TSI Holdings (TSE:3608): Net Margin Surge Driven by One-Off Gain Challenges Sustainability Narrative

Reviewed by Simply Wall St

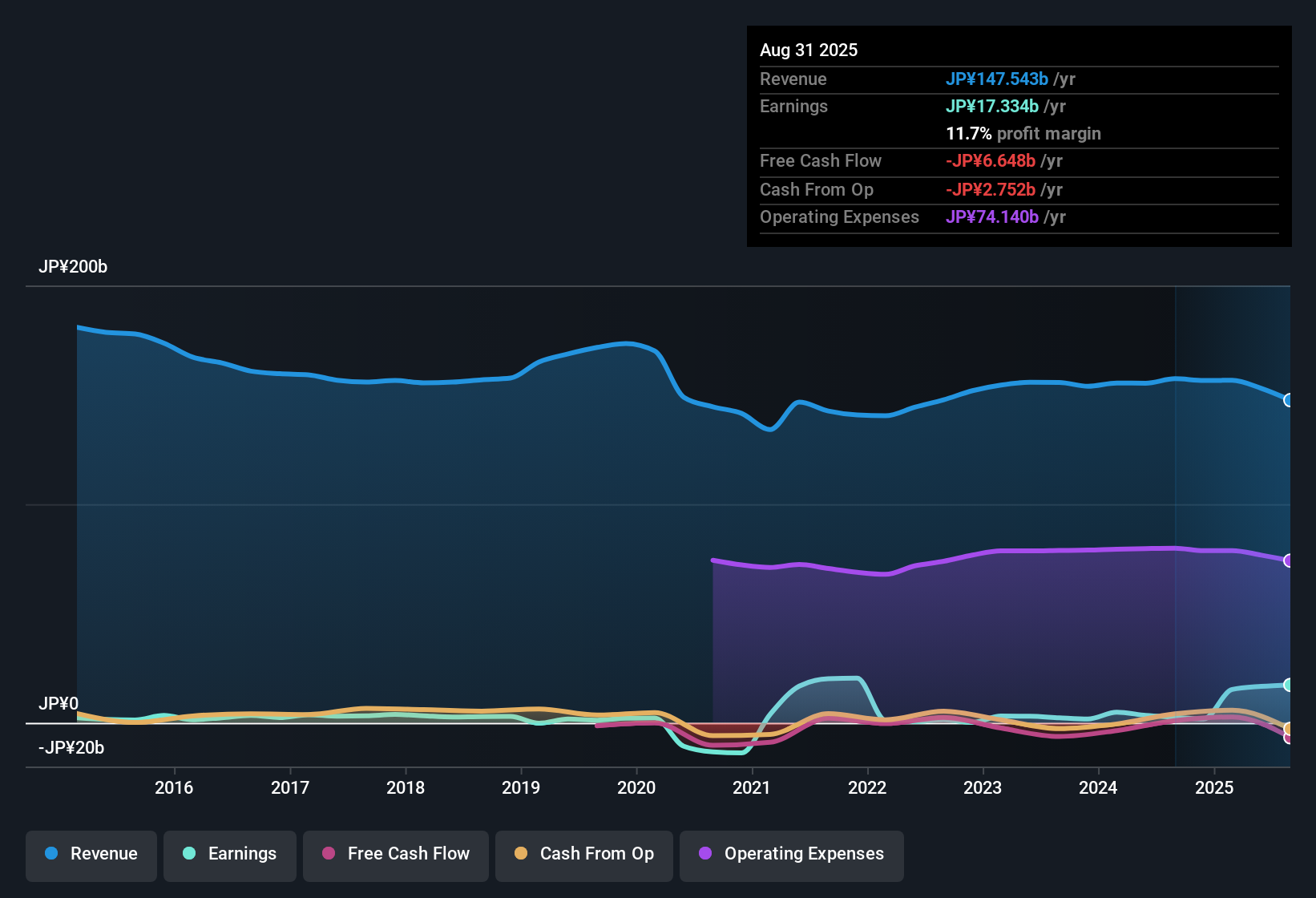

TSI Holdings Ltd. (TSE:3608) saw net profit margins climb to 11.7% for the year, a major leap from 1.6% previously, as EPS growth exploded by 570.3% and outpaced its five-year average of 26.6% per year. Recent profitability was boosted by a one-off gain of ¥21.8 billion, which may not reflect the company’s ongoing earnings power. With revenue growth forecast at 3% per year and the shares trading at just ¥976, well below an estimated fair value, the market seems cautious about whether these headline results can be sustained beyond the impact of exceptional items.

See our full analysis for TSI HoldingsLtd.The next section will set these numbers against popular market narratives to highlight which expectations meet reality and where the story might take an unexpected turn.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off ¥21.8 Billion Gain Skews Margin Picture

- TSI Holdings’ latest net profit margin was 11.7%, but this included a single large gain of ¥21.8 billion, which is not expected to repeat in future years.

- Several investors point to margin improvement as a sign of structural turnaround, yet the bulk of this leap comes from the one-off item.

- This means ongoing, underlying profitability is likely much lower than current figures suggest, challenging claims of a lasting profit surge.

- The forecast for future earnings drops by 22.2% per year over the next three years, underlining how the recent margin spike may not reflect sustainable performance.

Low 3.3x P/E Ratio Spells Deep Discount

- With the stock trading at just 3.3 times earnings, far below the JP Luxury industry’s 13x average and peers’ 20.7x, TSI Holdings is priced at a steep discount by the market.

- What surprises is that such a low valuation persists, even though TSI has averaged 26.6% annual profit growth over five years and is currently priced at ¥976, well below its DCF fair value of ¥3,272.54 per share.

- This deep discount points to the market bracing for profit declines or viewing the recent results as flattered by non-recurring gains.

- Analysts see limited confidence in growth durability despite the company’s strong track record before the latest earnings, making future stabilization a key question for re-rating.

Guidance Trails Market with Revenues Up Just 3%

- Revenue growth is projected at 3% per year, lagging the Japanese market average of 4.4% yearly, signaling that organic expansion is expected to be modest.

- The narrative around limited revenue momentum challenges hopes for multiple expansion, as investors are likely to remain cautious unless TSI Holdings delivers evidence of accelerating business growth.

- The risk of both sales and profits declining together keeps sentiment muted and puts the onus on management to demonstrate new growth drivers.

- With industry peers generally outpacing these forecasts, the company faces added pressure to justify a higher valuation in coming quarters.

To see how the latest figures connect to long-term industry context, risks, and value, dive into the full consensus narrative for TSI Holdings Ltd.

📊 Read the full TSI HoldingsLtd Consensus Narrative.Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on TSI HoldingsLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

TSI Holdings’ heavy reliance on one-off gains and muted long-term growth forecast leaves investors questioning the stability and sustainability of its performance.

If you want more consistent earnings and predictable expansion, shift your focus to companies that demonstrate reliable progress with steady results through cycles like stable growth stocks screener (2089 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TSI HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3608

TSI HoldingsLtd

Engages in the planning, manufacture, and sale of clothing in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)