Undiscovered Gems with Promising Potential This December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are navigating a complex landscape marked by central banks adjusting interest rates and mixed performances across major indices. While large-cap stocks have shown resilience, small-cap stocks, as indicated by the Russell 2000 Index's recent underperformance against the S&P 500, face unique challenges and opportunities in this evolving economic environment. In such conditions, identifying promising small-cap companies requires focusing on those with strong fundamentals and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Exotic Food (SET:XO)

Simply Wall St Value Rating: ★★★★★★

Overview: Exotic Food Public Company Limited manufactures and distributes a range of food products in Europe, the United States, and internationally, with a market cap of THB8.69 billion.

Operations: Exotic Food generates revenue primarily from its Seasoning and Dipping Sauces segment, which accounts for THB2.45 billion. The Cooking Paste segment contributes THB212.82 million to the overall revenue stream.

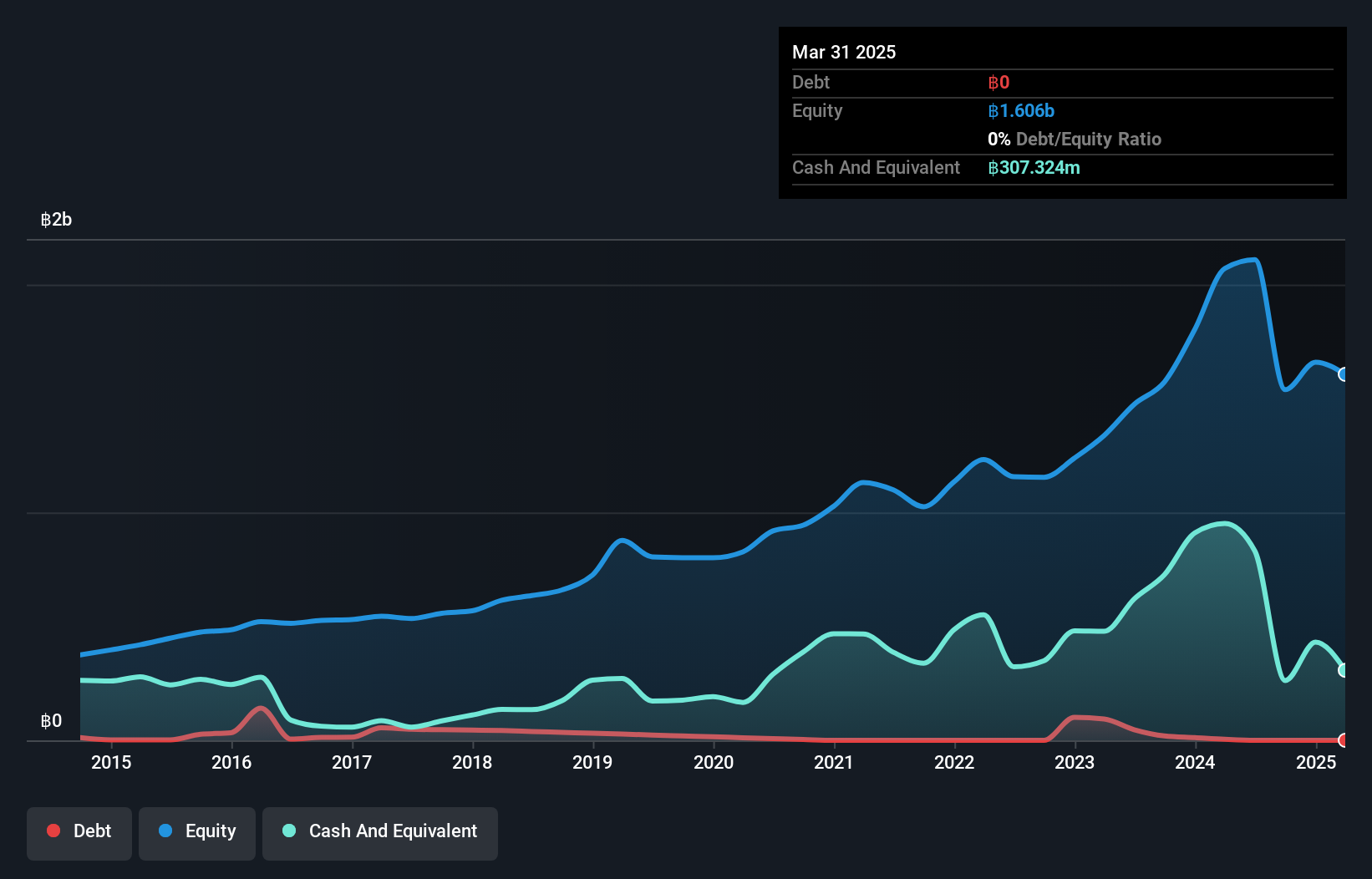

Earnings for Exotic Food have outpaced the broader food industry, growing by 40.5% over the past year, while its debt-free status enhances financial stability. Trading at 49.3% below estimated fair value suggests potential upside. Despite a dip in quarterly revenue to THB 545.62 million from THB 707.54 million and net income to THB 157.38 million from THB 248.15 million, nine-month figures show improvement with revenue reaching THB 1,975.75 million and net income at THB 670.48 million compared to last year's numbers of THB 1,728.47 million and THB 557.46 million respectively, indicating resilience amidst challenges.

- Click to explore a detailed breakdown of our findings in Exotic Food's health report.

Understand Exotic Food's track record by examining our Past report.

Ningbo Runhe High-Tech Materials (SZSE:300727)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ningbo Runhe High-Tech Materials Co., Ltd. operates in the high-tech materials industry and has a market capitalization of CN¥4.06 billion.

Operations: Ningbo Runhe High-Tech Materials generates revenue primarily from its high-tech materials segment. The company's net profit margin has shown fluctuations over the reported periods, reflecting variations in cost management and pricing strategies.

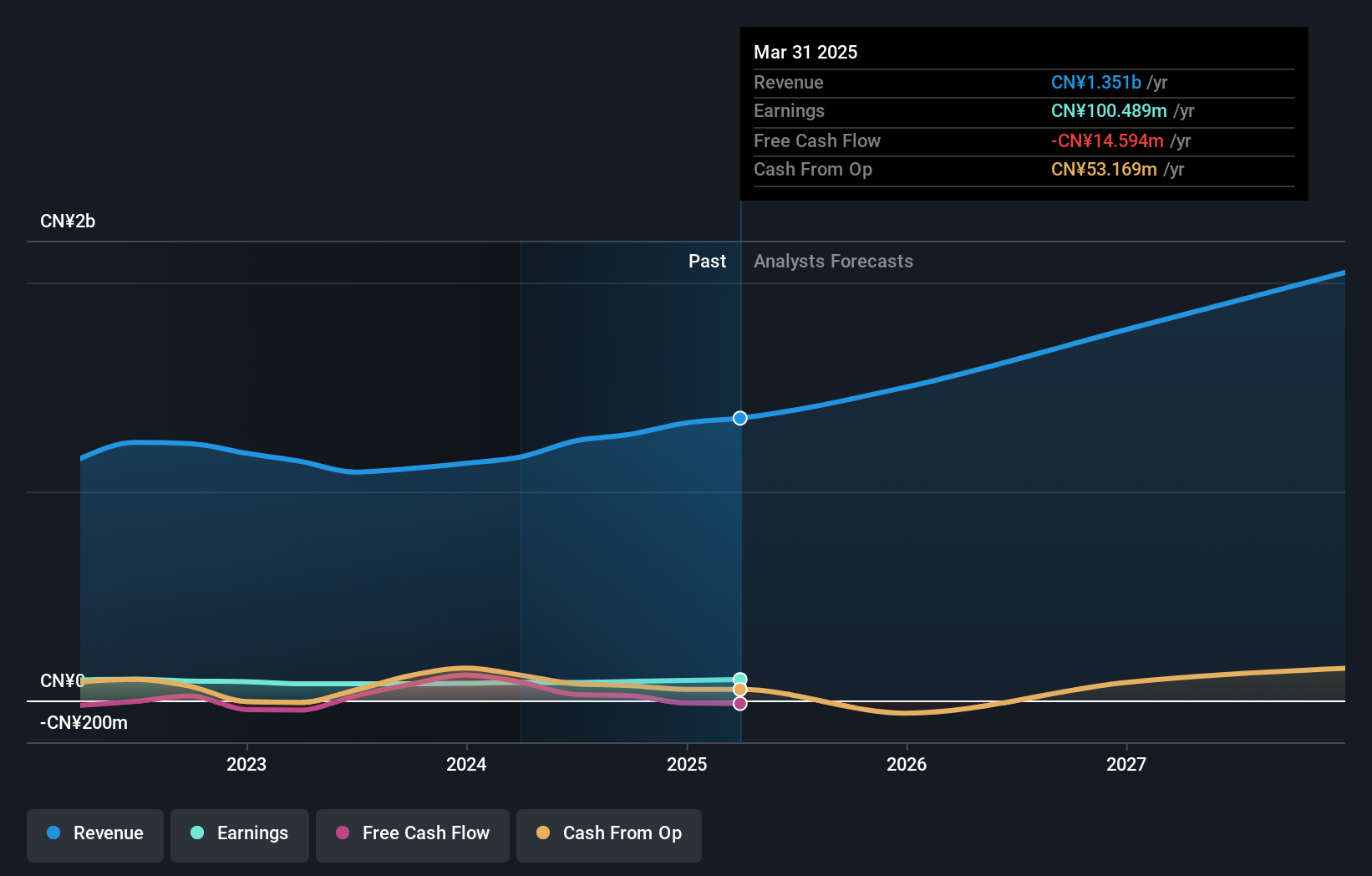

Ningbo Runhe High-Tech Materials, a smaller player in the chemicals industry, has shown impressive growth with earnings increasing by 14.2% over the past year, outpacing the industry's -4.7%. The company reported sales of CNY 993.65 million for the first nine months of 2024, up from CNY 854.42 million in the previous year, while net income rose to CNY 69.89 million from CNY 61 million. With EBIT covering interest payments by a factor of 23.7x and more cash than total debt, its financial health appears robust despite a rising debt-to-equity ratio now at 27.2%.

TSI HoldingsLtd (TSE:3608)

Simply Wall St Value Rating: ★★★★★★

Overview: TSI Holdings Co., Ltd. is involved in the planning, manufacturing, and sale of clothing both in Japan and internationally, with a market cap of ¥76.45 billion.

Operations: TSI Holdings generates revenue through the planning, manufacturing, and sale of clothing in both domestic and international markets. The company has a market capitalization of ¥76.45 billion.

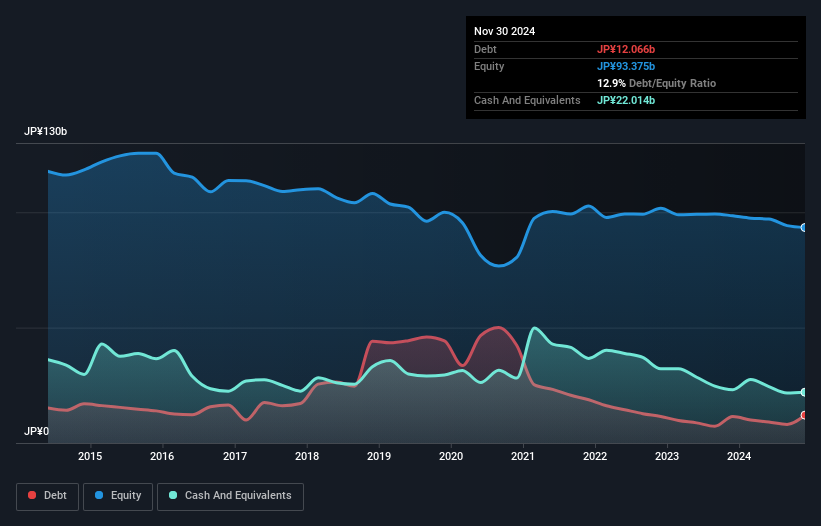

TSI Holdings, a small-cap player in the luxury sector, has been making waves with its strategic moves. Its earnings growth of 13% over the past year outpaced the industry's average, reflecting robust performance. The company is trading at a discount of 26% below its estimated fair value, suggesting potential upside for investors. Recent share repurchase activity saw TSI buy back approximately 4.5% of its shares for ¥3 billion, indicating confidence in future prospects. While sales struggled earlier due to unfavorable weather and rising costs from JPY depreciation, recent months have shown recovery signs driven by increased tourist demand and effective cost control measures.

- Take a closer look at TSI HoldingsLtd's potential here in our health report.

Evaluate TSI HoldingsLtd's historical performance by accessing our past performance report.

Key Takeaways

- Explore the 4621 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSI HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3608

TSI HoldingsLtd

Engages in the planning, manufacture, and sale of clothing in Japan and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives