There's Reason For Concern Over Wacoal Holdings Corp.'s (TSE:3591) Massive 26% Price Jump

The Wacoal Holdings Corp. (TSE:3591) share price has done very well over the last month, posting an excellent gain of 26%. The last 30 days bring the annual gain to a very sharp 49%.

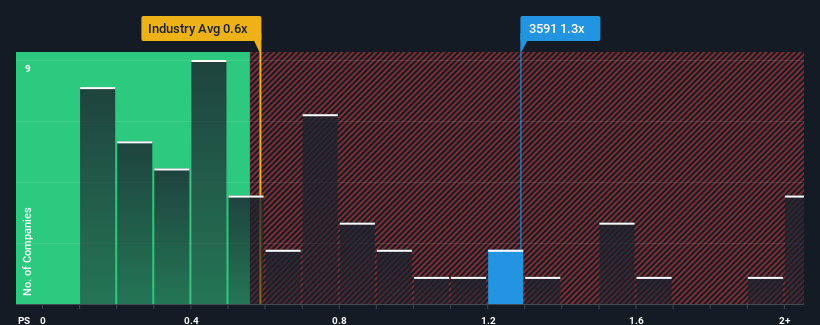

Since its price has surged higher, given close to half the companies operating in Japan's Luxury industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Wacoal Holdings as a stock to potentially avoid with its 1.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Wacoal Holdings

What Does Wacoal Holdings' P/S Mean For Shareholders?

Wacoal Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wacoal Holdings.How Is Wacoal Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Wacoal Holdings' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Fortunately, a few good years before that means that it was still able to grow revenue by 23% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 4.9% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 6.5%, which is not materially different.

In light of this, it's curious that Wacoal Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Wacoal Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Analysts are forecasting Wacoal Holdings' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Wacoal Holdings that you should be aware of.

If these risks are making you reconsider your opinion on Wacoal Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wacoal Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3591

Wacoal Holdings

Engages in the manufacturing, wholesale, and retail sale of intimate apparel, outerwear, sportswear, and other textile products and accessories in Japan, Asia, Oceania, the United States, and Europe.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives