- Japan

- /

- Consumer Durables

- /

- TSE:6752

Panasonic Holdings (TSE:6752) Enhances Market Presence with Dividend Increase and US TV Expansion

Reviewed by Simply Wall St

Take a closer look at Panasonic Holdings's potential here.

Competitive Advantages That Elevate Panasonic Holdings

Panasonic has demonstrated earnings growth, averaging 15% annually over the past five years. This growth is supported by a stable net debt to equity ratio of 3.5%, ensuring financial health. The company's strategic initiatives, including a recent dividend increase to JPY 20.00 per share, reflect its commitment to shareholder returns. Furthermore, its P/E ratio of 9.1x suggests it is priced attractively compared to industry peers, highlighting potential for market positioning improvements. Learn about Panasonic Holdings's dividend strategy and how it impacts shareholder returns and financial stability.

Vulnerabilities Impacting Panasonic Holdings

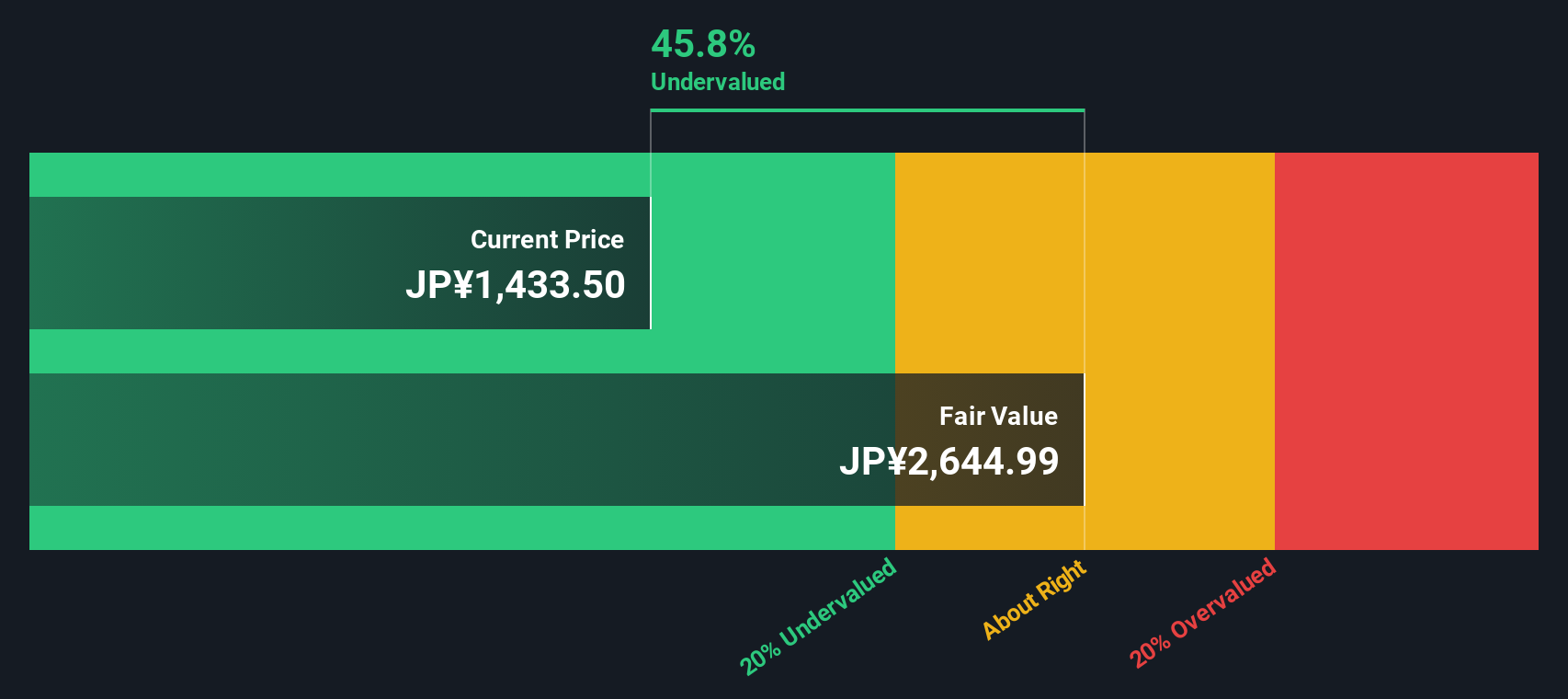

Despite strong earnings, Panasonic faces challenges with slow forecasted revenue growth of 1.8% per year, trailing the JP market average. Current net profit margins have decreased to 4%, impacting overall profitability. Additionally, a return on equity of 7.9% is below industry standards, indicating room for improvement in capital efficiency. The volatility in dividend payments over the past decade further complicates investor confidence. To learn about how Panasonic Holdings's valuation metrics are shaping its market position, check out our detailed analysis of Panasonic Holdings's Valuation.

Future Prospects for Panasonic Holdings in the Market

Panasonic's recent product-related announcements, such as the launch of the EH-NA9M hair dryer, showcase its innovative prowess. The integration of nanoe™ technology emphasizes its commitment to cutting-edge solutions. Additionally, the company's return to the US TV market with a new lineup, including OLED and Mini-LED models, expands its geographic footprint. These moves position Panasonic to capitalize on emerging opportunities and enhance its market presence. See what the latest analyst reports say about Panasonic Holdings's future prospects and potential market movements.

Regulatory Challenges Facing Panasonic Holdings

Economic headwinds pose a risk to Panasonic's growth trajectory, potentially affecting consumer spending. Supply chain disruptions remain a concern, impacting production timelines and customer satisfaction. Moreover, navigating complex regulatory environments could present hurdles, requiring strategic foresight to maintain compliance and operational continuity. Explore the current health of Panasonic Holdings and how it reflects on its financial stability and growth potential.

Conclusion

Panasonic Holdings has shown impressive earnings growth of 15% annually over the past five years, supported by a healthy net debt to equity ratio of 3.5%, reflecting its solid financial foundation. However, the company's challenges, including a slow revenue growth forecast of 1.8% and a net profit margin reduction to 4%, highlight areas needing strategic focus to boost capital efficiency and profitability. Panasonic's innovative product launches and expansion into the US TV market position it well to seize new opportunities and strengthen its market presence. Trading at a P/E ratio of 9.1x, below both the industry and peer averages, Panasonic is attractively priced, suggesting potential for price appreciation as it addresses its vulnerabilities and capitalizes on future prospects.

Next Steps

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:6752

Panasonic Holdings

Research, develops, manufactures, sells, and services various electrical and electronic products worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives