- Japan

- /

- Consumer Durables

- /

- TSE:1766

Undiscovered Gems in Global Markets To Explore This April 2025

Reviewed by Simply Wall St

As global markets grapple with heightened trade tensions and economic uncertainty, small-cap stocks have been particularly hard hit, with the Russell 2000 Index experiencing significant losses. In this challenging environment, investors might find opportunities by focusing on companies that demonstrate resilience through strong fundamentals and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| Kanro | NA | 6.17% | 37.33% | ★★★★★★ |

| Hangzhou Seck Intelligent Technology | NA | 15.95% | 6.81% | ★★★★★★ |

| AIC | NA | 25.92% | 57.48% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Zhejiang Hengwei Battery | NA | 9.07% | 10.81% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Dura Tek | 4.98% | 42.18% | 94.37% | ★★★★★☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 31.26% | 0.80% | 0.71% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Vontron Technology (SZSE:000920)

Simply Wall St Value Rating: ★★★★★★

Overview: Vontron Technology Co., Ltd. focuses on the research, development, manufacturing, and sale of separation membranes and related materials both in China and internationally, with a market cap of CN¥4.69 billion.

Operations: Vontron generates revenue primarily from the sale of separation membranes and related materials. The company's cost structure includes expenses associated with research, development, and manufacturing processes. Its net profit margin reflects the efficiency of its operations in converting revenue into actual profit.

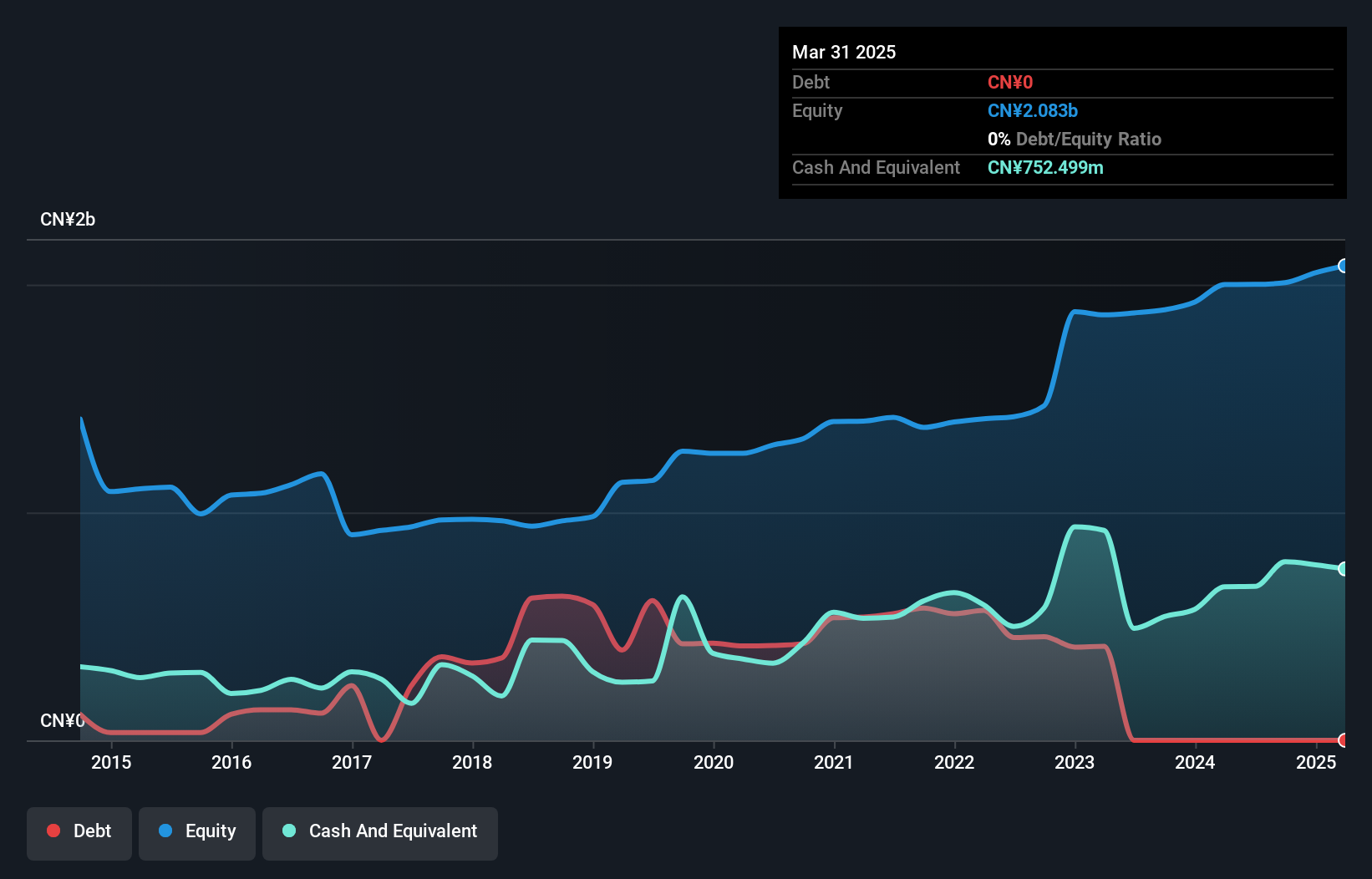

Vontron Technology, a nimble player in its industry, showcased a robust performance with earnings growth of 20% over the past year, outpacing the broader Chemicals sector's -4.1%. The company reported revenue of CNY 1.74 billion for 2024 compared to CNY 1.71 billion the previous year and net income rose to CNY 197.68 million from CNY 164.74 million. With a Price-To-Earnings ratio of 23.7x, it remains attractively valued against the CN market average of 33.6x and operates debt-free, enhancing its financial flexibility and potential for future opportunities without interest burdens.

- Unlock comprehensive insights into our analysis of Vontron Technology stock in this health report.

Explore historical data to track Vontron Technology's performance over time in our Past section.

Token (TSE:1766)

Simply Wall St Value Rating: ★★★★★★

Overview: Token Corporation operates as a construction company in Japan with a market cap of ¥173.16 billion.

Operations: Token Corporation's primary revenue streams are derived from its construction business and real estate rental business, generating ¥146.67 billion and ¥212.50 billion respectively.

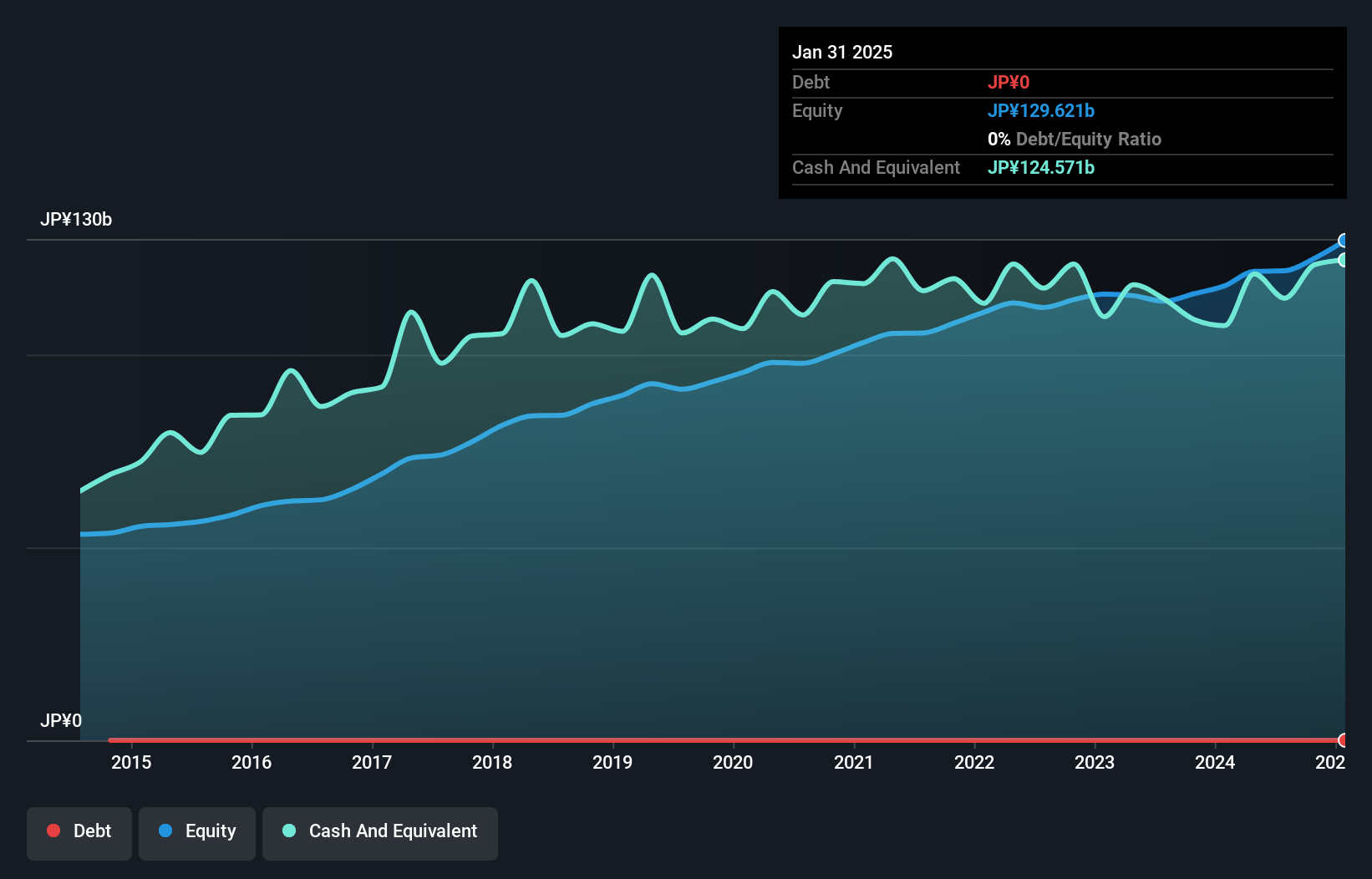

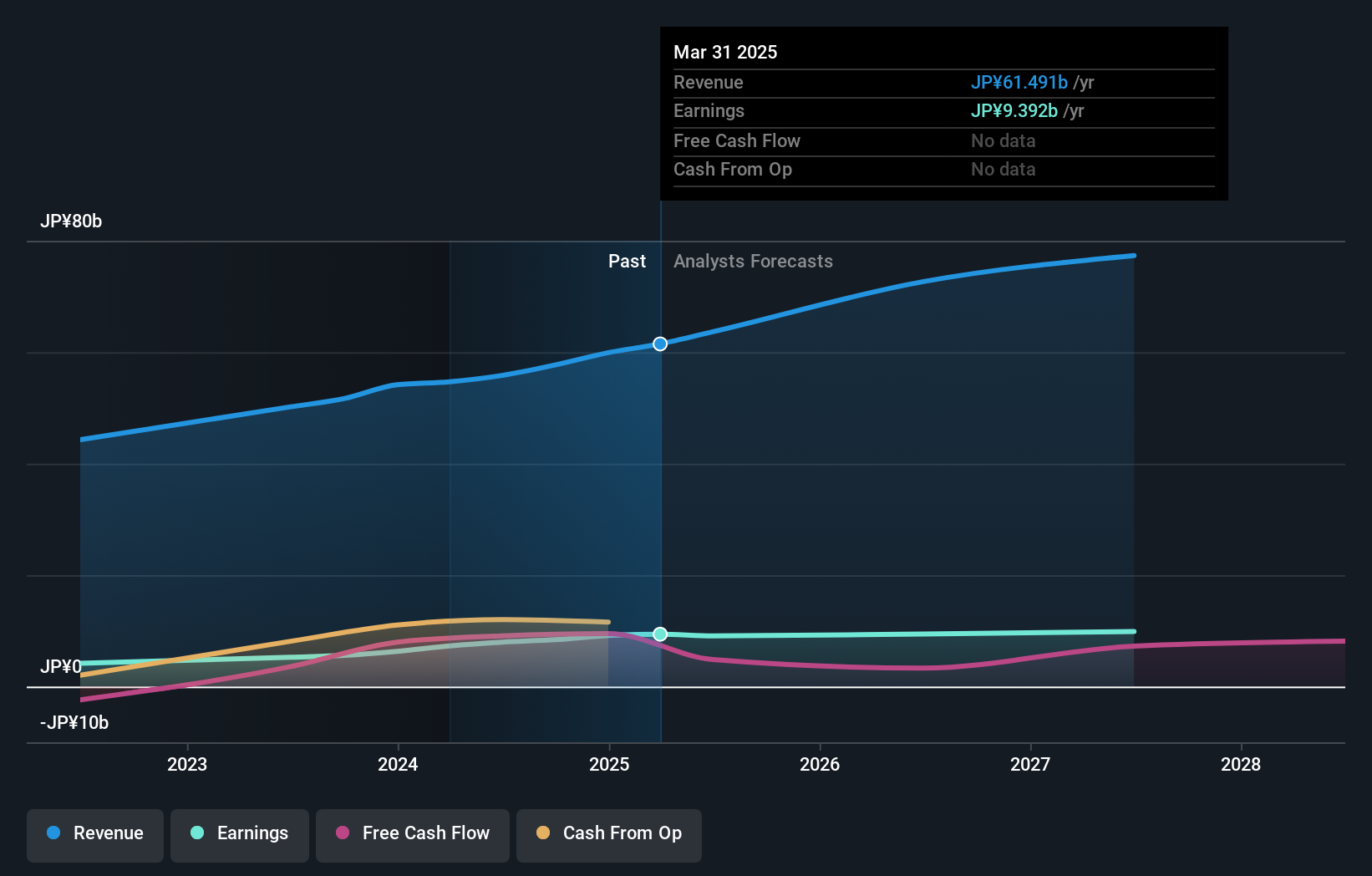

Token's performance is turning heads with a remarkable earnings growth of 167.8% over the past year, significantly outpacing the Consumer Durables industry's 11.3%. Trading at 43.1% below its estimated fair value, it presents an intriguing opportunity for investors seeking undervalued stocks. The company operates debt-free, ensuring no concerns over interest coverage or financial strain from liabilities. Additionally, Token has consistently generated positive free cash flow, recently reported at US$18 million in October 2024. With high-quality earnings and a forecasted annual growth rate of 5.8%, Token seems poised for continued stability and potential expansion in its market segment.

- Click to explore a detailed breakdown of our findings in Token's health report.

Assess Token's past performance with our detailed historical performance reports.

Maeda Kosen (TSE:7821)

Simply Wall St Value Rating: ★★★★★★

Overview: Maeda Kosen Co., Ltd. is a Japanese company that manufactures and sells civil engineering, construction, agricultural materials, and nonwoven fabrics, with a market cap of ¥131.69 billion.

Operations: The company generates revenue primarily from its Social Infrastructure Business, contributing ¥33.01 billion, and its Industry Infrastructure Business, which adds ¥26.92 billion.

Maeda Kosen, a notable player in the civil engineering materials sector, has demonstrated robust financial health with earnings surging 45% over the past year. The company is trading at 40.1% below its estimated fair value, presenting a potential opportunity for investors. Its debt management is commendable, with cash exceeding total debt and a significant reduction in the debt-to-equity ratio from 42.8% to 1.5% over five years. Recent activities include repurchasing shares worth ¥663 million and revising full-year forecasts upward due to strong sales in both public works materials and industrial products like automobile wheels.

- Delve into the full analysis health report here for a deeper understanding of Maeda Kosen.

Examine Maeda Kosen's past performance report to understand how it has performed in the past.

Next Steps

- Unlock more gems! Our Global Undiscovered Gems With Strong Fundamentals screener has unearthed 3220 more companies for you to explore.Click here to unveil our expertly curated list of 3223 Global Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Token might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1766

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives