Wacoal Holdings (TSE:3591): How Does the Share Buyback Shape Valuation Now?

Reviewed by Simply Wall St

Wacoal Holdings (TSE:3591) just wrapped up its share buyback program, purchasing nearly 4% of its shares between July and September for almost ¥10 billion. Investors are now considering the potential impact of this completed buyback on future value.

See our latest analysis for Wacoal Holdings.

Wacoal Holdings’ latest share buyback arrives as the company rides a wave of positive momentum, with the share price climbing more than 10% year-to-date and the total return for shareholders an impressive 29% over the past year. This recent surge builds on remarkable multi-year gains, with total shareholder returns above 160% for the last three years and 239% over five years, hinting at renewed optimism as management’s capital allocation decisions begin to shift sentiment in the stock’s favor.

If the buyback’s impact on performance has you rethinking what else is possible, it might be time to expand your search and discover fast growing stocks with high insider ownership

But with shares now trading close to recent highs and a history of strong returns, investors have to wonder if Wacoal Holdings is still undervalued or if markets have already priced in the company’s future growth.

Price-to-Earnings of 16.5x: Is it justified?

With Wacoal Holdings now valued at a price-to-earnings ratio of 16.5x after its surge, investors must decide if this premium is warranted compared to the past and industry averages.

The price-to-earnings (P/E) ratio reflects how much investors are willing to pay for a company's earnings. It is a key barometer in the consumer durables and luxury space, where profitability and consistency can be less predictable than in mature industries. For Wacoal Holdings, a P/E of 16.5x sits notably above the Japanese luxury sector average of 13.2x, signaling the market is pricing in stronger earnings power or perhaps expecting above-trend growth.

However, this optimism might be tested going forward. Wacoal Holdings is also considered expensive relative to its estimated fair P/E of 5.3x, suggesting the current market multiple could be hard to justify unless the company delivers upside surprises or sustained outperformance.

Explore the SWS fair ratio for Wacoal Holdings

Result: Price-to-Earnings of 16.5x (OVERVALUED)

However, if these trends persist, slowing revenue growth and a sharp decline in annual net income could challenge the upbeat outlook.

Find out about the key risks to this Wacoal Holdings narrative.

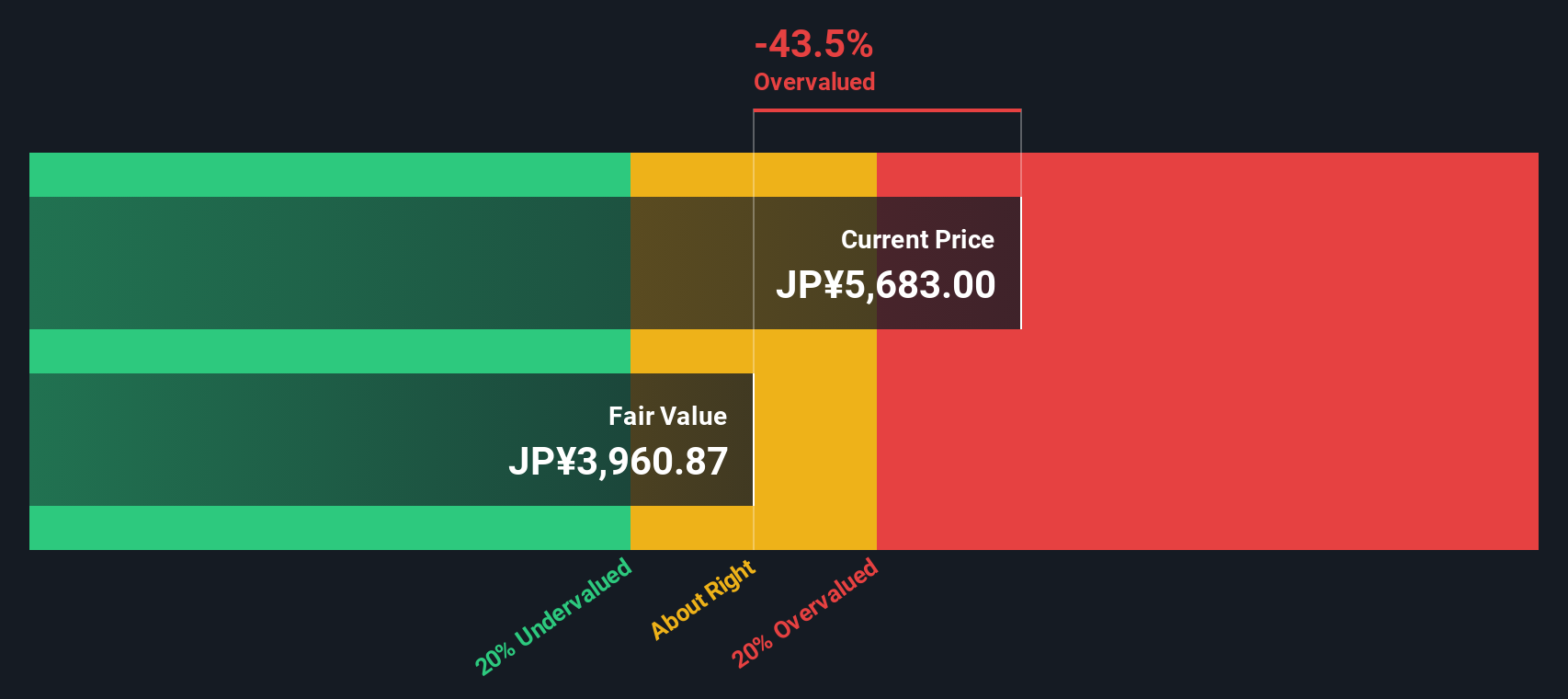

Another View: Discounted Cash Flow Provides a Different Perspective

Looking beyond earnings multiples, our DCF model presents a less optimistic picture for Wacoal Holdings. It suggests that shares are trading well above their estimated fair value, indicating that the market’s enthusiasm may have outpaced the company’s fundamentals. Could this be a signal to approach with caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wacoal Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wacoal Holdings Narrative

If you see things differently or want to dig into the data yourself, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Wacoal Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next opportunity slip by. Use the Simply Wall Street Screener to pinpoint untapped stocks that could take your portfolio to the next level.

- Tap into powerful income streams by checking out these 17 dividend stocks with yields > 3% with strong dividend potential.

- Jump ahead of trends and spot exciting technology frontrunners through these 26 AI penny stocks that are pushing the boundaries in artificial intelligence.

- Unlock unrealized value by scanning these 874 undervalued stocks based on cash flows primed for future growth based on real cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wacoal Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3591

Wacoal Holdings

Engages in the manufacturing, wholesale, and retail sale of intimate apparel, outerwear, sportswear, and other textile products and accessories in Japan, Asia, Oceania, the United States, and Europe.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives