As global markets continue to navigate the evolving landscape of trade policies and technological advancements, major indices like the S&P 500 have reached record highs fueled by optimism around softer tariffs and AI investments. In this dynamic environment, dividend stocks can offer stability and potential income, making them an attractive consideration for investors seeking to diversify their portfolios amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

FujishojiLtd (TSE:6257)

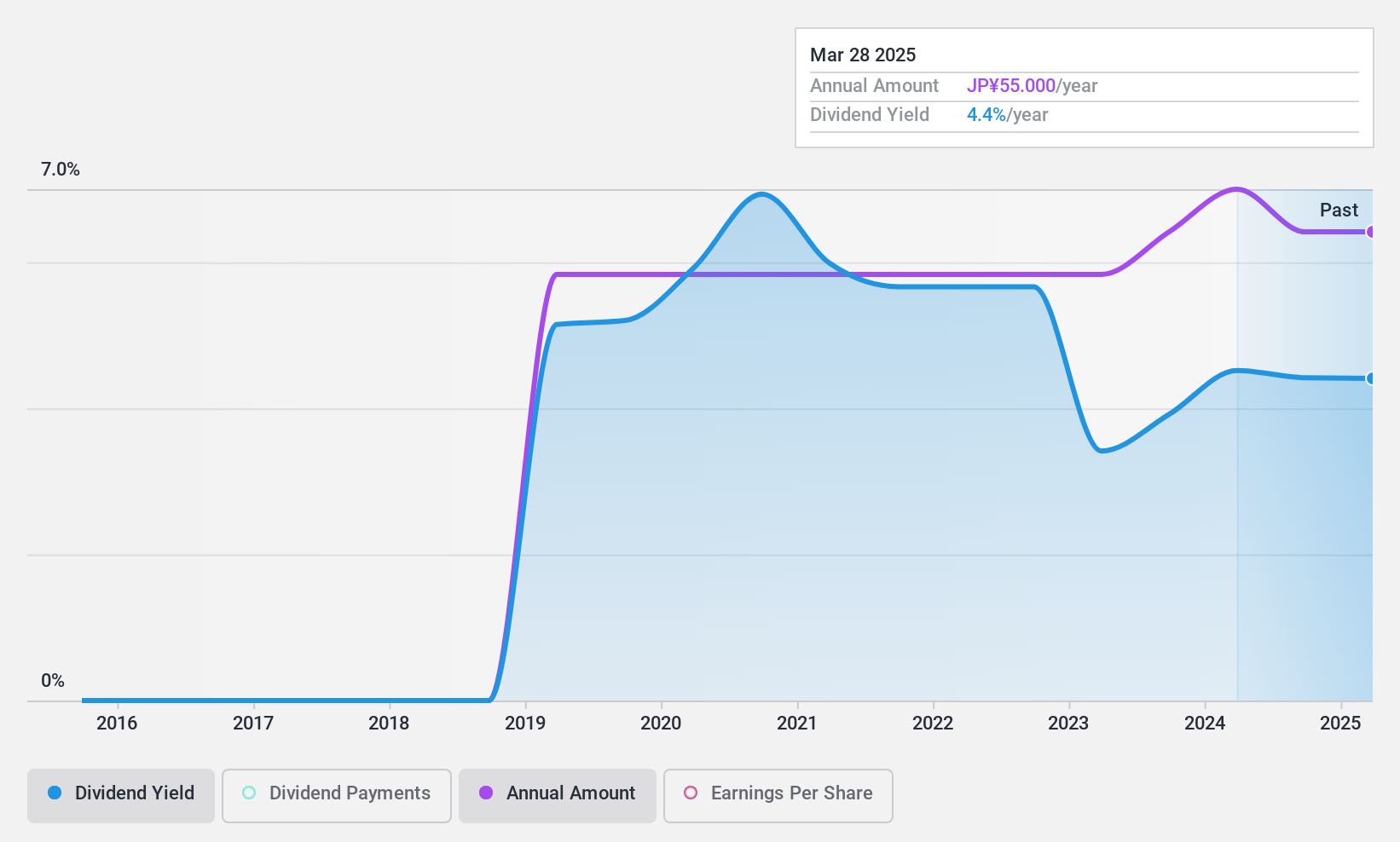

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fujishoji Co., Ltd. is involved in the development, manufacture, and sale of gaming machines in Japan, with a market cap of ¥29.25 billion.

Operations: Fujishoji Co., Ltd. generates its revenue primarily through the development, manufacturing, and sales of gaming machines in Japan.

Dividend Yield: 3.9%

Fujishoji Ltd.'s dividends are well-covered by both earnings and cash flows, with payout ratios of 33.1% and 20.7%, respectively. Its dividend yield is competitive within the Japanese market, ranking in the top quartile. However, its dividend track record is unstable and has been volatile over the past six years. Despite these fluctuations, Fujishoji trades significantly below its estimated fair value, potentially offering value to investors seeking dividend income amidst volatility concerns.

- Dive into the specifics of FujishojiLtd here with our thorough dividend report.

- Our valuation report here indicates FujishojiLtd may be undervalued.

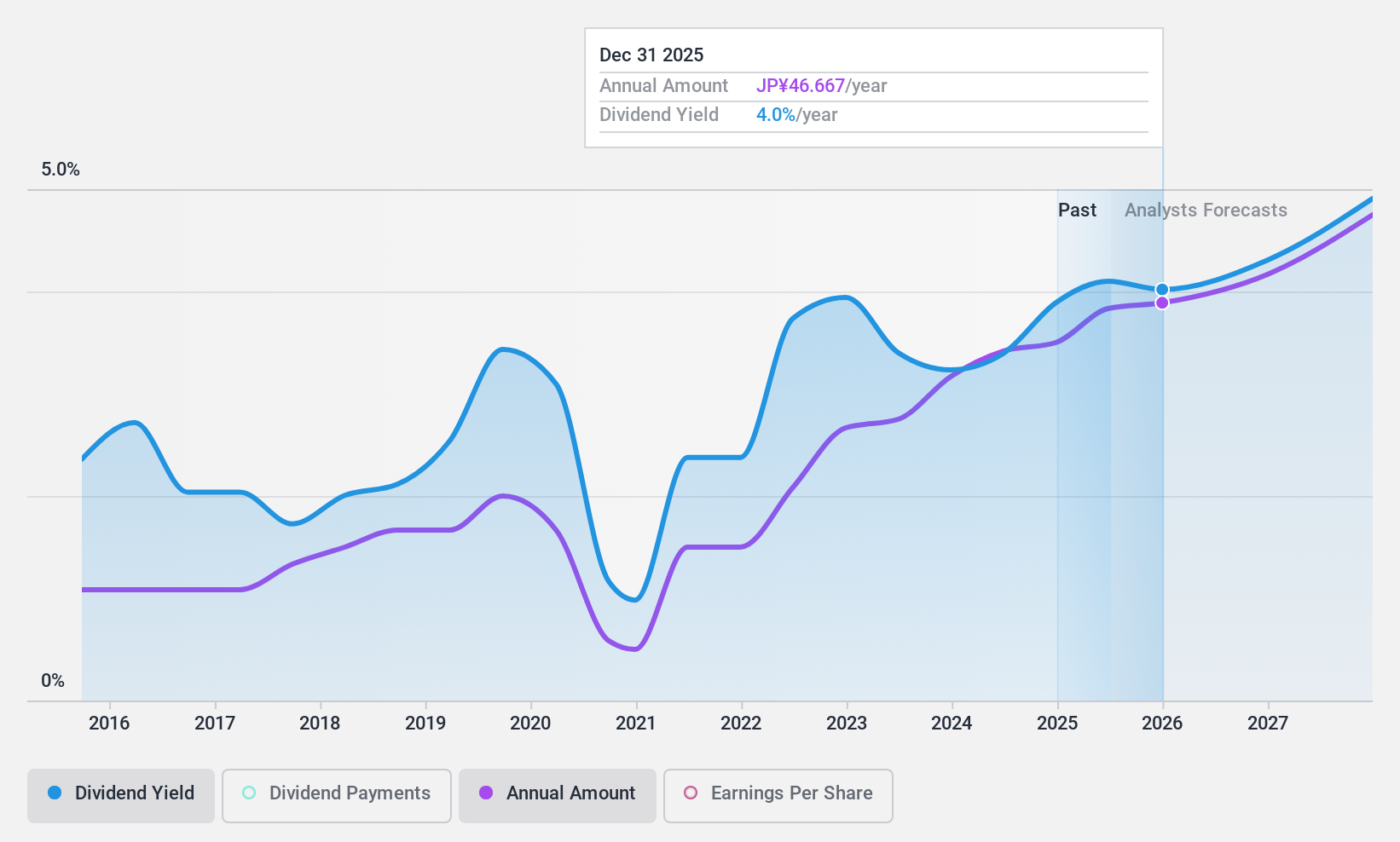

KITZ (TSE:6498)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KITZ Corporation manufactures and sells valves and flow control devices both in Japan and internationally, with a market cap of ¥100.89 billion.

Operations: KITZ Corporation's revenue is primarily derived from its Valve Business, which accounts for ¥139.45 billion, and its Copper Products Business, contributing ¥31.50 billion.

Dividend Yield: 3.6%

KITZ Corporation's dividends are well-supported by earnings and cash flows, with payout ratios of 34% and 37.2%, respectively. Despite a volatile dividend history over the past decade, recent buybacks totaling ¥2.99 billion may enhance shareholder value. The stock trades at a discount to its estimated fair value, but its dividend yield is slightly below top-tier levels in Japan. Earnings growth forecasts suggest potential stability for future payouts amidst historical volatility concerns.

- Take a closer look at KITZ's potential here in our dividend report.

- Our valuation report unveils the possibility KITZ's shares may be trading at a discount.

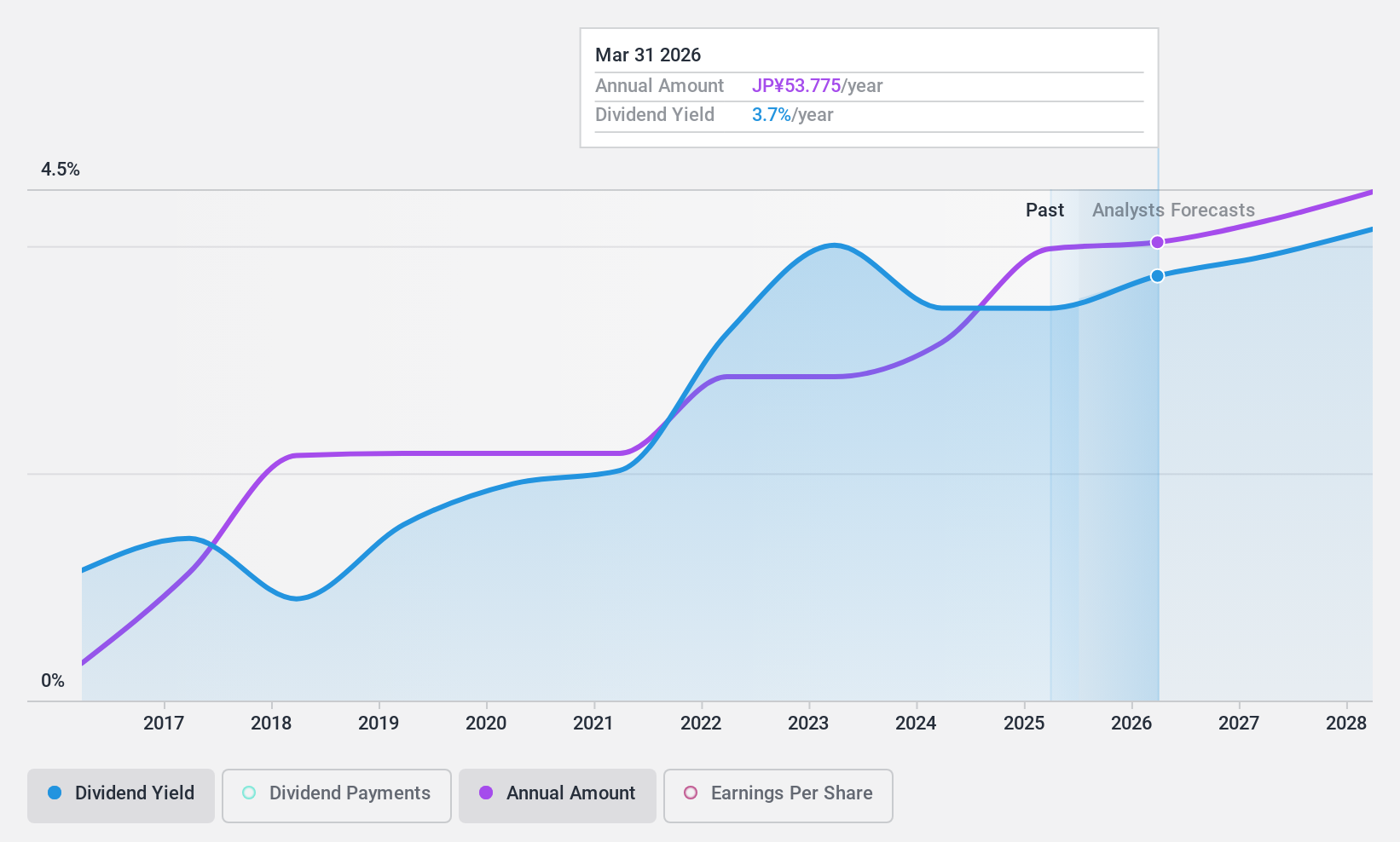

Japan Lifeline (TSE:7575)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Japan Lifeline Co., Ltd. is a medical device company that focuses on developing, producing, importing, distributing, and trading cardiovascular-related medical devices in Japan with a market cap of ¥99.75 billion.

Operations: Japan Lifeline Co., Ltd. generates revenue from the manufacture and sale of medical devices, amounting to ¥54.24 billion.

Dividend Yield: 3.2%

Japan Lifeline's dividends have been stable and growing over the past decade, supported by a payout ratio of 39% and a cash payout ratio of 57.3%. Although its dividend yield of 3.23% is below Japan's top-tier levels, it remains reliable. The company trades at a significant discount to estimated fair value and has recently increased its dividend guidance for March 2025. A new distribution agreement with Terumo Corporation may bolster future earnings growth.

- Navigate through the intricacies of Japan Lifeline with our comprehensive dividend report here.

- Our expertly prepared valuation report Japan Lifeline implies its share price may be lower than expected.

Turning Ideas Into Actions

- Take a closer look at our Top Dividend Stocks list of 1962 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6257

Flawless balance sheet unattractive dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion