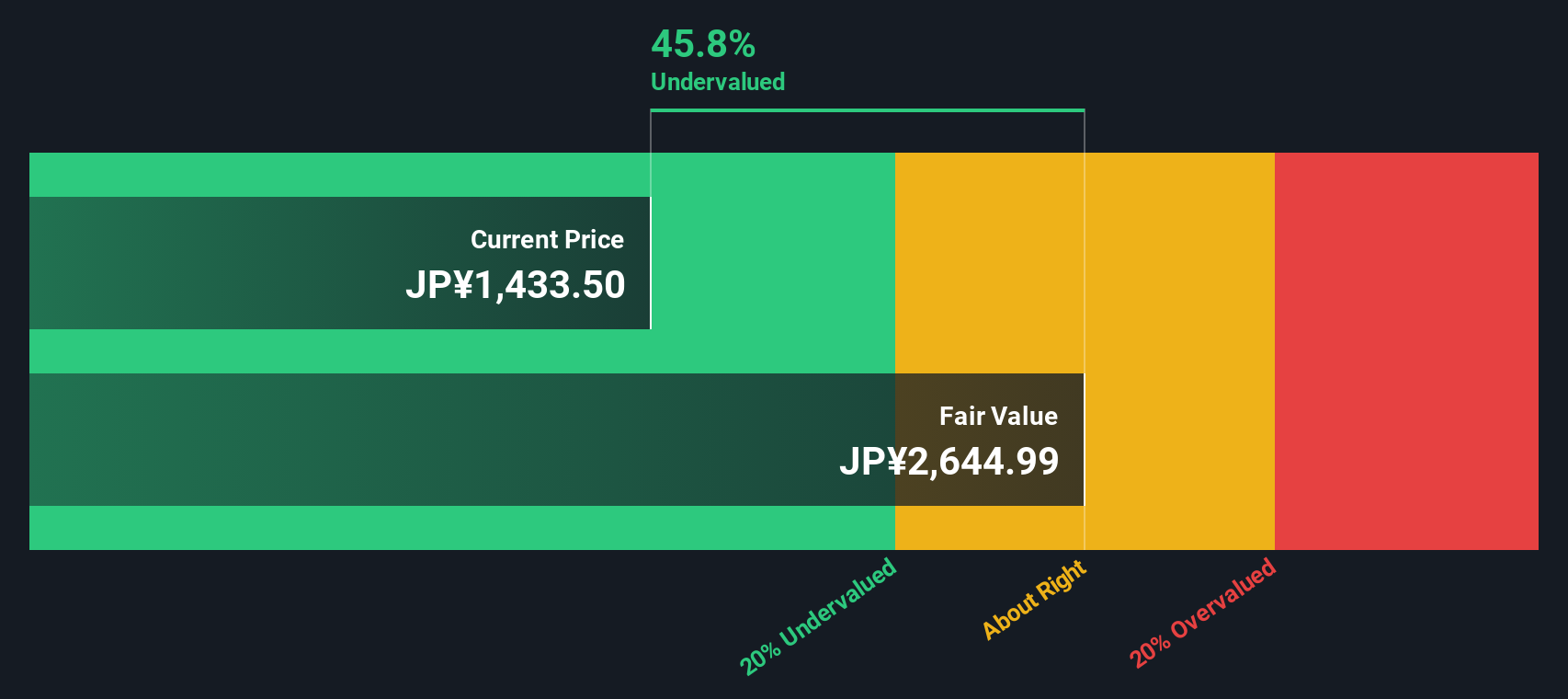

But after the excitement over new product momentum and a year of strong share appreciation, is Panasonic Holdings undervalued, or is all that future growth already reflected in today’s price?

Most Popular Narrative: 24.4% Undervalued

According to the most widely followed valuation narrative, Panasonic Holdings currently trades at a significant discount to its estimated fair value. This suggests strong potential upside based on present assumptions.

Demand for industrial energy storage systems is accelerating beyond initial expectations due to large-scale data center investment driven by generative AI adoption. This is likely to support revenue growth and improve recurring earnings quality in the Energy segment.

Curious about what’s fueling this bold fair value call? Here’s a hint: this narrative counts on a mix of accelerating profit margins, long-term growth in new energy technologies, and ambitious assumptions about future earnings. Want to discover exactly how Panasonic's future potential is quantified? The full narrative breaks down the numbers in detail and highlights the most surprising drivers.

Result: Fair Value of ¥2,035.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain. Slower electric vehicle demand and ongoing restructuring delays could challenge Panasonic’s ability to deliver on optimistic growth forecasts.

Find out about the key risks to this Panasonic Holdings narrative.Another View: What Does Our DCF Say?

Some investors turn to our SWS DCF model for a different lens on value. This approach also suggests Panasonic Holdings is undervalued. This reinforces the earlier fair value narrative and raises a new question: which assumptions matter most for the future?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Panasonic Holdings Narrative

If you see things differently or want to dive into the numbers yourself, you can put together your own narrative in just a few minutes. Do it your way.

A great starting point for your Panasonic Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means being open to new opportunities. Don’t miss out on exciting trends and potential winners. Start your next search with the Simply Wall Street Screener:

- Capture high yields for your portfolio by tapping into dividend stocks with yields > 3% and finding companies consistently paying over 3%.

- Get ahead of the curve in artificial intelligence by scanning the market for tomorrow’s leaders among AI penny stocks.

- Boost your returns by targeting stocks that look undervalued based on their cash flows using the power of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:6752

Panasonic Holdings

Research, develops, manufactures, sells, and services various electrical and electronic products in Japan, the United States, Europe, Asia, China, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives