Will Sankyo’s (TSE:6417) Dividend Shift Reveal More About Its Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

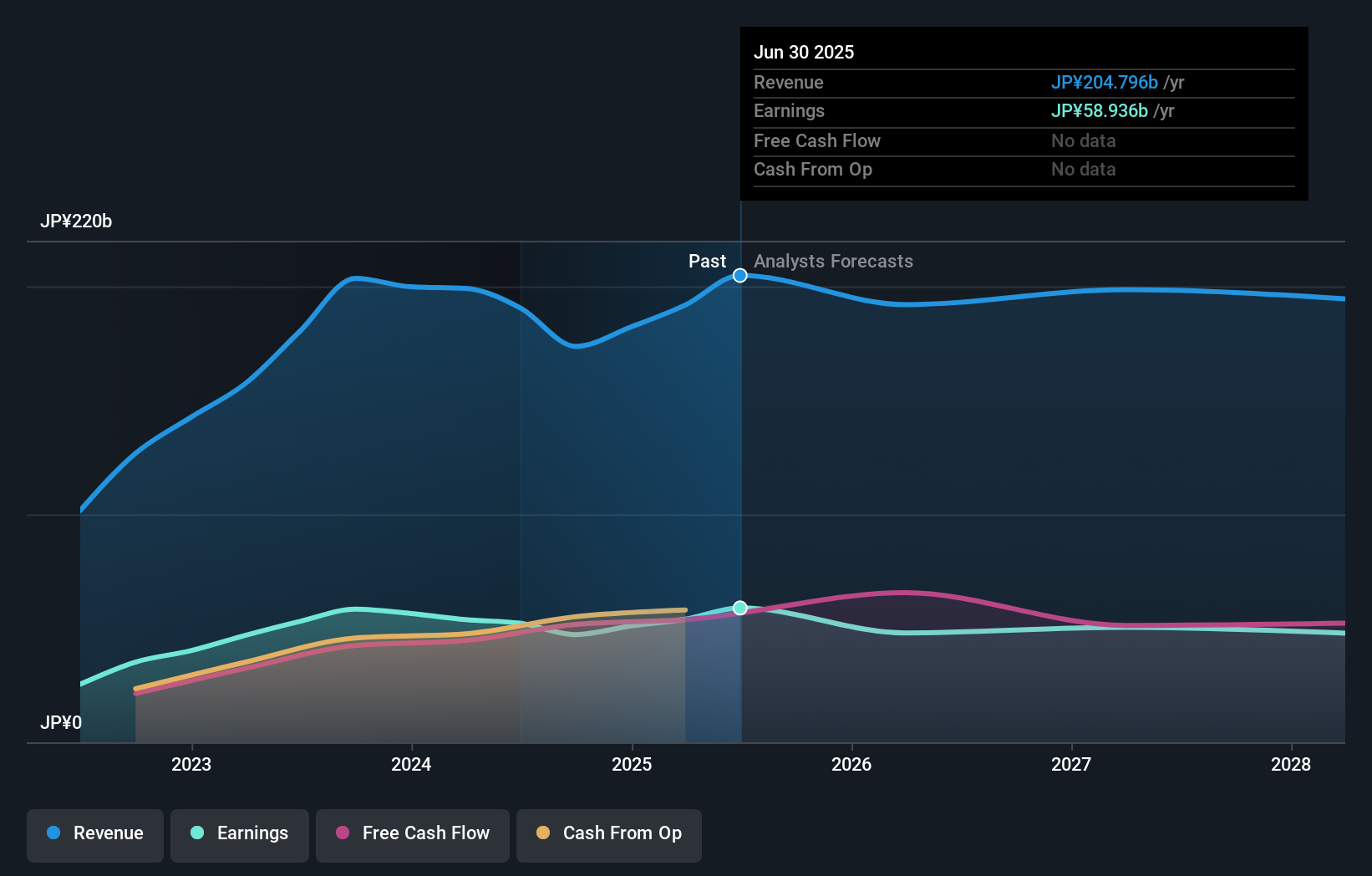

- On September 19, 2025, Sankyo Co., Ltd. released updated earnings and dividend guidance for the six months ending September 30, 2025, highlighting expected net sales of ¥100.0 billion and adjustments to its interim and year-end dividends.

- The company cited strong performance from new pachinko machines featuring hit anime titles as a key driver behind increased first-half operating expectations, while also rebalancing its dividend payouts for the fiscal year.

- With Sankyo's robust product momentum and evolving dividend policy, we'll explore how these developments shape the company's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Sankyo's Investment Narrative?

To see Sankyo as a worthwhile opportunity, one needs to believe in the company’s ability to consistently drive margin and revenue growth through innovation in pachinko titles and resilience in its core customer base. The latest news of higher-than-expected sales and operating income for the half-year, powered by successful new anime-themed machines, signals relevant short-term strength and renews optimism around timely product launches as a key catalyst. However, a sharper focus now falls on Sankyo’s dividend policy, a bigger interim payout but reduced year-end dividend may reflect both confidence in sales momentum and caution about longer-term earnings consistency. While the shift in payouts could affect investor sentiment, especially for those prioritizing dividend stability, the bigger risk still lies in the sustainability of content-driven hardware demand, sharp swings in unit sales, and governance factors such as board inexperience. In contrast, the evolving dividend strategy could point to shifting risk profiles that investors should watch closely.

Despite retreating, Sankyo's shares might still be trading 41% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Sankyo - why the stock might be worth as much as 71% more than the current price!

Build Your Own Sankyo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sankyo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sankyo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sankyo's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6417

Sankyo

Manufactures and sells game machines and ball bearing supply systems in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives