- Japan

- /

- Consumer Durables

- /

- TSE:1928

Sekisui House (TSE:1928) Margin Compression Challenges Bullish Growth Narrative Heading Into Earnings Season

Reviewed by Simply Wall St

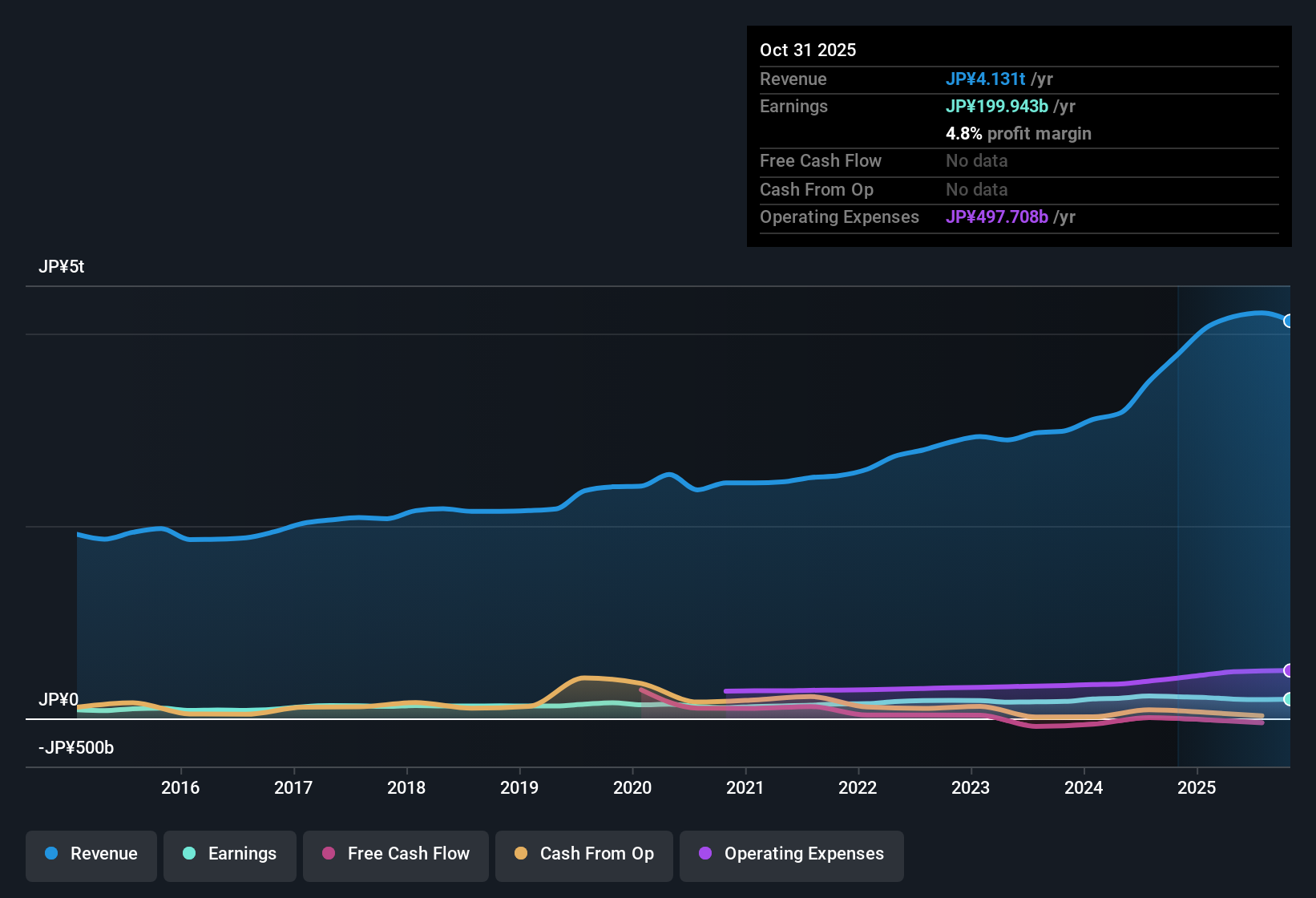

Sekisui House (TSE:1928) has laid out another quarter of solid scale in its Q3 2026 update, with recent quarterly revenue running between about ¥0.9 trillion and ¥1.2 trillion and EPS ranging from roughly ¥51 to ¥112 over the last five reported quarters, while trailing twelve month revenue sits around ¥4.2 trillion and EPS just above ¥300. The company has seen revenue move from about ¥3.5 trillion to ¥4.2 trillion on a trailing basis, with EPS easing back from roughly ¥359 to ¥303 over the same window. This sets up an earnings season where investors are likely to focus on what the margin picture implies for the next leg of growth.

See our full analysis for Sekisui House.With the headline numbers on the table, the next step is to see how this latest print lines up against the dominant narratives around Sekisui House, and where the margin trends might start to shift those stories.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Slip From 6.6% To 4.7%

- Over the last 12 months, Sekisui House earned a 4.7% net margin, down from 6.6% the prior year, even though trailing revenue rose to about ¥4.2 trillion.

- Critics highlight that this bearish margin trend clashes with the company’s 11.7% annual earnings growth over five years. This creates a tension between:

- Recent negative year on year earnings movement and the drop in net margin to 4.7%, which point to profitability pressure.

- Forecast earnings growth of about 5.16% per year, which still implies the business is expected to expand despite thinner margins.

11x P/E Versus DCF Fair Value

- The stock trades on a trailing P/E of 11x, below the JP Consumer Durables industry at 11.6x and the broader JP market at 14.1x, while the current share price of ¥3,342 sits well above the DCF fair value estimate of about ¥838.57.

- What stands out for a bearish view is how the apparently reasonable 11x multiple collides with cash flow based concerns:

- The dividend yield of 4.31% is not well covered by free cash flow and debt is not well covered by operating cash flow, raising questions about how sustainable that payout looks at ¥3,342.

- The large gap between the share price and DCF fair value of roughly ¥838.57 highlights that a pure earnings multiple paints a more comfortable picture than the cash flow models do.

TTM Revenue Near ¥4.2T, Growth Moderates

- Trailing twelve month revenue has climbed from roughly ¥3.5 trillion to about ¥4.2 trillion, while earnings for the same period fell from ¥232,814 million to ¥196,325 million and TTM EPS eased from about ¥359 to ¥303.

- Supporters taking a more constructive stance point to the still positive growth profile, but the numbers temper that bullish angle:

- Revenue is forecast to grow about 3% per year and earnings roughly 5.16% per year, which is slower than the past five year earnings growth rate of 11.7% per year.

- The combination of softer TTM EPS at around ¥303 and declining margins suggests future gains may rely more on steady execution than on rapid growth surprise.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sekisui House's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Sekisui House faces pressure from slipping margins, softer earnings and an uncovered dividend, which make its current valuation and payout look harder to justify.

If you want income backed by stronger fundamentals, use our these 1928 dividend stocks with yields > 3% to quickly focus on companies offering healthier, more sustainable yields without similar coverage concerns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1928

Sekisui House

Designs, constructs, and contracts built-to-order detached houses in Japan and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026