- Japan

- /

- Consumer Durables

- /

- TSE:6752

Is Panasonic Shares Worth a Closer Look After 32% Surge and EV Battery Expansion?

Reviewed by Bailey Pemberton

- Wondering whether Panasonic Holdings stock is truly a bargain right now? You are not alone, and we are here to break down what the numbers and the narrative really say about its value.

- The stock has climbed 32.2% over the past year and surged 19.7% year to date. This may indicate renewed optimism and possible growth momentum.

- Recent headlines have highlighted Panasonic’s continued investments in electric vehicle battery production and its strategic partnerships in the renewable energy sector. These developments have generated interest among investors and industry watchers, which may have influenced the recent uptick in the stock’s price and shifted perceptions on its future prospects.

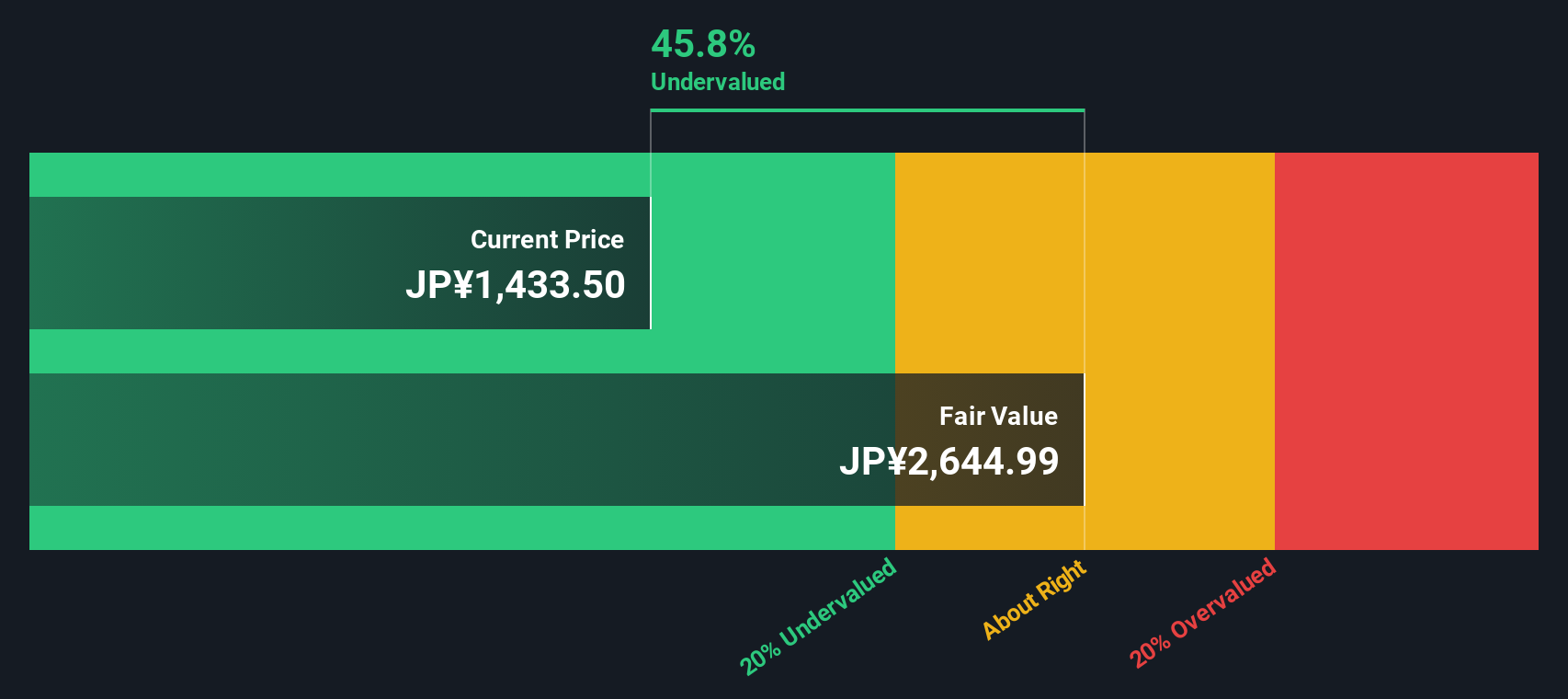

- On our valuation checks, Panasonic scores a solid 4 out of 6. This suggests there may be some undervalued opportunities. Next, we will dig into what that score really means and show you how to assess value from several angles, with a fresh perspective to watch for at the end.

Find out why Panasonic Holdings's 32.2% return over the last year is lagging behind its peers.

Approach 1: Panasonic Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their present value. For Panasonic Holdings, this approach uses cash flow projections over the next decade to estimate the business's intrinsic worth.

Currently, Panasonic holds a last twelve months Free Cash Flow (FCF) of negative ¥32.86 billion. Despite this, analysts forecast significant growth. By 2030, the FCF is projected to reach ¥605 billion. Detailed annual projections indicate incremental gains, such as ¥213 billion in 2026 and up to ¥782 billion by 2035, according to analyst estimates and extrapolations.

Applying the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share for Panasonic Holdings comes out to ¥4,007. This is based on Simply Wall St's detailed projections and calculations using cash flows in the company’s reporting currency of Japanese yen.

With the current share price trading at a 51.7% discount to the calculated intrinsic value, the DCF analysis indicates that the stock appears significantly undervalued at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Panasonic Holdings is undervalued by 51.7%. Track this in your watchlist or portfolio, or discover 929 more undervalued stocks based on cash flows.

Approach 2: Panasonic Holdings Price vs Earnings

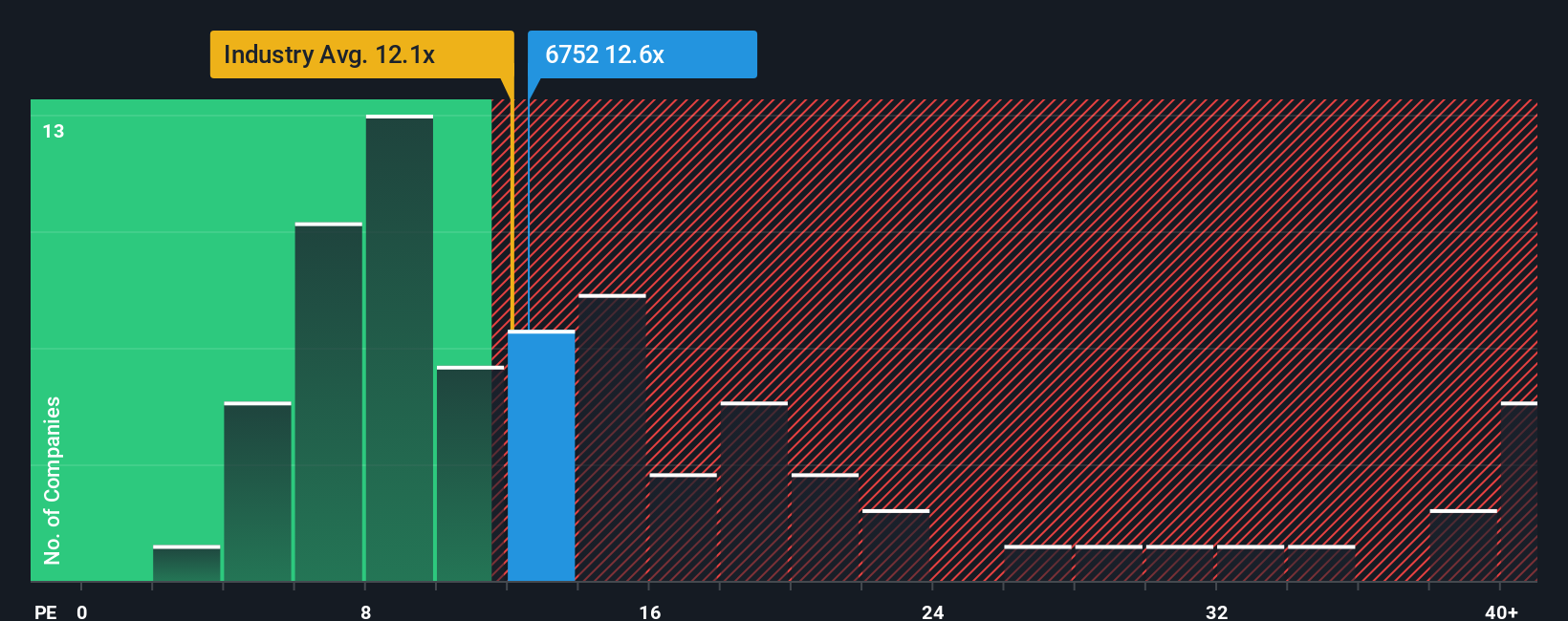

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it directly relates a stock’s share price to its per-share earnings. For businesses like Panasonic Holdings that have positive and stable earnings, the PE ratio offers a simple way to gauge how much the market is willing to pay for future profits.

Interpreting what is a “fair” PE ratio requires factoring in more than just raw numbers. Generally, companies with strong growth prospects or lower risks can justify a higher PE, while those facing slower growth or higher risks typically command a lower ratio. Market outlook, earnings volatility, and overall sector performance all play a role.

Panasonic Holdings currently trades at a PE ratio of 14.1x. This is higher than the Consumer Durables industry average of 12.0x, but significantly below its peer average of 31.2x. Benchmarking against these figures can be informative, but it is often too simplistic given the unique strengths or challenges each company faces.

This is why Simply Wall St’s proprietary “Fair Ratio” is especially useful. The Fair Ratio for Panasonic Holdings stands at 29.5x. This reflects a nuanced assessment that accounts for the company’s earnings growth outlook, profit margins, risks, size, and industry context. Unlike a straight peer or industry comparison, the Fair Ratio adapts to Panasonic’s distinctive profile and is designed to better represent what investors should reasonably expect to pay for its earnings power.

With the current PE ratio (14.1x) sitting well below the Fair Ratio (29.5x), this suggests Panasonic Holdings is undervalued using the PE approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Panasonic Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are an intuitive way for investors to connect their perspective about a company's story, including assumptions about its future revenue, earnings, and margins, to a financial forecast and an estimate of fair value. Instead of just comparing static numbers, Narratives let you describe the reasons behind your view and see how changing key drivers, like profit margins or growth trends, would impact Panasonic Holdings’ intrinsic value.

On Simply Wall St’s Community page, Narratives are used by millions of investors to transparently share, refine, and update their investment outlooks. They make it easy to track whether the current share price is above or below your own fair value so you can decide when to buy or sell. Narratives update dynamically as new news or earnings data becomes available, keeping your outlook relevant at all times.

For example, some investors see Panasonic powering global electrification with its advanced batteries and set their fair value at the high end of analyst ranges. Others are concerned about tariff risks and slower EV demand, adopting much more conservative forecasts. Narratives empower you to choose the scenario that reflects your view and to adapt quickly as new information emerges.

Do you think there's more to the story for Panasonic Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6752

Panasonic Holdings

Research, develops, manufactures, sells, and services various electrical and electronic products in Japan, the United States, Europe, Asia, China, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success