- Japan

- /

- Consumer Durables

- /

- TSE:3291

Iida Group Holdings Co., Ltd. Just Recorded A 24% EPS Beat: Here's What Analysts Are Forecasting Next

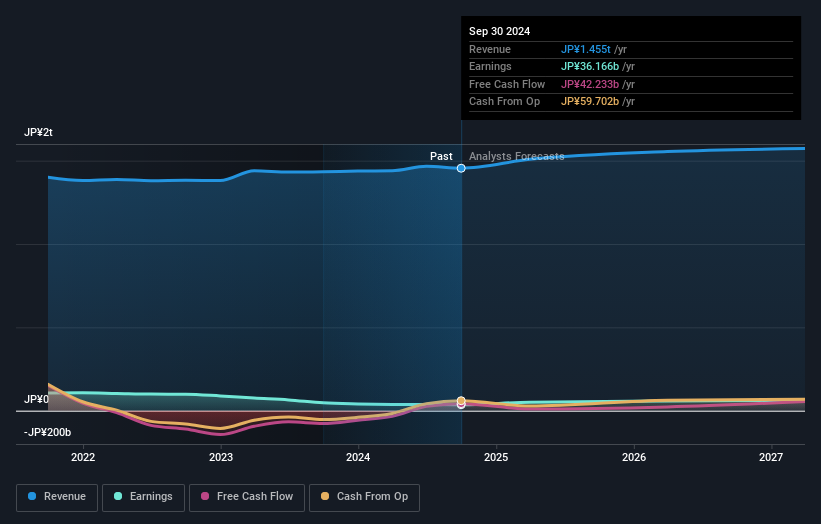

Investors in Iida Group Holdings Co., Ltd. (TSE:3291) had a good week, as its shares rose 4.4% to close at JP¥2,289 following the release of its half-year results. It looks like a credible result overall - although revenues of JP¥687b were what the analysts expected, Iida Group Holdings surprised by delivering a (statutory) profit of JP¥84.36 per share, an impressive 24% above what was forecast. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Iida Group Holdings

After the latest results, the five analysts covering Iida Group Holdings are now predicting revenues of JP¥1.51t in 2025. If met, this would reflect a satisfactory 3.7% improvement in revenue compared to the last 12 months. Per-share earnings are expected to jump 41% to JP¥182. Before this earnings report, the analysts had been forecasting revenues of JP¥1.51t and earnings per share (EPS) of JP¥177 in 2025. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

The consensus price target rose 6.8% to JP¥2,276, suggesting that higher earnings estimates flow through to the stock's valuation as well. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Iida Group Holdings at JP¥2,430 per share, while the most bearish prices it at JP¥2,100. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting Iida Group Holdings is an easy business to forecast or the the analysts are all using similar assumptions.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting Iida Group Holdings' growth to accelerate, with the forecast 7.5% annualised growth to the end of 2025 ranking favourably alongside historical growth of 0.3% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 1.6% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Iida Group Holdings to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Iida Group Holdings' earnings potential next year. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple Iida Group Holdings analysts - going out to 2027, and you can see them free on our platform here.

You still need to take note of risks, for example - Iida Group Holdings has 1 warning sign we think you should be aware of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3291

Iida Group Holdings

Engages in the purchase, planning, design, construction, sale, and after-sales service of detached houses and house condominiums in Japan.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026